Accounts payable is a critical business process through which all companies track and manage their payable obligations efficiently and effectively.

The latest Accounts Payable Process Automation Report shared by Business Insider has some shocking revelations. Here are some key takeaways from the report:

The $22 trillion US B2B payments market has been slow to digitize, with 36% of firms using paper invoicing, 47% relying on manual processes for approval, and 49% of payments made by check.

Forty-four percent of businesses are looking to add automation to their payables processes as a way to capitalize on the efficiency and cost-cutting benefits it brings in, while also cutting fraud and increasing access to payment data.

Large enterprises have the highest budgets for digital solutions, but they’re also the most likely to already be using them, which makes small businesses, middle-market companies, cross-border businesses, and the gig economy the ripest targets for innovation.

Check it. Accounts Payable Process Automation Report: Technologies, market trends, benefits, and solutions of digitizing in 2020 https://t.co/hShyrDkCMo via @businessinsider #tech #digital #data #business pic.twitter.com/bhmZrBnDF1

— Kohei Kurihara -DataPrivacy for Fighting Covid-19- (@kuriharan) July 2, 2020

Accounts payable is a critical business process through which all companies track and manage their payable obligations efficiently and effectively. Tracking of your debts and paying them on time is essential for any business. It also helps in maintaining good relations with the vendors and save money by making early payments. Here in this article, we have explained all the basics of accounts payable such as accounts payables department, accounts payables automation, and accounts payable software.

We will cover the following topics related to accounts payables in this article:

What Is Accounts Payable?

What Is Included in Accounts Payable?

What Is the Difference Between Accounts Payable and Accounts Receivable?

How to Record Accounts Payable?

Example of Accounts Payable

What Is the Accounts Payable Process?

Why the Accounts Payable Process Have Internal Controls?

Why Is Accounts Payable so Important?

Accounts Payable Best Practices

What Happens If I Can’t Clear My Accounts Payable?

What Is an Accounts Payable Aging Schedule?

What Is the Function of the Accounts Payable Department?

What Are the Responsibilities of Accounts Payable Manager?

What Is Accounts Payable Automation?

What Is Accounts Payable Software?

What Is Accounts Payable (AP)?

Accounts payable (AP) is an account in the general ledger that represents a company’s obligation to pay for items or services purchased on credit. So accounts payable are what you owe to your vendor or supplier for items or services purchased on credit. When any goods or services are purchased on credit from your vendor or supplier, they will send you an invoice. This invoice shows the amount you owe for goods and services and is added to your AP balance. AP are recorded as a short-term liability on your company’s balance sheet.

Check out our guide to learn more about accounts payable automation.

What Is Included in Accounts Payable?

Accounts payable (AP) are recorded under the current liabilities section on your balance sheet. AP is short-term debt payments due to your vendors or suppliers. AP are debts that every company must pay to avoid default. Many people assume that accounts payable is an expense. AP is not an expense account. AP is a liability account. An accounts payable (AP) department is responsible for making payments for business expenses, travel, etc.

What Is the Difference Between Accounts Receivable and Accounts Payable?

Accounts payable are your liability, which you owe to your vendors or suppliers for goods or services purchased on credit. Accounts receivable are your asset as it is money that your customers owe you in exchange for goods and services purchased on credit.

Let’s understand the difference between accounts payable and accounts receivable with an example.

Let’s say your company, named ABC company, bought some goods from another company named CDE company on credit. Here CDE company will send you an invoice for $500 for products purchased on credit.

When you receive the invoice, you will record it as an accounts payable in your financial books, because this money you owe to CDE company for goods purchased on credit.

Journal Entry in ABC Company Accounting Books

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Purchases | $500 | |||

| Accounts Payable | $500 | |||

CDE company will record this amount as an accounts receivable in their books as this money they will receive from ABC company.

Journal Entry in CDE Company Accounting Books

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Accounts Receivable | $500 | |||

| Sales | $500 | |||

How to Record Accounts Payable?

In this section, we will explain the recording of AP journal entry in your accounting books. Whenever a company has purchased any goods or services from vendors on credit, they need to record AP journal entry in their accounting books.

Example- On January 1, 2020, your company ABC company purchased a car for $50,000 on credit from the CDE company. Every company maintains different chart of accounts for bookkeeping. ABC company maintains an asset account named vehicle for recording the purchase of all vehicle assets. So here asset account named vehicles will be debited by $50,000 and your liability account, AP will be credited by $50,000. Here is the journal entry for the above example:

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Transportation vehicles | $50,000 | |||

| Accounts Payable | $50,000 | |||

Journal Entry to Record a Purchase of Inventory on Credit

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Purchases | XXX | |||

| Accounts Payable | XXX | |||

Journal Entry to Record a Purchase of Services on Credit

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Expense Account | XXX | |||

| Accounts Payable | XXX | |||

Journal Entry to Make a Cash Payment to a Supplier

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Accounts Payable | XXX | |||

| Cash | XXX | |||

Example of Accounts Payable

Here we have explained accounts payable accounting journal entries with an example.

