Businesses need efficient inventory management, good cash flow management, invoicing management, management of business expenses and filing of taxation.

However, there is little to no digital penetration for managing these factors, leading to 44% of small businesses not making it to their 5th year, while only 40% of the small businesses succeed. Of all the businesses that have failed, 82% of those small businesses have failed due to poor bookkeeping and cash flow problems.

The impact of such bad accounting is multi-fold for a business. It leads to poor business decisions which are based on half information and insights. It also leads to rising inventory costs, with expenses and late payments eating away at your cash flow.

Small businesses also get heavily fined for inaccurate tax filings. Together, this leads to the business losing its money and consequently its failure.

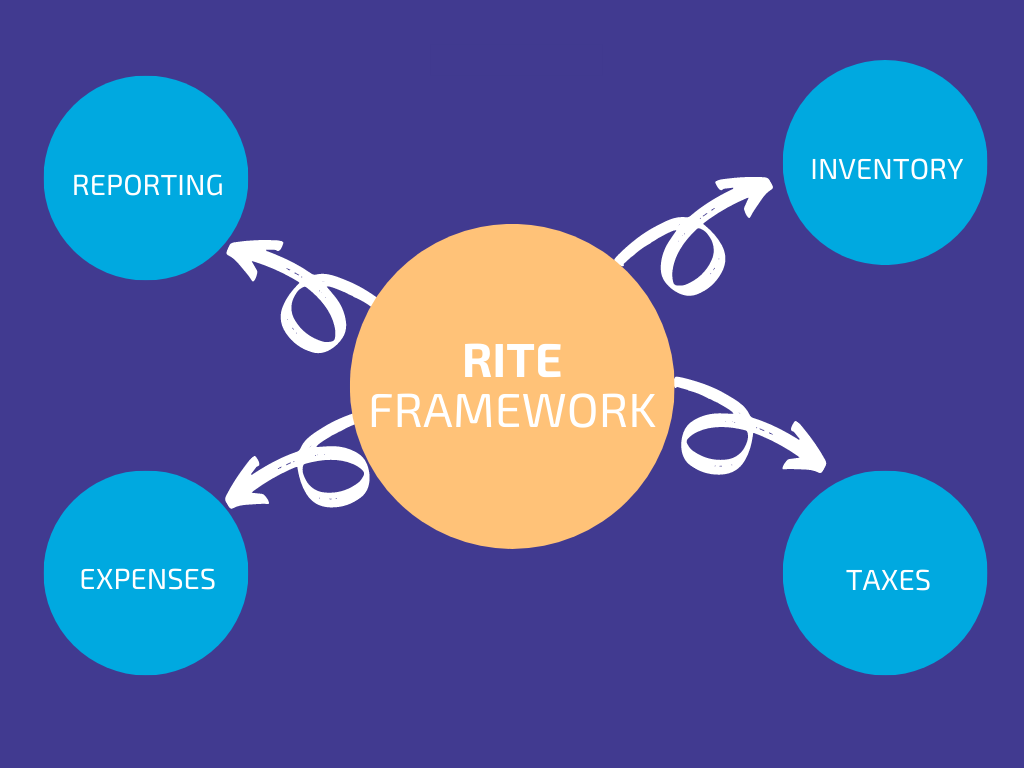

Rectifying this situation is made possible by following the RITE framework. RITE is an acronym for reporting, inventory, taxes and expenses.

If these 4 factors are managed correctly, they will solve all the major problems of a business, thereby ensuring its success. A successful business is one with increasing revenue, high returns on investment, improved customer retention and satisfaction and high gross profit.

This article is going to focus on how a business loses its money and how it can change this trend and start saving money. The format of the article is as follows:

- What Is Accounting?

- Why Is Accounting Important for Your Business?

- 4 Ways Your Business Loses its Money

- 15 Accounting Tips to Save You Money

- How can Deskera Help You Save Money?

- Key Takeaways

- Related Articles

What Is Accounting?

Accounting is the process of recording, summarizing, analyzing and reporting financial transactions of a business to oversight agencies, regulators and tax departments.

It is how your business records, organizes and understands its financial information. It is also made clear and understandable for all the stakeholders and shareholders. The results are then presented in various reports with several analyses.

The financial reports and results then formed need to be transparent, reliable and accurate.

Why Is Accounting Important for Your Business?

Accounting is one of the most important activities undertaken by the business. This is because accounting helps you to understand your business trends and accordingly plan its growth.

To achieve this decided growth, milestones are set in between. These are assessed on the basis of financial statements like profit and loss statements and cash flow statements. These financial statements give a full picture of the business's finances and financial health.

Financial statements when up-to-date demonstrate where your company stands, which helps it to secure a loan for funding your business as and when needed.

Potential buyers and investors will also rely on accounting reports to know the profitability of your business and its growth pathway.

Accounting is also vital to keep track of your account receivables and account payables. This will help you in maintaining a positive cash flow for your business. By keeping track of your balance sheet, it will also give insights into how effectively your payments are made and received. Changes, if required in these processes can then be put into place based on these data.

