In today’s increasingly digital business landscape, small businesses must rely on more than just manual bookkeeping to stay competitive. Accounting software has become a crucial tool in helping small businesses manage their finances efficiently, ensuring accuracy and compliance while freeing up valuable time to focus on growth.

According to the Sage Practice of Now report, 58% of businesses have turned to accounting software to meet their clients' evolving needs. The trend toward digital solutions is particularly strong among small businesses, with 82% adopting cloud-based accounting tools, far surpassing the 52% adoption rate seen among larger enterprises.

This shift towards cloud accounting highlights the importance of accessible and scalable financial management solutions that can grow with a business. By automating routine tasks like invoicing, expense tracking, and payroll management, accounting software not only reduces human error but also provides real-time insights into a business’s financial health. These insights empower small business owners to make data-driven decisions that drive profitability and long-term success.

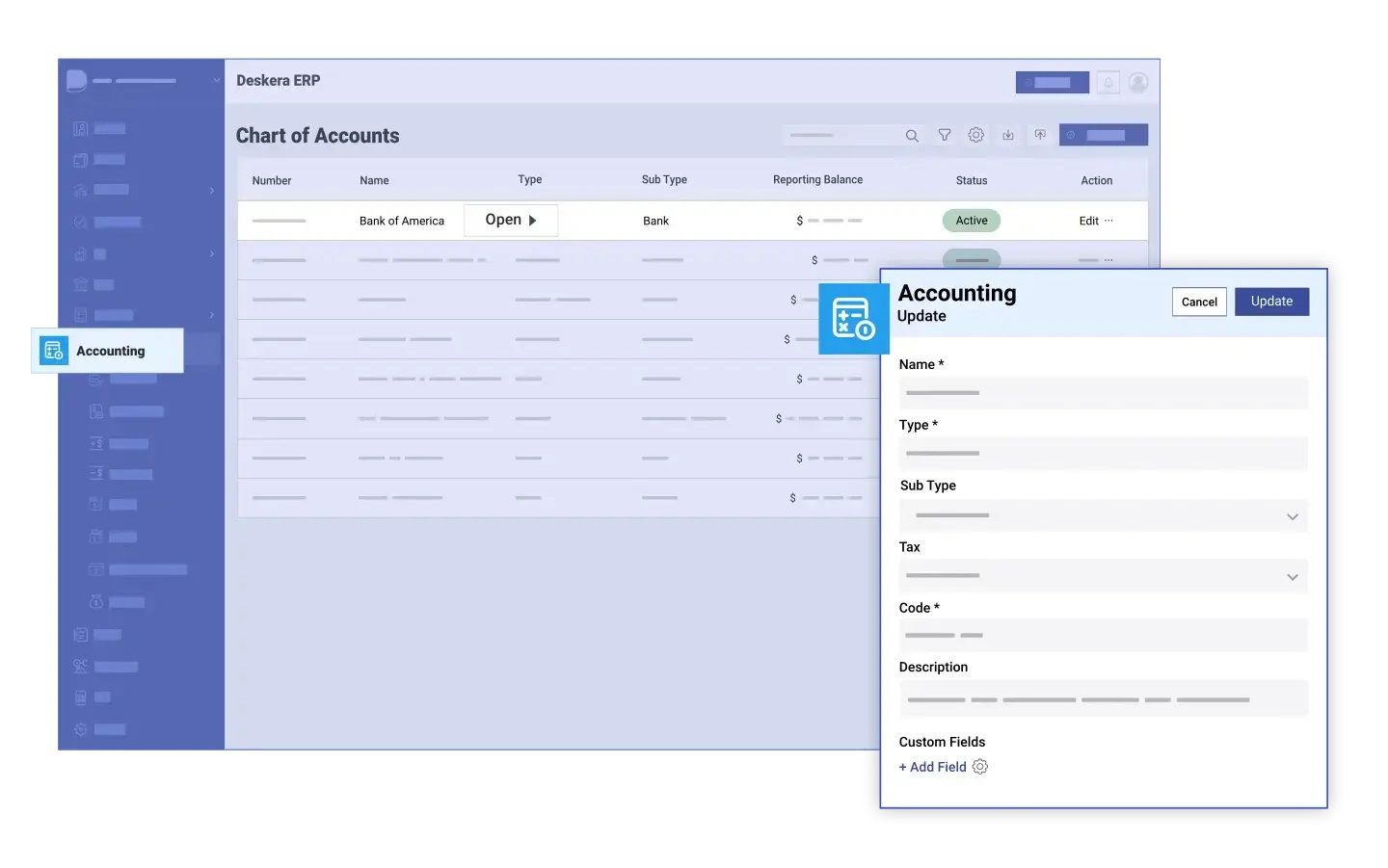

Deskera ERP offers a comprehensive suite of accounting features tailored for small and medium-sized businesses. With cloud-based capabilities, it enables real-time financial tracking, automated invoicing, and easy reconciliation of accounts.

The platform also supports multi-currency transactions, detailed financial reporting, and tax compliance, ensuring that businesses can manage their finances with accuracy and ease.

Deskera ERP’s user-friendly interface simplifies complex accounting tasks, making it a go-to solution for businesses looking to streamline their financial operations.

What is Accounting Software?

Accounting software is a digital tool designed to help businesses manage their financial transactions and records. It automates various accounting tasks, such as tracking income and expenses, managing invoices, and generating financial reports.

By centralizing financial data in a digital format, accounting software streamlines financial management processes, improves accuracy, and provides insights into a business's financial health.

Types of Accounting Software

The types of accounting software are:

1. Desktop Accounting Software

- On-Premises Solutions: Installed directly on a computer or server within the business. Offers full control over the software and data but requires manual updates, maintenance, and is limited in terms of remote access and scalability.

2. Cloud-Based Accounting Software

- Online Solutions: Accessible via the internet from any device with a web connection. Provides benefits such as remote access, automatic updates, scalability, and reduced IT maintenance.

3. Industry-Specific Accounting Software

- Tailored Solutions: Designed to cater to the unique accounting needs of specific industries or business types. Addresses particular compliance requirements and operational nuances.

4. Open-Source Accounting Software

- Customizable Solutions: Software that is freely available for modification and distribution. Allows businesses to customize the software according to their specific needs, often with community support and shared development.