On March 31, 2020, ABC company purchased $1,000 worth of inventory items on credit from the CDE company. Here in this example, the inventory account will be debited, and accounts payable will be credited. Here is the journal entry posted in ABC company books in the above example:

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Inventory | $1,000 | |||

| Accounts Payable | $1,000 | |||

What Is the Accounts Payable Process?

In every company, the accounts payable process is dependent on the organization’s size and hierarchy. In small companies, the entire process is done by the accounts payable manager. However, in big organizations, each step will be executed by different accounts payable executives.

The AP department has to set ground rules and processes to follow before making the vendor payment. These guidelines and control over the accounts payable process are essential to avoid errors caused due to manual work.

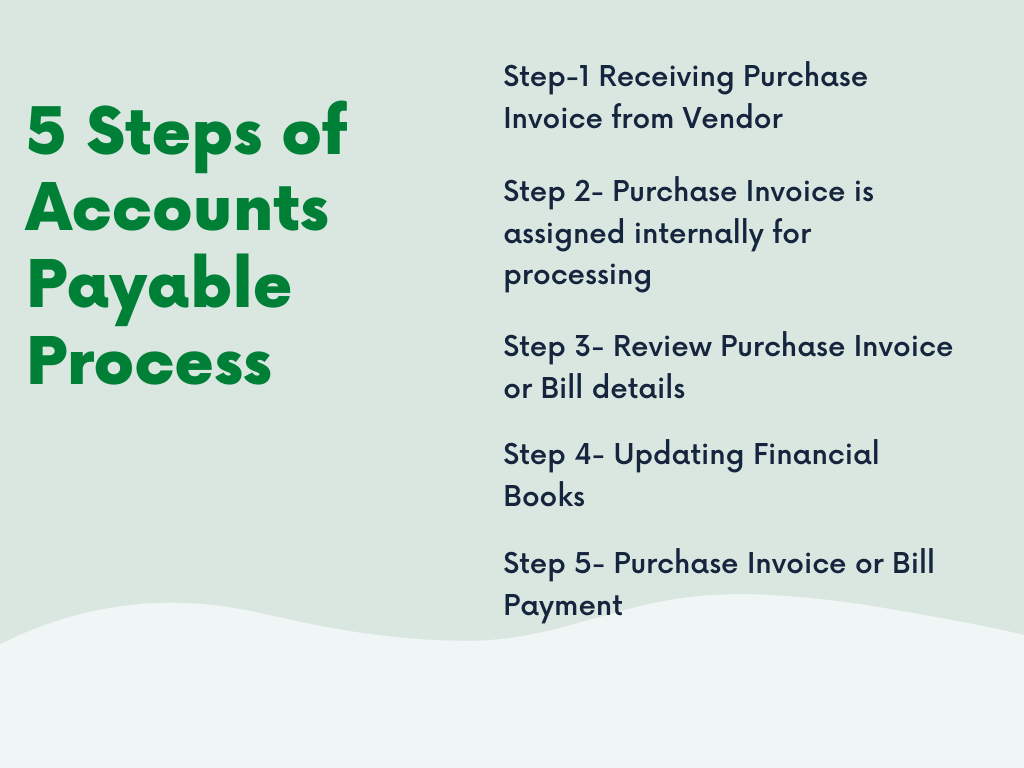

Here we have listed the main steps of the accounts payable process:

Step-1 Receiving the Bill or Purchase Invoice

Once the purchase order is accepted by the vendor, they will send you a bill and goods to your store or warehouse. The purchase invoice can be shared by vendors in multiple ways such as email, send hardcopy in the mail, fax, etc. The bills contain details of goods, services and inventory that you have purchased along with the amount payable, taxes if any, discounts and the billing and shipping details.

Step 2-Purchase Invoice or Bill Is Assigned Internally for Processing

Once the purchase invoice is received, it is assigned internally for processing. AP managers need to check and compare it against the purchase order sent to the vendor.

Step 3- Review Bill details

This is a crucial step where AP manager need to make sure that purchase invoice or bill has all the relevant information such as vendor name, item details, payment details, etc.

Step 4- Updating Financial Books

Once the bill is received and verified, ledger accounts need to be updated, and bill entry is made in the financial books.