Lastly, solid accounting gives you a complete financial report which when used for tax calculations and liabilities ensures that minimum to no tax laws is broken. Accounting is crucial for every business and can basically determine the future of your business.

4 Ways Your Business Loses its Money

If not taken care of, it becomes quite easy for a business to lose its money. The 4 main ways by which your business loses its money are:

Poor Reporting

It was found that of all the businesses which used spreadsheets, 91% had errors in their accounts receivables, incorrect invoicing and incorrect amounts.

Another of the major problems for small businesses is late payments, which ends up creating cash flow problems for them. 61% of late payments were found to be due to compliance or administrative issues.

These compliance or administrative issues involved details like printing of wrong tax code and quoting of an incorrect tax amount. This led to the customers sending back their invoices, and you required to correct them and then send them back to the customers. This led to a loss of time in receiving the payment. For such past due invoices, an average delay of 37 days was found in getting paid after the due date.

All of the problems highlighted here are associated with poor reporting.

When your business is using spreadsheets or legacy systems to handle your reporting, poor reporting tends to become the by-product. Such systems are largely inefficient and lead to delayed reporting- which is the absence of real-time reporting.

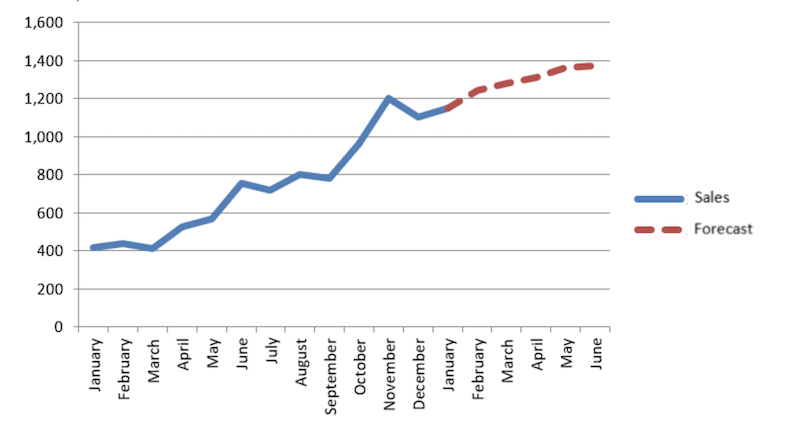

Under such circumstances, even historical data like what was revenue and expenditure last year and your monthly trends. This disables your business from forecasting which consequently leads to slower decision making.

Your business will be unable to predict and plan for the upturns and downturns. An increase in liabilities and expenses will also be observed by your business. This is also because traditional systems of reporting do not give you easy access to balance sheets, profit and loss statements and cash flow statements.

You can see all these data in real-time and what you cannot see, you cannot measure and hence not control. Ultimately, poor reporting causes problems with your cash flows and trade receivables which are detrimental to your business’s health.

A proactive reporting system will ensure that you and your business do not face such problems.

Mismanaged Inventory

43% of the businesses were found to be tracking their inventory manually, out of which only 63% of the tracking done was accurate. This results in the business either overstocking or under-stocking. In the case of under-stocking, it led to late shipping by 33% of the businesses.

Such inefficiencies spoil your brand image and make your customers look for alternatives. All in all, your profits will reduce considerably and your business will become more prone to downturns in the business cycles than to upturns. These problems causing loss of cash for your business are associated with mismanaged inventory.

Mismanaged inventory is expensive and loss inductive for your business. When your inventory is mismanaged, your orders would not be fulfilled on time. Moreover, you will also face unnecessary inventory costs because of a lack of forecast and reporting.

Overstocking of inventory will lead to unoptimized usage of your warehouse space. It will add on to the expenses and you will not have enough sales to meet those expenses. On the other hand, in case of under stocking of inventory, you will not be able to meet your sales date on time. This will make the customers unhappy and end up in you losing your money.

Inventory management is done by the people. Transfer of the inventory, management of the warehouse and handling of the orders all are covered in inventory management.

When there is mismanaged inventory, you will hire more people for this purpose, leading to more expenditure for your business. An automatic, real-time system should be put into place for inventory management to solve all these issues.

Do Not Mess with Taxes

When your business does not have proper reporting in place, the taxation filing gets delayed or you do an incorrect reporting of tax collected.

Even if this is avoided by the business, oftentimes they end up filing tax returns with missing information or calculating incorrect tax liability.

In either of the cases, it leads to expensive penalties and in some circumstances even loss of your brand value. Indirectly, facing these take extra time and energy which could have been otherwise used to grow your business.

Taxes are messed with when done in a hurry and manually. The solution to both of these is resorting to an automated system of reporting, inventory management and taxation. This increases efficiency, reduces errors and eliminates all possibilities of business losses.

Expensive Mistakes

One of the most expensive mistakes that a business owner is likely to make is mixing business and personal expenses. If you do this, your books would become chaotic and unorganized.