5. Enterprise Resource Planning (ERP) Accounting Software

- Integrated Solutions: Part of a broader ERP system that integrates accounting with other business functions such as inventory, HR, and customer relationship management. Offers comprehensive management of business processes in a unified system.

6. Small Business Accounting Software

- Simplified Solutions: Designed specifically for small businesses with straightforward accounting needs. Often includes basic features like invoicing, expense tracking, and financial reporting, with a focus on ease of use and affordability.

7. Personal Finance Software

- Individual Solutions: Tailored for personal rather than business use. Helps individuals manage their personal finances, track spending, and create budgets. Not typically suited for complex business accounting needs.

The Core Functions of Accounting Software

The core functions of accounting software that your small business will benefit from are:

Invoicing and Billing

Invoicing and billing are fundamental functions of accounting software, designed to streamline the financial transaction process. Automation in invoicing ensures that bills are generated and sent promptly, reducing manual errors and administrative overhead.

Businesses can customize invoice templates to reflect their brand and include essential details such as item descriptions, quantities, and pricing.

Additionally, the software tracks payment statuses, automatically sending reminders for overdue invoices, which helps in maintaining a healthy cash flow.

Recurring billing capabilities simplify the management of subscription-based services or regular contracts by automating the process of generating and sending invoices at set intervals.

This functionality not only saves time but also ensures that all invoices are accurate and consistent, leading to improved financial management and enhanced customer satisfaction.

Expense Tracking

Expense tracking is a critical feature of accounting software that enables businesses to monitor and manage their expenditures effectively. The software categorizes expenses based on predefined or customizable categories, such as travel, office supplies, or utilities, making it easier to analyze spending patterns.

Integration with bank accounts and credit cards allows for real-time updates, automatically importing and categorizing transactions, which minimizes manual data entry and errors. Users can attach receipts and other supporting documents directly to expense entries, ensuring comprehensive record-keeping.

Additionally, advanced features may include setting spending limits and alerts for specific expense categories, helping businesses stay within budget and manage cash flow more effectively. This streamlined approach to expense management enhances accuracy, simplifies accounting processes, and aids in financial planning.

Payroll Management

Payroll management is a complex task that accounting software simplifies through automation. The software calculates employee wages, taxes, and deductions based on inputted data, ensuring accurate and timely payroll processing.