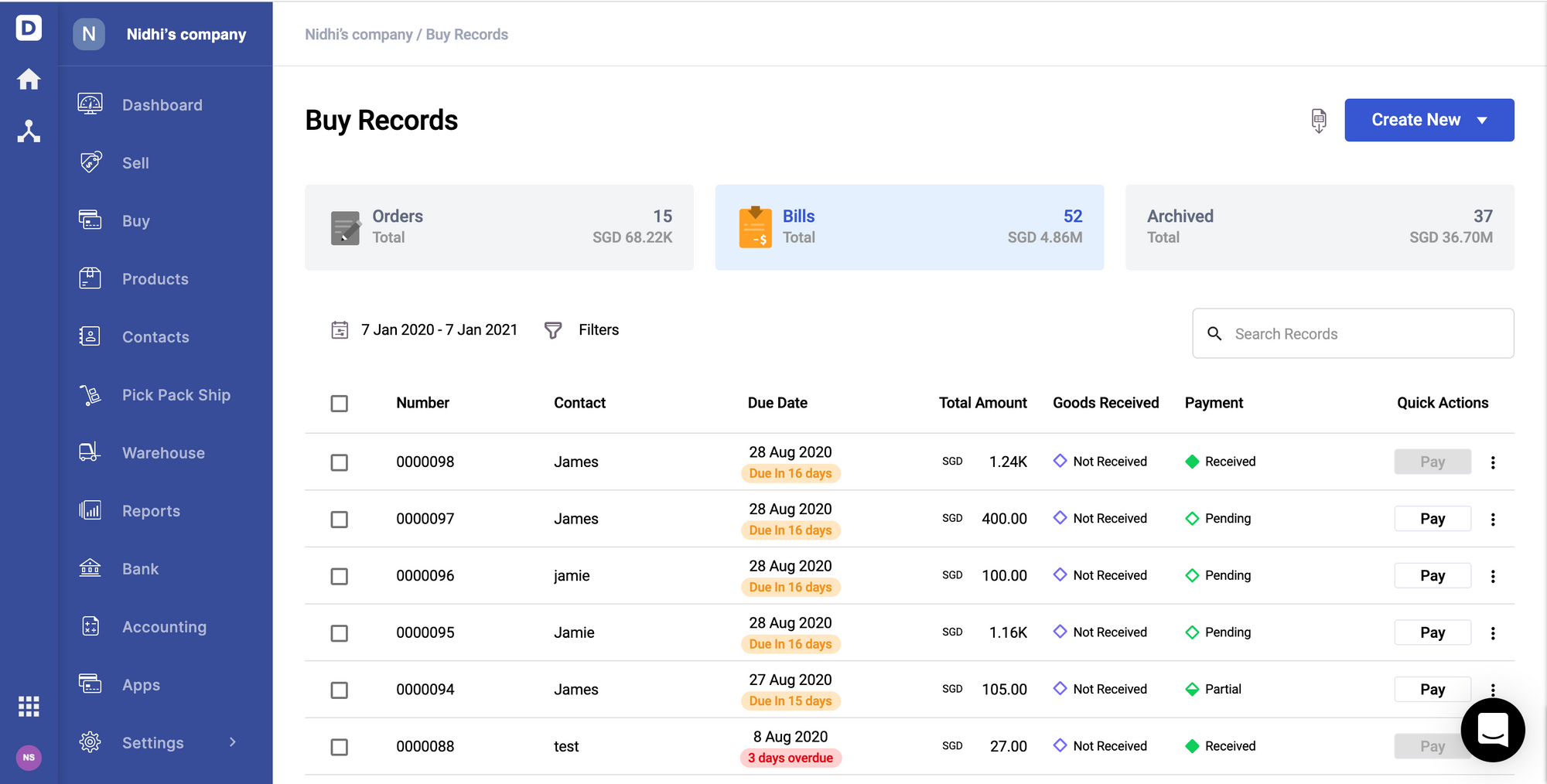

Step 5- Purchase Invoice or Bill Payment

The next important step after recording the expense is making purchase invoice payment. All bills must be tracked and paid on time to avoid late payment charges. Vendor bank account details are entered on the payment voucher. In some companies, approval is required before issuing a payment voucher to the vendor.

Why the Accounts Payable Process Have Internal Controls?

Every organization must have internal processes and control over the AP process to ensure the company’s cash and assets are safe. These internal controls help you to prevent paying a fraudulent or inaccurate invoice. Also, it avoids scenarios where you might pay the vendor twice for the same bill.

Why Is Accounts Payable so Important?

Tracking and paying your accounts payable on time helps you to maintain good relations with your vendors. Also, when you pay back on time, you can save some money as many vendors offer discounts to buyers who pay their pending payments on time or early. Here we have explained the importance of AP with an example.

Example- Vendor ABC company asked the CDE company to pay an invoice within 30 days and offered two percent discount if the CDE company pays within 15 days.

CDE company ordered goods worth $2000 from vendor ABC company. When CDE company received the purchase invoice or bill, they made the following journal entry in their financial books:

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Purchases | $2,000 | |||

| Accounts Payable | $2,000 |

The invoice sent by ABC company offered a two percent discount for paying the invoice within 15 days. CDE company wanted to save two percent amount, so they decided to pay the invoice within 15 days. Here in this example, the journal entry posted by CDE company will have following details:

- The discount amount received because CDE company decided to pay early

(2000 * 2%= $40) - The payment made to the ABC company ($2000- 40= $1960)

- Updating the accounts payable for ABC company (debit $2000)

Here in this example, the journal entry will be

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Accounts Payable | $2,000 | |||

| Cash | $1,960 | |||

| Discount | $40 |

Here in this example, the CDE company saved 40 dollars by making an early payment.