Additionally, it would lead to bloating of your business’s expenses and drawing from the business’s funds which has nothing to do with your business. This will negatively affect the profit and loss statement, balance sheet and even cash flow statements. It will also mess up your tax filings.

Not tracking expenses at all is another mistake committed by small businesses. There are countless expenses undergoing at all times and a business usually struggles and fails at keeping a track of them all.

This makes your business reactive in nature, wherein it should be proactive. Your business can become proactive if you have a real-time reporting system. Such a system notifies you with each addition/subtraction, enabling you to take necessary actions instantaneously.

Time spent in reconciling the expenses at the end of the month/quarter/year tends to become excessively time consuming, prone to errors and thereby a loss for your business. It also makes your accountant charge you more as your bookkeeping takes more time. One of the ways of avoiding it is by having real-time reporting and accounting.

15 Accounting Tips to Save You Money

Saving money is an art that requires checks and balances in the minutest of the details. You do that and your business will be saving money.

The 15 accounting tips to save you money are:

1. Historical Reports for Forecasting

Reporting of your business needs to be done correctly to combat several of the prominent problems. One of the first steps is to have a system in place which keeps all historical data of your business in one place over a period of time.

Such data will help you to identify your business’s trends, when your sales went up, when your expenses went down, what is profitable/non-profitable for your business and what is your turnover ratio to mention a few.

When your business uses this information in the coming months/weeks/days, to predict and plan the further strategies and actions of your business.

This will ensure that your business is more protected against otherwise unforeseen circumstances and threats. This will also help your business to identify its opportunities pre-hand and prepare for them accordingly.

Thus, historical reports for forecasting is an important accounting tip to save you money.

2. Complete View of Finances

Having a system in place which gives a complete view of your finances is also beneficial for your business. A complete view of finances includes statements like trial balance, balance sheet and profit and loss statement at the click of a button even on the go.

This will keep you better informed and updated about your business which will give you a competitive advantage over your competitors. It will also keep you better prepared for what is going to come next.

Lastly, you will also know what is happening in your business, which will help in instantaneous course-correcting as and when required. This accounting tip to save you money is a must for following.

3. Automation of Invoicing and Collection Reminders

One of the activities that result in the considerable expenditure by the business is manual invoicing and sending and collecting reminders. The inputs required in this manual work when automated leads to saving money.

Saving money is as direct as it is indirect if you follow this account tip to save you money for your business. This is because while money is saved by cutting down on costs of manual inputs, it is also saved because an automated system is more efficient, faster and timely.

For a business, such an automated system ensures that your business incurs the least of penalties due to late payments and incorrect invoices. It also keeps your receivables under control.

4. Real Time Tracking On-the-Go

For you to make quick decisions for your business, you need all the data and information of your business at your fingertips.