Automated payroll systems handle various payroll types, including hourly, salaried, and commission-based pay, and generate detailed pay stubs for employees. The software also manages tax withholdings, benefits, and other deductions, ensuring compliance with federal and state regulations.

Automated tax filings and direct deposit options streamline the payment process, reducing administrative burden and minimizing errors. By integrating payroll with other accounting functions, such as expense tracking and financial reporting, businesses can maintain accurate financial records and ensure regulatory compliance.

This efficiency helps in managing employee compensation effectively while saving time and reducing the risk of errors.

Financial Reporting and Analytics

Financial reporting and analytics are essential functions of accounting software that provide insights into a business’s financial health. The software generates comprehensive financial reports, including balance sheets, income statements, and cash flow statements, offering a detailed overview of financial performance.

Customizable reporting features allow businesses to create reports tailored to specific needs, such as departmental expenses or project budgets. Real-time data integration ensures that reports reflect the most current financial information, facilitating timely decision-making.

Advanced analytics tools offer insights into financial trends, profitability, and operational efficiency, helping businesses make informed strategic decisions.

By visualizing financial data through charts and graphs, the software enhances understanding and communication of financial performance, supporting better planning and management.

Tax Preparation and Compliance

Tax preparation and compliance are streamlined by accounting software, reducing the complexity and risk associated with tax obligations. The software automatically calculates tax liabilities based on financial data, ensuring accurate and timely tax filings.

It generates necessary tax forms and reports, such as W-2s, 1099s, and VAT returns, simplifying the reporting process. Integration with accounting records ensures that all tax-related information is up-to-date and accurate, helping businesses avoid penalties and audit issues.

Additionally, the software provides tools for tracking deductible expenses and tax credits, optimizing tax benefits. By maintaining compliance with federal, state, and local tax regulations, businesses can focus on growth rather than navigating the intricacies of tax laws.

Bank Reconciliation

Bank reconciliation is a crucial accounting function that software automates to ensure accuracy and efficiency. The process involves matching bank statements with accounting records to verify that transactions are accurately recorded.

Accounting software automatically imports bank transactions and compares them with internal records, highlighting discrepancies and exceptions.

This automation reduces manual effort, minimizes errors, and speeds up the reconciliation process. Features such as auto-matching and exception reporting further streamline the task, allowing businesses to quickly resolve discrepancies.

By providing a clear and accurate view of financial status, automated bank reconciliation supports better cash flow management and financial oversight, helping businesses maintain accurate and up-to-date records.

Cash Flow Management

Effective cash flow management is essential for maintaining business liquidity, and accounting software provides tools to streamline this process. The software monitors cash inflows and outflows, providing real-time insights into the company’s cash position.

It helps businesses forecast future cash flow by analyzing historical data and projecting upcoming expenses and revenues. Automated alerts and reports notify users of potential cash shortfalls or surpluses, enabling proactive financial planning.

By integrating cash flow management with other accounting functions, such as invoicing and expense tracking, the software ensures a comprehensive view of financial health. This enables businesses to make informed decisions, manage liquidity effectively, and plan for both short-term and long-term financial needs.

Inventory Management

Inventory management is a key function for product-based businesses, and accounting software provides tools to handle this crucial task efficiently. The software tracks inventory levels in real-time, integrating with sales and purchasing systems to ensure accurate stock counts.

It helps manage reorder points and inventory turnover rates, automating the reordering process to prevent stockouts or overstocking. By providing detailed reports on inventory costs and sales trends, the software supports informed decision-making and strategic planning.

Integration with financial records ensures that inventory costs are accurately reflected in financial statements. This comprehensive approach to inventory management enhances operational efficiency, reduces carrying costs, and improves overall profitability.

Accounts Payable and Receivable

Managing accounts payable and receivable is essential for maintaining financial stability, and accounting software offers robust tools to streamline these processes. For accounts payable, the software tracks vendor invoices, manages payment schedules, and ensures timely payments to avoid late fees.

It automates approval workflows and integrates with bank accounts for seamless payment processing. For accounts receivable, the software manages customer invoices, tracks payment statuses, and sends automated reminders for overdue accounts.

By automating these tasks, businesses can improve cash flow, reduce manual errors, and enhance financial management. Integration with other accounting functions, such as invoicing and expense tracking, provides a complete view of financial transactions and supports efficient cash management.