Accounts Payable Best Practices

Here we have listed the best practices that can help you to improve your accounts payable process:

Centralization of Accounts Payable process

Centralizing the AP process for all the departments with predefined processes will help you to eliminate data redundancy and save time on the purchase invoice processing. It will also help to reduce the data entry mistakes and control ordering by employees.

Automated Payments Reminders

Automated Payments Reminders will help you to avoid late or missed payments. Also, you can take advantage of discounts and negotiate the credit terms with your vendors for future purchases.

Vendor Profile Management

Creating and managing comprehensive vendor profiles in AP software helps you to access vendor profile information anytime, anywhere with web and mobile apps. You can track the status of deliveries, payment details, contract terms, and purchase invoices in the system.

Manage Your Cashflow

AP automation helps you to plan future expenses. It also helps you to plan and maintain a budget. An AP software helps you to ensure that all payments are matching the purchase orders approved previously with the vendor. AP automation helps to build a cash flow to fill the gaps when cash flow slows, and bills are due.

What Happens If I Can’t Clear My Accounts Payable?

According to the general accounting principles, all businesses are supposed to clear accounts payable by the due date as it is their current liabilities. If any business is unable to pay the amount in the short term due to some financial issues, they can talk to their vendor and inform them about the delay in payment. If you have a good relationship with your vendor, they might agree to make the due amount as long-term notes. Some vendors ask for interest payments for all delayed payments.

What Is an Accounts Payable Aging Schedule?