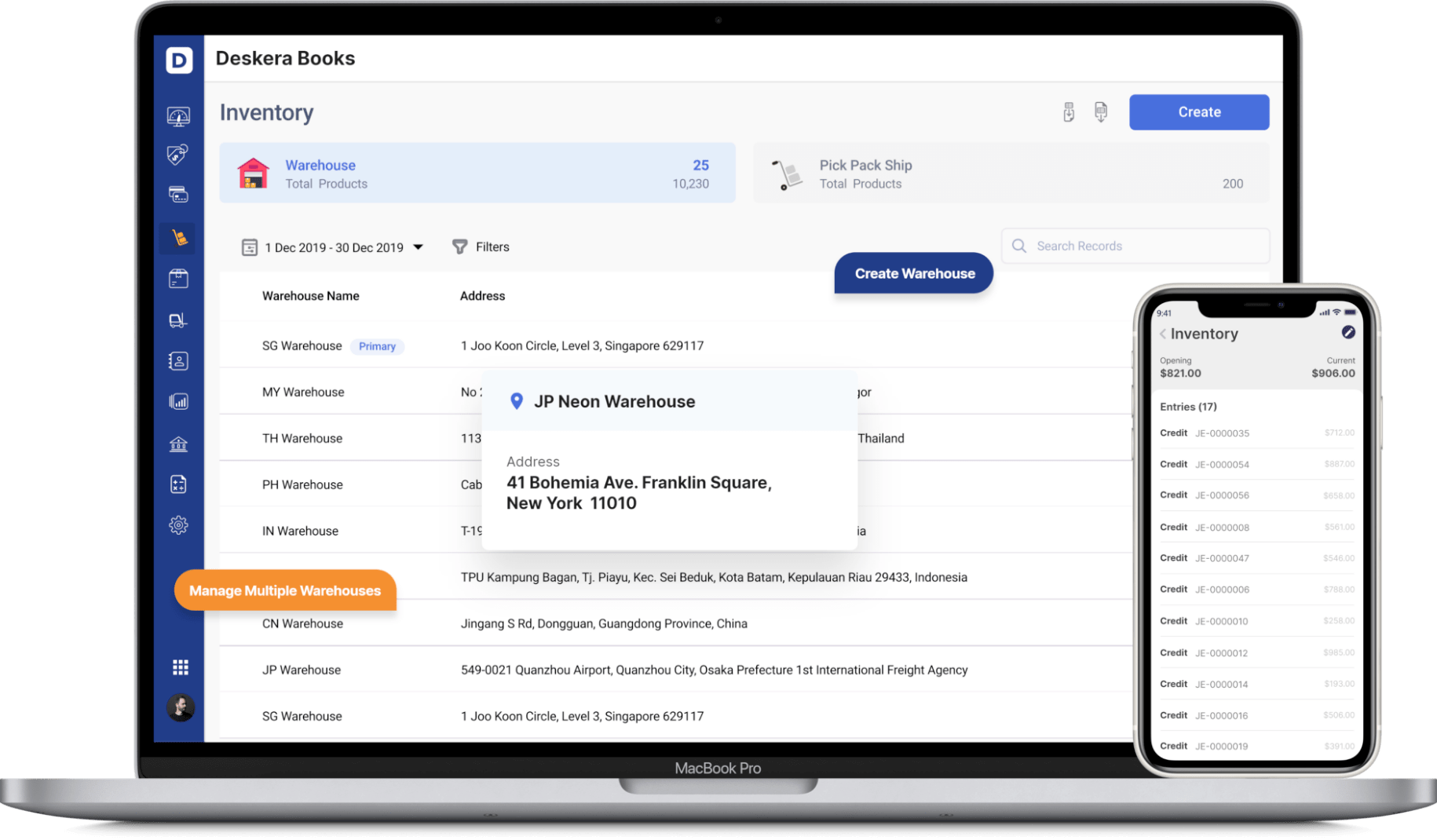

Using a system like Deskera which has a mobile app, along with all the reports and their insights in there will be highly beneficial for your business. Such a system will be all-comprehensive with your financial reports, sales reports and payable and receivables reports to mention a few.

When your business is efficient and well versed with the changing trends, it will satisfy your customers more. This will result in your business growth not just momentarily but in future as well.

Real-time tracking on the go is therefore the last accounting tip to save you money under the subsection of reporting done RITE.

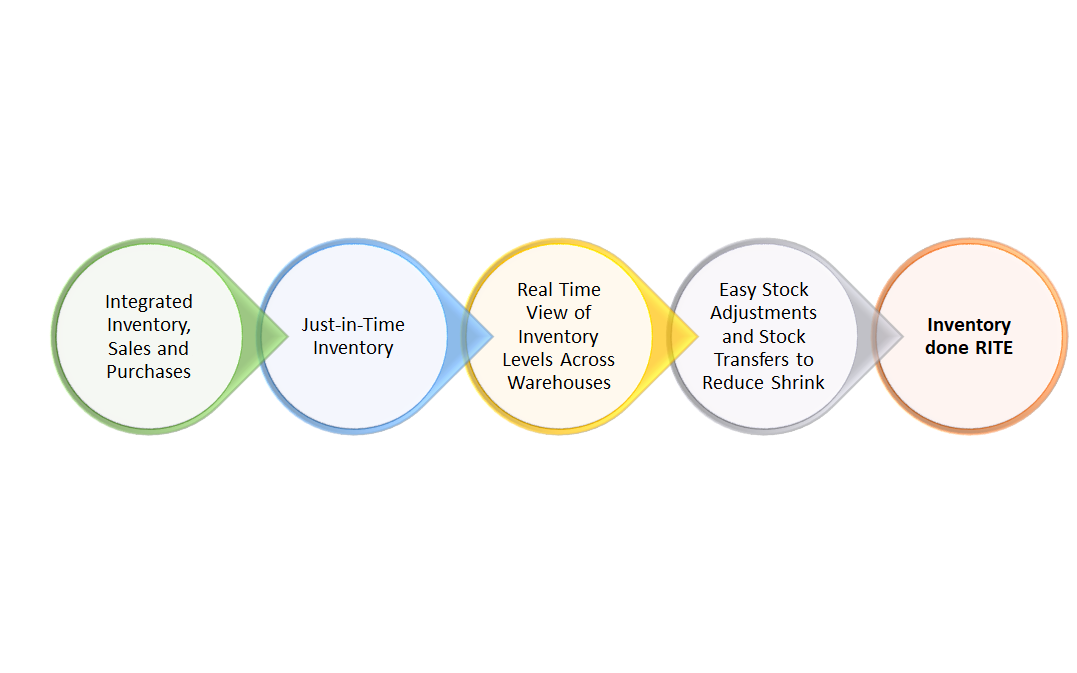

5. Integrated Inventory, Sales and Purchases

Integrating your inventory system with your sales, purchases, stock adjustments, stock transfers and assembly lines.

By doing so, your business would be eliminating the overhead costs of having to update records manually and of keeping track of inventory manually across its different databases.

An integrated inventory will remove late deliveries and increase the overall efficiency of your business and therefore improve customer retention. This accounting tip to save you money is basic yet very important.

6. Just-in-Time Inventory

In simple terms, just-in-time inventory means that you never keep advance and excess inventory. This can be facilitated by keeping a backorder function in your business.