Budgeting and Forecasting

Budgeting and forecasting are critical for financial planning, and accounting software provides tools to simplify these processes. The software enables businesses to create detailed budgets based on historical financial data and projected income and expenses.

It tracks actual performance against budgeted figures, highlighting variances and helping identify areas for improvement. Advanced forecasting tools analyze trends and generate projections for future financial performance, supporting strategic planning and decision-making.

By integrating budgeting and forecasting with other accounting functions, such as financial reporting and expense management, the software provides a comprehensive view of financial performance.

This integration supports effective resource allocation, helps manage financial risks, and guides long-term business growth.

Audit Trail and Compliance

Maintaining an audit trail and ensuring compliance are crucial aspects of financial management, and accounting software simplifies these tasks. The software records all financial transactions in a detailed audit trail, providing a clear history of changes and access to transaction details.

This functionality supports internal and external audits by offering transparency and traceability. Compliance features ensure that financial data meets regulatory standards and reporting requirements. The software often includes tools for generating compliance reports and tracking regulatory changes.

By automating record-keeping and compliance processes, businesses can reduce the risk of errors, ensure regulatory adherence, and streamline audit preparation.

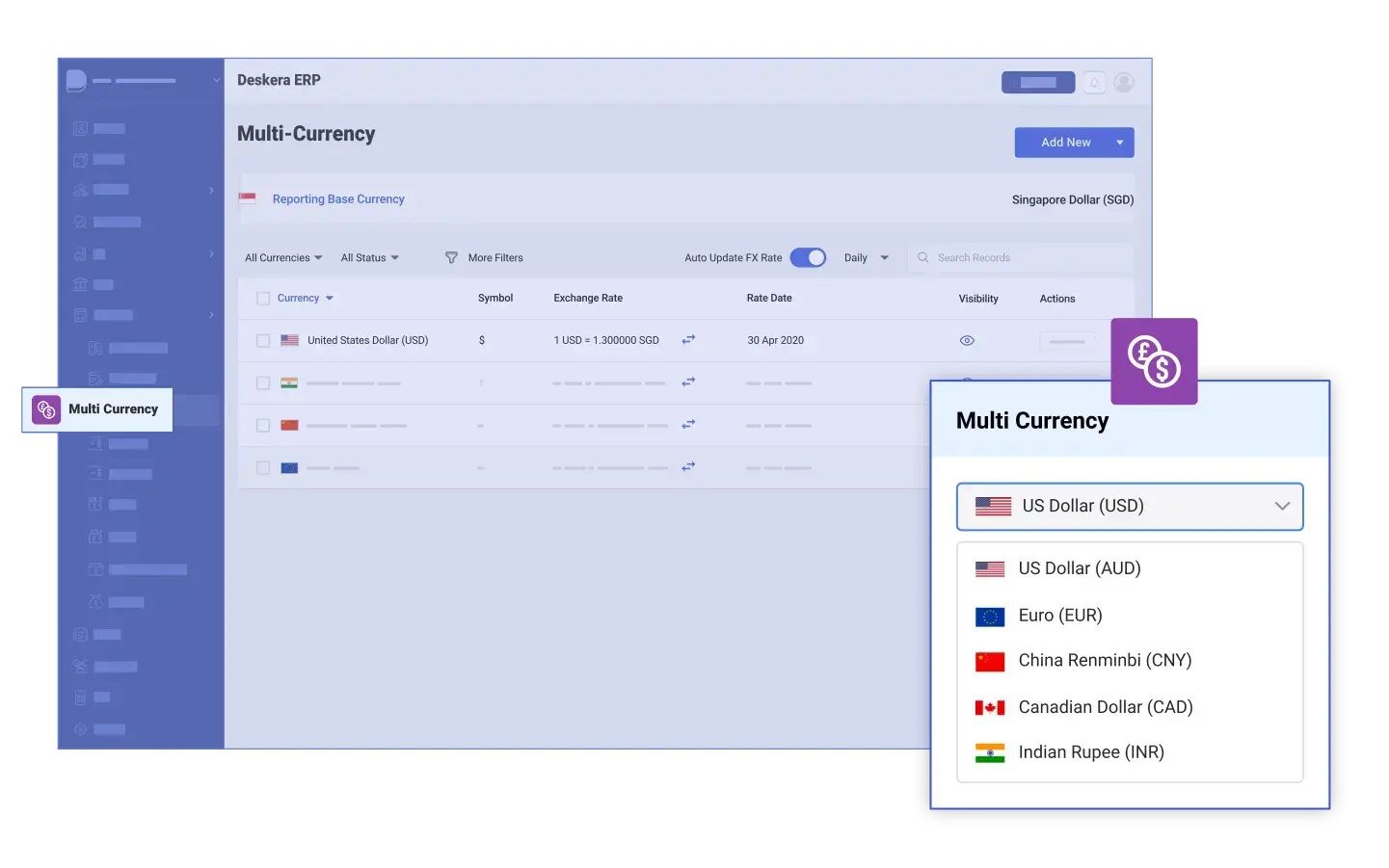

Multi-Currency and Global Accounting

For businesses operating internationally, multi-currency and global accounting features are essential for managing diverse financial operations.

Accounting software supports transactions in multiple currencies, automatically converting exchange rates and ensuring accurate financial reporting. It handles international tax compliance, regulatory requirements, and multi-currency bank reconciliations, streamlining global financial management.

By integrating with local accounting standards and providing consolidated financial reports, the software supports businesses with international operations. These features enhance efficiency, reduce manual effort, and ensure accurate financial management across different currencies and regions.

Whether for small businesses or larger enterprises, global accounting capabilities facilitate smooth international operations and support strategic growth.

How Accounting Software Helps Small Businesses Overcome Common Challenges

1. Managing Cash Flow

- Challenge: Small businesses often struggle with cash flow management, making it difficult to cover expenses, invest in growth, or respond to unexpected financial needs.

- Solution: Accounting software provides real-time visibility into cash flow by tracking income and expenses, automating invoicing, and setting up payment reminders. This helps businesses monitor their financial status, anticipate shortfalls, and ensure timely payments.

2. Ensuring Accurate Financial Records