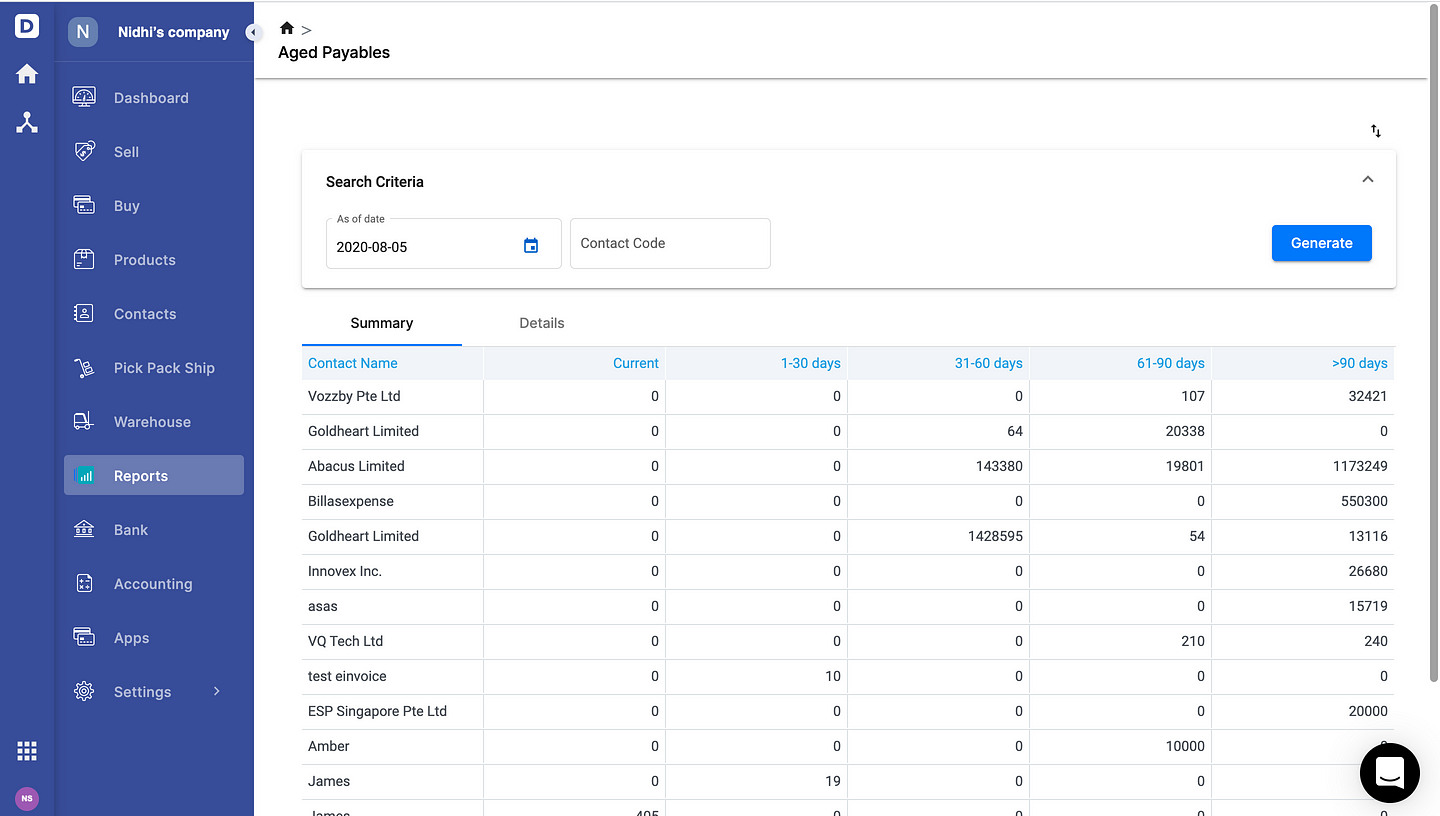

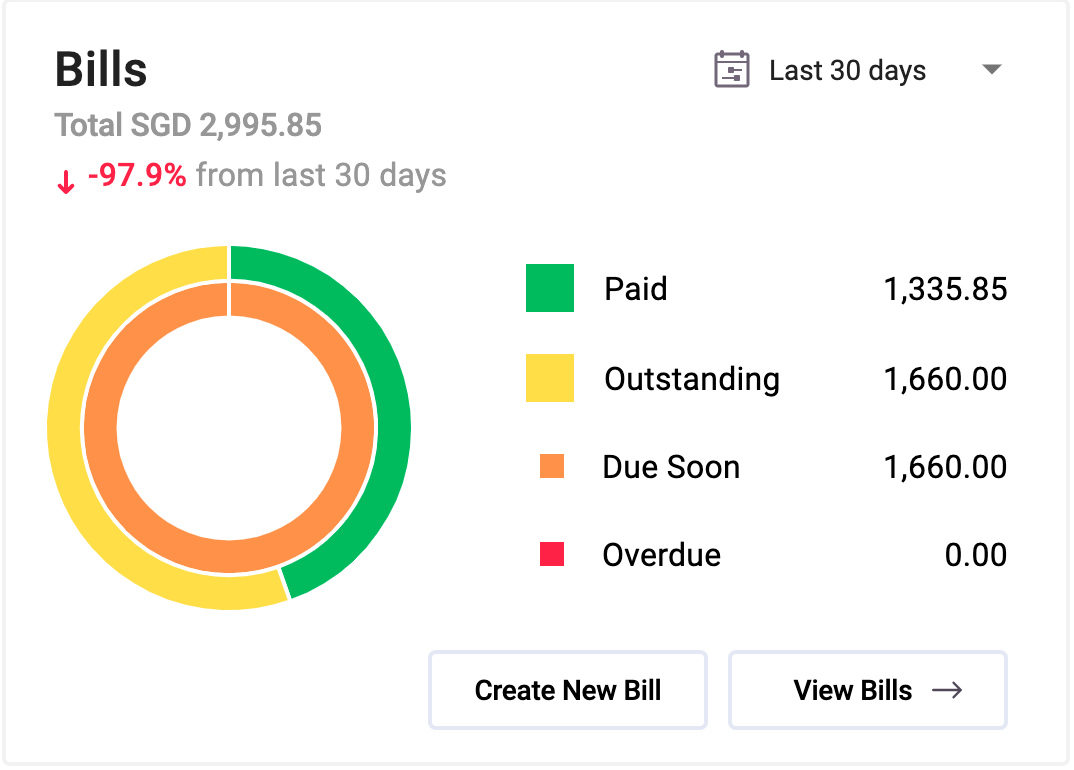

If you have many vendors, it will be difficult for you to maintain and track accounts payable for each supplier. All businesses must create AP aging reports to keep track of all vendor payments.

Accounts payable aging schedule shows you the list of all suppliers with the payback period. Also, the aging schedule highlights late payments to avoid late payment charges by vendors.

Here’s a sample accounts payable aging schedule generated by Deskera Books accounting software:

What Is the Function of the Accounts Payable Department?

In every organization, the AP department is responsible for managing, tracking, and paying for all incoming bills or purchase invoices. Most big organizations have an independent accounts payable department, but in small businesses, accounts payable and receivable tasks are done by the same department. Here we have listed main functions done by the AP department:

Internal Payments

AP department is responsible for checking and making internal payments for goods, service purchased by employees. Also, AP department manages and controls petty cash. Whenever any employees buy anything for the company, they need to raise reimbursement requests along with the receipt. This is applicable for small expenses such as the purchase of office supplies, or some office equipment, etc. In most companies, these small expenses are handled as petty cash.