A backorder function is one that tells you what are the things that you are short of in your inventory as soon as you receive an order.

Using the backorder function, you can create purchase orders as and when needed and bring them in. This prevents your business from the expenses of keeping excess inventory and saving you money.

You can also opt for pseudo drop shipping, wherein you can get the orders directly from the vendor and have them shipped to your suppliers- if that is your business model.

Having just-in-time inventory, is therefore, an accounting tip that makes sure your business saves more by eliminating the otherwise extra expenditure.

7. Real Time View of Inventory Levels Across Warehouses

In case your business has various warehouses, you should have a real-time view of your inventory in each of the warehouses. When you are fulfilling your orders, if you do not have a real-time view of your inventory across them all, you will end up either overstocking it or understocking it.

In such cases, your warehouse would have a set limit of the orders it can ship at a particular point in time and based on this you transfer your orders to them and supply them with the inventory.

The warehouses might incur extra shipping costs between themselves and the other warehouses if you do not manage the whole sales and purchases correctly.

If this is done incorrectly, it will either lead to incomplete completion of orders or delayed shipping of the orders. Both of these will make the customer dissatisfied with your business and take a hit on your brand image.

All in all, if this accounting tip to save you money is not followed it will bring huge losses to you. RITE reporting and RITE inventory management is the key to savings here.

8. Easy Stock Adjustments and Stock Transfers to Reduce Shrink

The key to the RITE inventory management is also easy stock adjustments and stock transfers which can be made possible by having the RITE reporting followed by your business.

When this is ensured, your business will save money, reduce expenditure, make more profits and even have happier customers than ever.

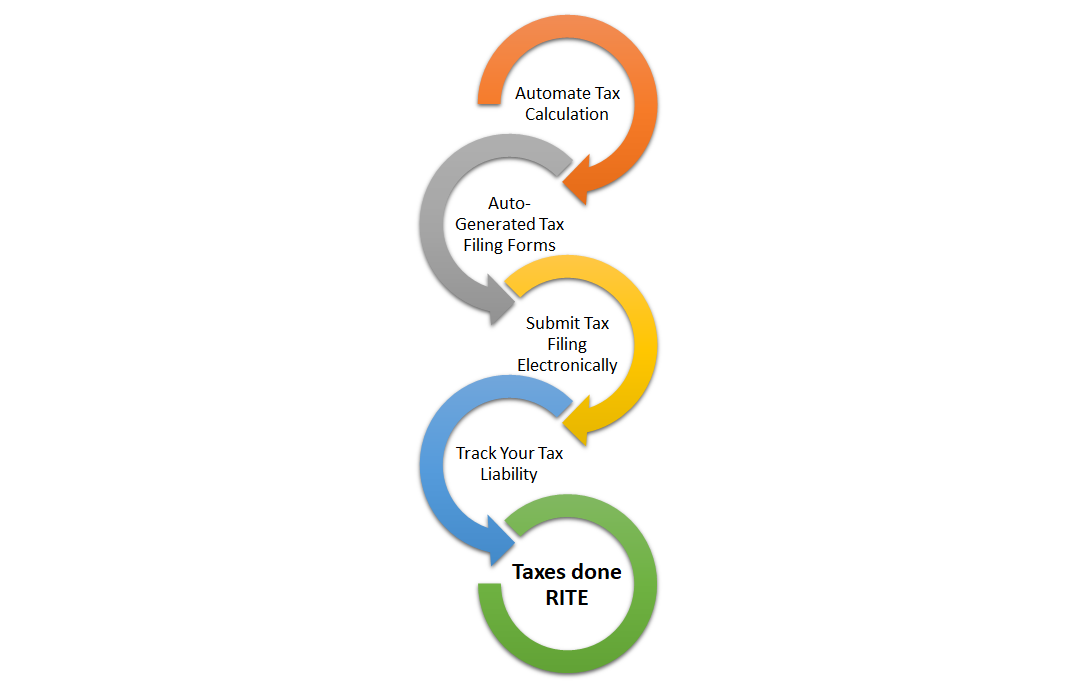

9. Automate Tax Calculation

If your business is doing tax calculations manually, errors become inevitable due to complicated tax laws that need all the minute details to be looked after.

For instance, India has SGST, CGST, IGST and a whole list of products and services, each of which has a different tax slab to be followed. Based on the code, where your business is located and where your contact’s business is located- the tax amount changes. Within these basic parameters, there are several other sub-parameters that need to be looked into and considered.

In the US, the sales taxes can differ with the zip codes. You can be a supplier of 2 shops on the same street, but if their zip codes are different, so can be their taxes.

Considering the various permutations and combinations that go into tax calculation, automating it is the only way of ensuring your business is not put under the threat of mistakes. This accounting tip to save you money is a must for your business.

10. Auto-Generated Tax Filing Forms

A system that calculates the taxes for you automatically, as well as auto-generates tax filing forms, is all comprehensive. If your system does only the prior and not the latter, then you should change it to something which includes both. Deskera Books is one such cloud system.