- Challenge: Maintaining accurate financial records manually can lead to errors and inconsistencies, which can result in poor decision-making and compliance issues.

- Solution: Accounting software automates data entry and calculations, reducing the risk of human error. It also keeps financial records organized and up-to-date, ensuring accuracy in financial reporting and making it easier to track and audit transactions.

3. Time Management

- Challenge: Small business owners often juggle multiple roles, leaving little time for manual accounting tasks like bookkeeping, invoicing, and report generation.

- Solution: By automating routine accounting tasks, the software frees up valuable time that can be redirected toward strategic business activities. This time efficiency allows small business owners to focus on growth and customer satisfaction.

4. Meeting Regulatory Compliance

- Challenge: Navigating tax laws and financial regulations can be complex, especially for small businesses without dedicated accounting expertise.

- Solution: Accounting software helps businesses stay compliant by automatically calculating taxes, generating necessary financial reports, and maintaining accurate records that are aligned with regulatory requirements. This reduces the risk of fines and penalties.

5. Budgeting and Forecasting

- Challenge: Creating accurate budgets and financial forecasts can be challenging, especially when relying on manual methods that may lack real-time data.

- Solution: Accounting software offers tools for budgeting and forecasting based on real-time financial data. It allows small businesses to create detailed financial plans, set spending limits, and project future financial performance, leading to better financial planning and resource allocation.

6. Improving Decision-Making

- Challenge: Without clear insights into their financial health, small businesses may struggle to make informed decisions that drive growth and profitability.

- Solution: Accounting software provides comprehensive financial reports and dashboards that offer a clear overview of the business's financial position. These insights enable business owners to make data-driven decisions, such as when to invest in new opportunities or cut costs.

7. Simplifying Tax Preparation

- Challenge: Tax season can be particularly stressful for small businesses, especially if records are disorganized or incomplete.

- Solution: Accounting software simplifies tax preparation by organizing financial data throughout the year, making it easy to generate tax reports and file returns accurately. This streamlines the process and reduces the likelihood of errors or missed deductions.

8. Enhancing Collaboration with Accountants

- Challenge: Small businesses may find it difficult to collaborate efficiently with external accountants or financial advisors, especially when using manual or outdated systems.

- Solution: Many accounting software solutions allow multiple users to access the system simultaneously, making it easier for business owners and accountants to collaborate in real-time. This improved communication ensures that financial strategies are aligned and that the business is operating at its full potential.