Vendor Payments

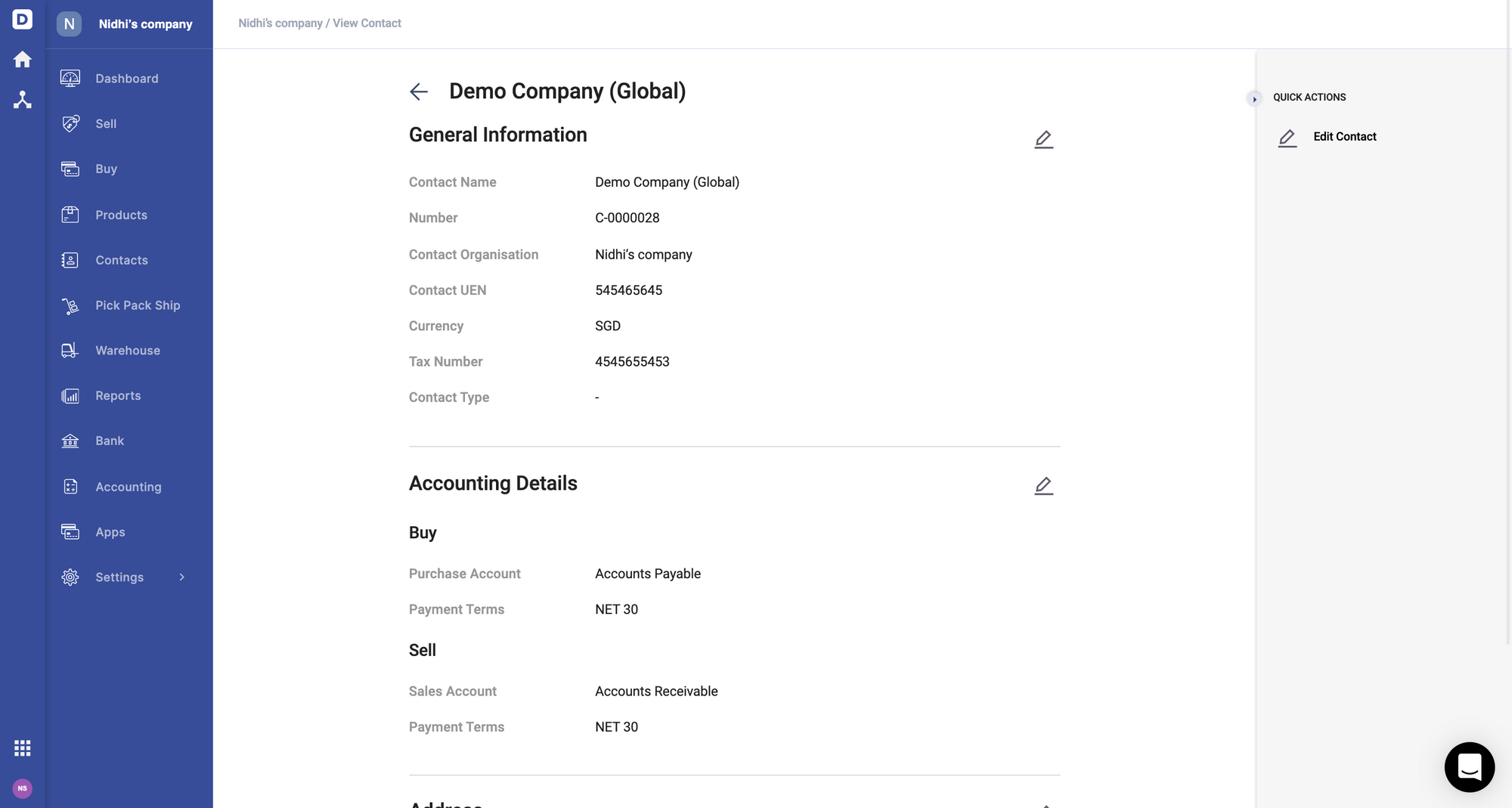

The most important job of the accounts payable department is to organize and maintains supplier contact information such as billing and shipping addresses, payment terms, bank account details, email address etc. For big organizations, an AP department mainly handles pre-approved purchase orders to verify purchases when a bill is received. Once a bill is verified, the accounts payable department issues a payment voucher to the vendor.

Vendor Management

The AP department is also responsible for maintaining good relations with vendors by making timely payments. The accounts payable department needs to develop strategies to save the business money by negotiating discounts by making early payments for the purchase invoice. Additionally, the accounts payable department also negotiates credit terms with the vendors.

Financial Reports

The AP department is responsible for making and tracking of all the vendor payments. Accounts payable needs to prepare end-of-month aging reports for all vendors. AP aging reports can be prepared manually or with the help of accounting software.

What Are the Responsibilities of Accounts Payable Manager?

Accounts payable manager role is very important in every organisation. Here we have listed the responsibilities and job description of AP manager:

- Reviewing, checking, posting all bills, or purchase invoices.

- Verifying purchase invoice against purchase order shared previously with the vendor.

- Maintaining files with copies of all vouchers, purchase invoices, etc.

- Maintaining and updating vendor information such as name, billing and shipping addresses, phone numbers, bank account details, payment method, email addresses, etc.

- Reconciling bank statements.

- Communicate with vendors in case of any discrepancies in invoice items or prices.