The benefit of an auto-generated tax filing form is that it ensures that all the details filled in are accurate. It does so through its system which keeps itself regularly updated with the changing tax rules and forms by the government.

If your business does not use automated systems, you will become liable to making costly mistakes that will affect your cash flow. It will also take away your time from growing your business and keeping the customers happy and satisfied. Indirectly, this will be a loss for your business.

11. Submit Tax Filing Electronically

If your country permits you to file your taxes electronically, use that option as it will save lots of time and expenses.

Electronic submission will let you see your errors immediately as there would be many checks and barriers involved there. This reduces your chances of an incorrect filing drastically.

All in all, this accounting tip to save you money will do just that- save you lots of money- directly and indirectly.

12. Track Your Tax Liability

Using an automatic system to calculate your taxes, will help you to track your tax liabilities automatically as well. The report having your tax liabilities would have a total tax liability figure after considering every single detail- the tax in, tax out, deductions at source and many more as decided by your government.

Based on this, you will know whether you have a positive tax liability (the government pays you) or a negative tax liability (you pay to the government). In case of negative tax liability- year after year, you will have to forecast it and prepare for it.

Details like the returns, the tax that needs to be paid out, tax liabilities, the tax that needs to be returned need to be included in the preparation to offset the cash flow problems that might happen otherwise.

This accounting tip to save you money will save the future of your business as well.

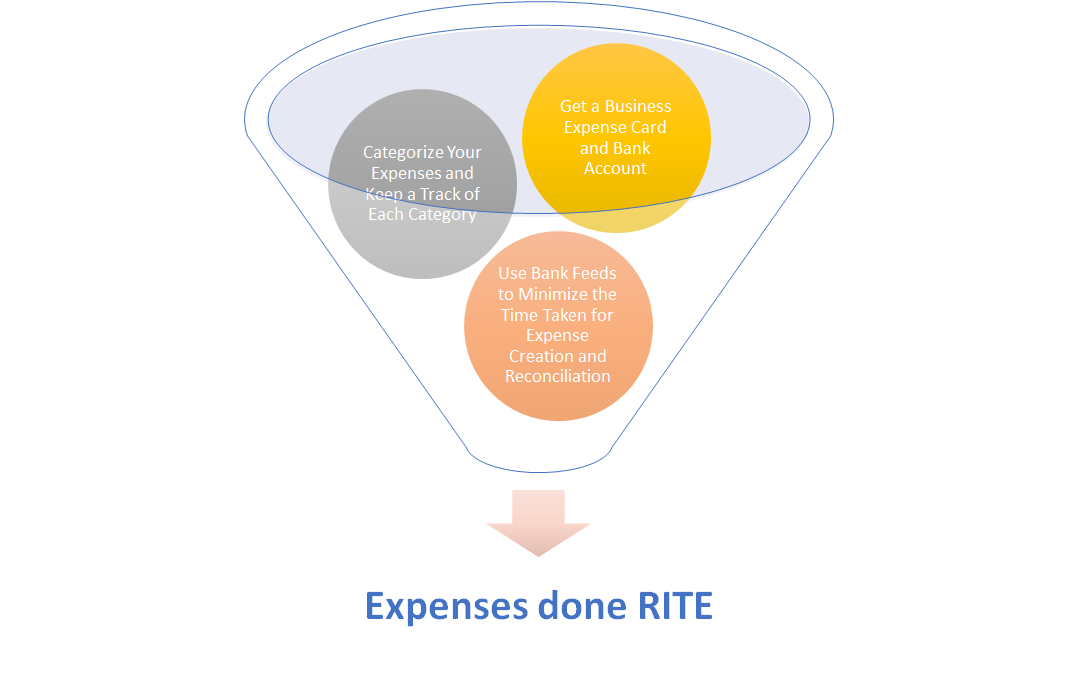

13. Get a Business Expense Card and Bank Account

Your business should have its bank account and expense card. You should not use your personal bank account for your business expenses. On the other hand, you should not use your business account for your personal expenses.

Doing so will save you from mistakes arising from incorrect reporting. This will save the business from losses, penalties and correcting expenditure.

No software or cloud system can help you with this as it is more about your habit. But, if followed, it is a successful accounting tip to save you money.

14. Categorize Your Expenses and Keep a Track of Each Category

Your business should categorize its expenses and keep track of each category regularly. There should be a notification and approval system in place.

For example, if you have established a maximum budget of $100 for monthly stationery, the moment that figure is crossed, it will require your approval for further spending in that category.

The categorization and tacking of the expenses will also reveal the expenditure trends of your business. When combined with real-time reporting and inventory management, it will give you a complete picture of how your business is doing, how much it is spending, how many orders you are going to get and what your profit and loss statement will look like if this trend continues.

This will facilitate you to make changes in how you do things. These changes when done will prevent you from traps like negative cash flows.

15. Use Bank Feeds to Minimize the Time Taken for Expense Creation and Reconciliation

Use a system for your business that is directly connected with your bank account or at least allows you to import your bank statements directly. This will allow you to do your expense reconciliation automatically and even categorize them.

By connecting your expenses with your bank feed, it is ensured that you are not recording additional expenses or lesser expenses. Bank here becomes the source for all your expenses, making their reporting faster and accurate.

Using this accounting tip to save you money is interconnected with the majority of the previous tips.

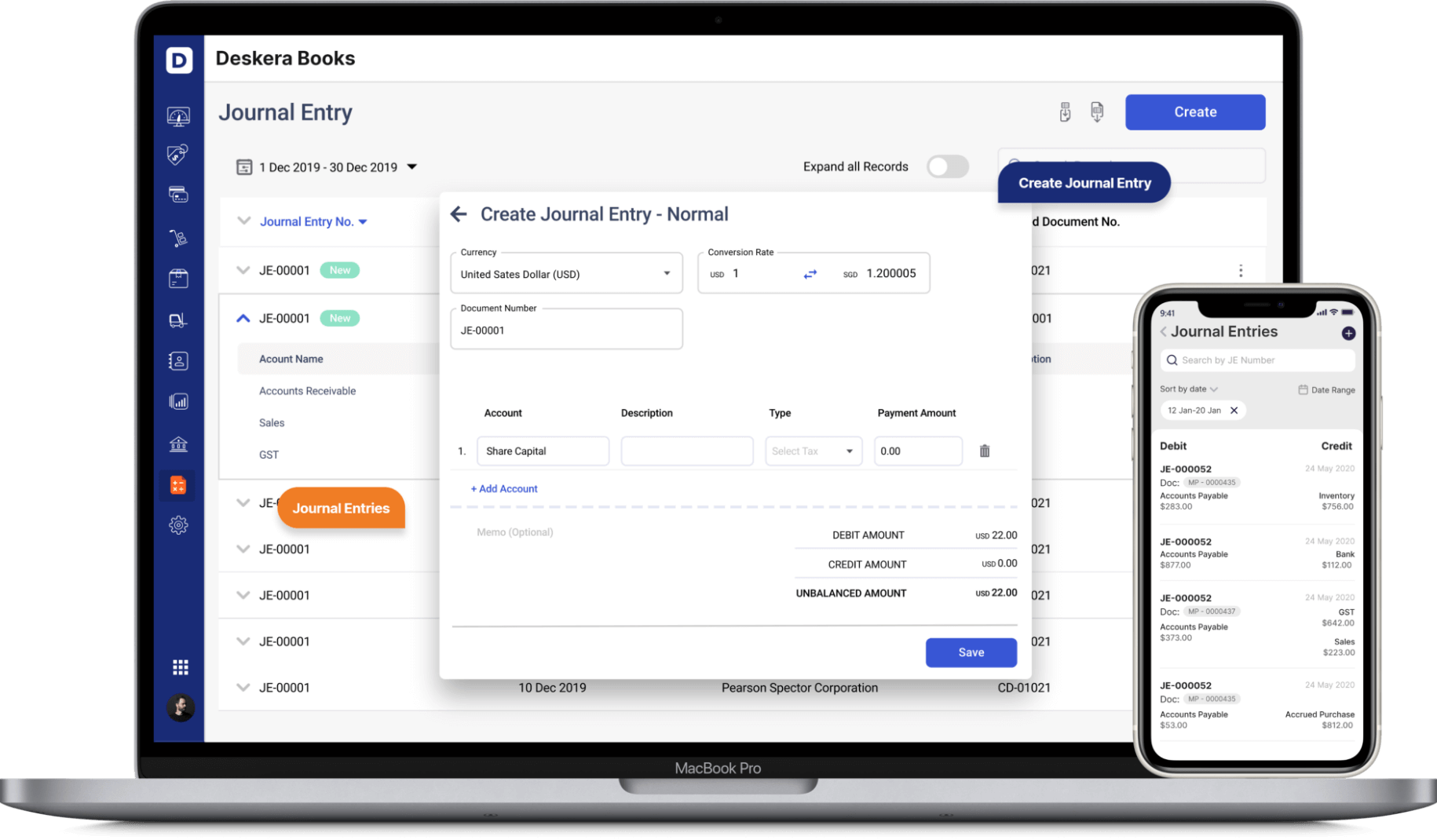

How can Deskera Help You Save Money?