- Maintaining accounts payable aging schedule.

- Keep track of pending payments and making vendor payments.

What is Accounts Payable Automation?

Accounts payable automation refers to tools or processes that allow you to eliminate the manual aspects of AP, such as manual tracking of purchase invoices, bills, etc. Accounts payable automation software or AP automation software allows you to automate the entire process by online submission and approval of purchase orders and purchase invoices.

Accounts payable automation allows you to reduce errors by removing the manual processing of invoices. AP automation also provides you better visibility and control over your financial data.

What Is Accounts Payable Software?

Accounts payable software or AP software allows you to automate your payable process, such as purchase invoice approvals, email notifications, system alerts, and duplicate invoice identification. Accounts payable automation software will enable you to generate financial reports, which will give you complete visibility of your current liabilities. AP automation software allows you to have better control over your financial data.

Summary

Many businesses underestimate the importance of accounts payable management and automation. As the AP process is vital for every company, all businesses must spend time on its successful implementation. AP automation is very important to increase efficiency and avoid errors made by manual work.

Accounts payable automation will help you to reduce the time and cost of purchase invoice processing. AP automation will also help to reduce human errors and increase efficiency. All companies must implement AP automation software to streamline the accounts payable process. Implementing accounts payable automation software will eliminate most of the paperwork involved in bookkeeping.