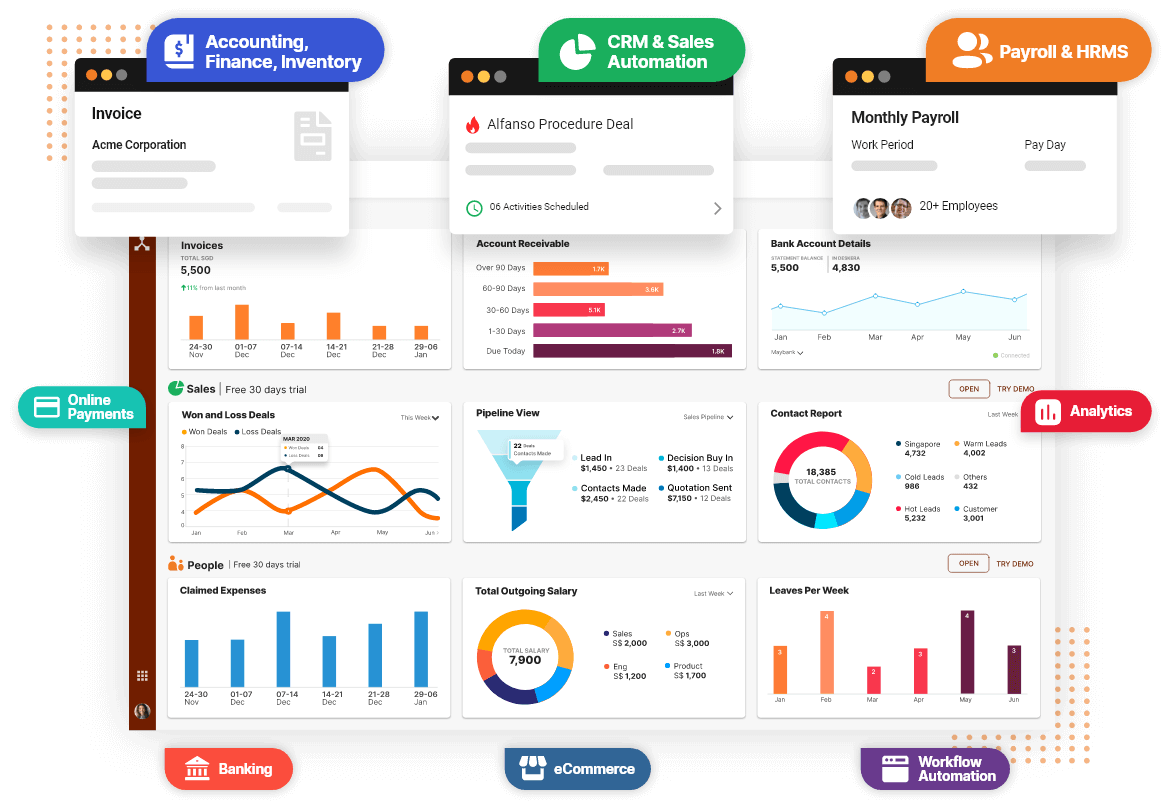

Deskera is an automatic cloud system that saves you money and is highly efficient. It is that companion to your business, who will guide you down the right path by giving you the most detailed insights and analysis.

Deskera Books will help you get real-time reporting and automatic inventory management with tracking of serial numbers and batch numbers. It will also assist in automatic tax calculations that are customized to the country laws that your business is a part of.

Deskera Books is online accounting software that can help your company save time by automating the process of creating journal entries. For each sale and purchase business transaction in debit and credit terms, the double-entry record will be auto-populated. The transaction data is consolidated into each ledger account by Deskera. Their values will be instantly transferred to the corresponding financial reports.

You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant.

Deskera can also help with your inventory management, customer relationship management, HR, attendance and payroll management software. Deskera can help you generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

Deskera books will also generate automatic tax reports and all the relevant tax forms. If your country allows electronic filing, Deskera books also have that enabled.

Further on, through its system, you can track your expenses, know the trends of your expenses and connect your bank feeds with the system.

Deskera will hence be your one-stop solution for doing the accounting RITE and save you money. It will also help you in assessing the indirect costs incurred by your business. This includes, for instance, incomes paid to your workforce and for which work and how it can be better optimized. Such insights would be accessible through Deskera people.

Deskera is an all-in-one software that can overall help with your business to bring in more leads, manage customers and generate more revenue.

Thus, Deskera is the accounting tip to save you money by investing some in getting the system for your business.

Key Takeaways

For a business to succeed and be profitable, with a high return on investment, it has to have a fine balance between all of its activities. These activities include accounting, sales, purchase, inventory management, infrastructure development, customer service, campaigns like email marketing campaigns and taxations to mention a few.

What makes a business suffer loss is when it has:

- Poor Reporting

- Mismanaged Inventory

- Messing with Taxes

- Made Expensive Mistakes

To ensure that a business does not make losses, and rather saves money for its growth and development which will be more profitable in the long run, it needs to take care of several aspects of accounting.

These are 15 accounting tips to save you money. They are:

- Historical Reports for Forecasting

- Complete View of Finances

- Automation of Invoicing and Collection Reminders

- Real Time Tracking On-the-Go

- Integrated Inventory, Sales and Purchases

- Just-in-Time Inventory

- Real Time View of Inventory Levels Across Warehouses

- Easy Stock Adjustments and Stock Transfers to Reduce Shrink

- Automate Tax Calculation

- Auto-Generated Tax Filing Forms

- Submit Tax Filing Electronically

- Track Your Tax Liability

- Get a Business Expense Card and Bank Account

- Categorize Your Expenses and Keep a Track of Each Category

- Use Bank Feeds to Minimize the Time Taken for Expense Creation and Reconciliation

So, use these tips and subscribe to the Deskera cloud system and be a witness to a wide range of positive changes and profits that your business makes.

Related Articles