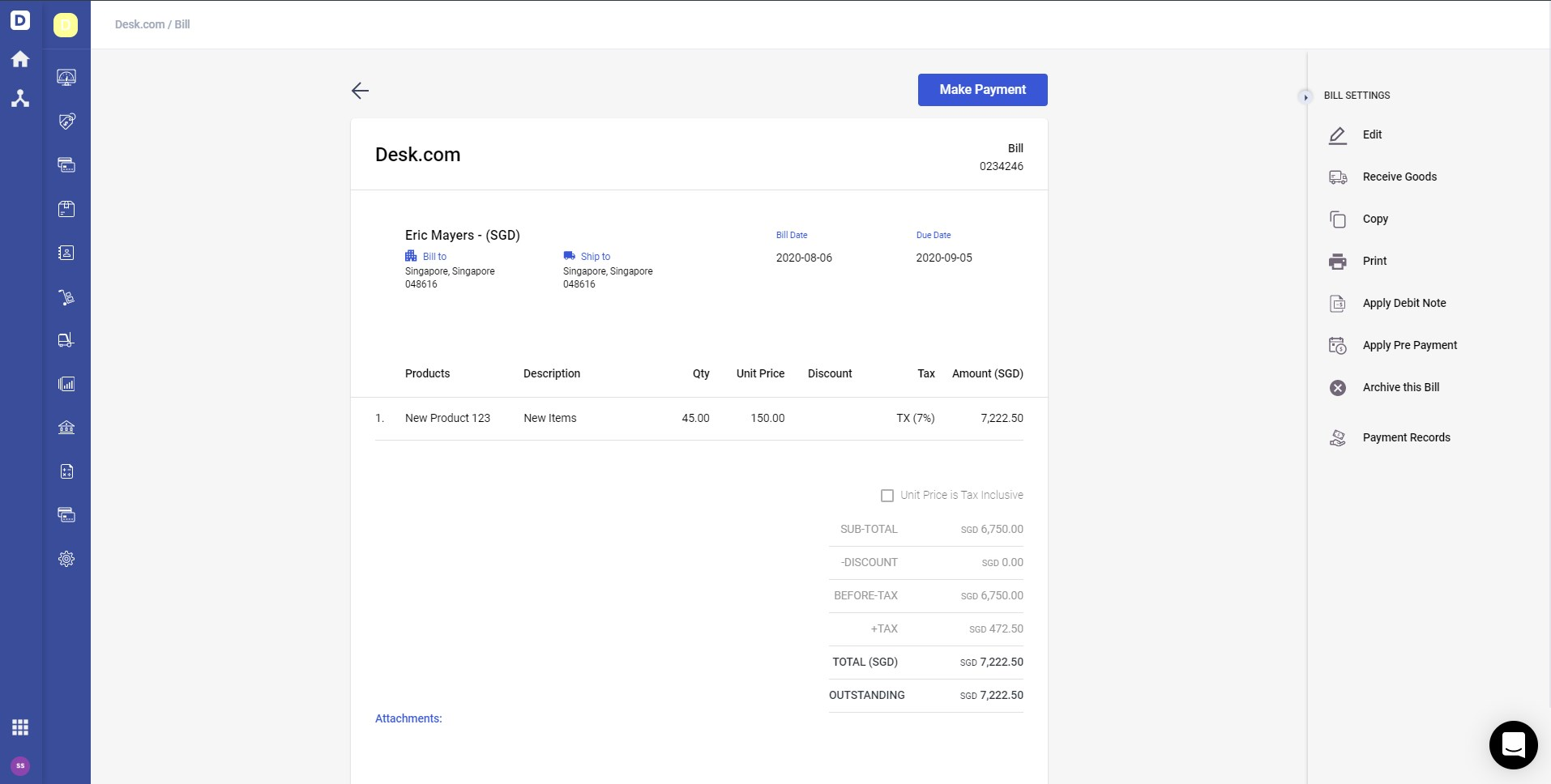

How Deskera Books Help You With Accounts Payable Automation

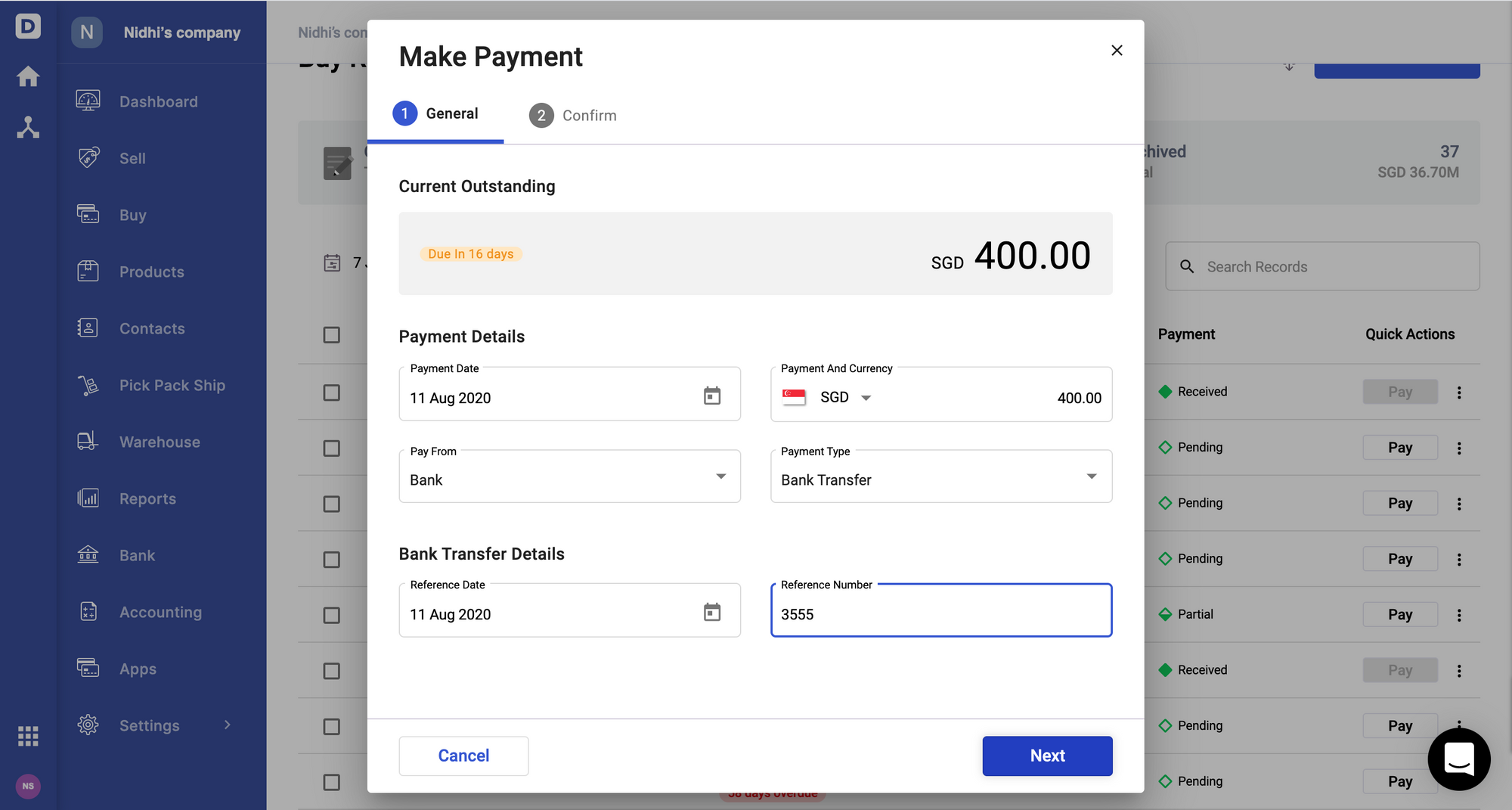

Deskera Books allows you to easily track and manage bills, purchase orders, and vendor credit notes in one place. You can access your bills any time from anywhere, on your mobile or desktop. With Deskera Books, automated reports get a complete overview of your accounts payables. Get automated alerts for all due bills to avoid late payment fees and poor relationship with your vendors.

Learn More about Deskera Books Features:

- Stay on Top of Your Billing

- Better Accounting for Business

- Making Purchases with Ease

- Invoicing with Deskera Books

- Journal Entries with Deskera

Sign up for a 30-day free trial of Deskera Books now!

Related Articles