Benefits of Accounting Software

The benefits of accounting software are:

1. Improved Accuracy

- Reduced Human Error: Automates calculations and data entry, minimizing the risk of errors associated with manual accounting tasks.

- Consistent Data: Ensures uniformity in financial reporting and record-keeping, reducing discrepancies and inconsistencies.

2. Time Efficiency

- Automated Processes: Streamlines repetitive tasks such as invoicing, payroll, and expense tracking, saving time for more strategic activities.

- Faster Reporting: Generates financial reports quickly, allowing for timely decision-making and analysis.

3. Enhanced Financial Management

- Real-Time Access: Provides up-to-date financial information, helping businesses monitor their cash flow and financial health in real-time.

- Comprehensive Insights: Offers detailed insights into financial performance, helping businesses identify trends, manage budgets, and forecast future financial outcomes.

4. Better Compliance

- Regulatory Adherence: Facilitates compliance with accounting standards and tax regulations by automating calculations and maintaining accurate records.

- Audit Trails: Maintains detailed records of financial transactions, making it easier to track changes and support audits.

5. Cost Savings

- Reduced Labor Costs: Decreases the need for extensive manual bookkeeping, potentially lowering payroll expenses.

- Minimized Errors: Reduces the cost of correcting mistakes that can occur with manual accounting methods.

6. Enhanced Data Security

- Secure Storage: Protects sensitive financial data with encryption and secure access controls.

- Regular Backups: Ensures data is backed up regularly to prevent loss due to system failures or other issues.

7. Improved Cash Flow Management

- Efficient Billing: Automates invoicing and payment reminders, reducing delays in receivables and improving cash flow.

- Expense Tracking: Monitors and categorizes expenses, helping identify areas for cost savings and better financial planning.

8. Scalability

- Adaptable Solutions: Accommodates the growth of a business by allowing the addition of new features or modules as needed.

- Flexible Integration: Integrates with other business tools and systems, enhancing overall operational efficiency.

9. Enhanced Collaboration

- Multi-User Access: Allows multiple users to access and work on financial data simultaneously, improving teamwork and coordination.

- Cloud Accessibility: Enables remote access, facilitating collaboration among team members and external accountants.

10. Customization

- Tailored Features: Many accounting software solutions offer customizable features to meet the specific needs and preferences of different businesses.

- Personalized Reports: Provides options to create reports and dashboards that align with business goals and requirements.

What is a Cloud-Based Accounting Software?

Cloud-based accounting software is a type of accounting solution that operates on the internet, allowing users to access financial data and manage accounting tasks via a web browser or mobile app.

Unlike traditional desktop accounting software, which is installed on a local computer or server, cloud-based software is hosted on remote servers managed by the software provider.

The Benefits of Cloud-Based Accounting Software

The benefits of cloud-based accounting software are:

1. Accessibility and Collaboration

- Anytime, Anywhere Access: Cloud-based accounting software allows you to access your financial data from any device with an internet connection. This flexibility means you can manage your finances, review reports, and perform transactions no matter where you are, whether you’re in the office, at home, or on the go.

- Enhanced Collaboration: Cloud solutions facilitate real-time collaboration between team members and external accountants. Multiple users can work on the same financial documents simultaneously, improving efficiency and communication.

2. Data Security

- Robust Security Measures: Leading cloud accounting platforms invest in advanced security technologies, including encryption, secure servers, and multi-factor authentication. These measures help protect sensitive financial information from unauthorized access and cyber threats.

- Regular Backups: Cloud-based systems automatically back up your data regularly. This means that in the event of data loss due to system failures or other issues, your information is safeguarded and can be easily restored.

3. Scalability

- Flexible and Adaptable: Cloud-based accounting software is designed to scale with your business. Whether you’re a small start-up or a growing enterprise, you can easily adjust your subscription plan or add features as your needs evolve.

- Cost-Effective: Many cloud solutions offer subscription-based pricing, which can be more affordable than traditional on-premises software. This model allows businesses to pay only for the features they need and upgrade as necessary.

4. Automatic Updates and Maintenance

- Seamless Updates: Cloud accounting software providers handle all updates and maintenance, ensuring that you always have access to the latest features and security patches without any additional effort or cost on your part.

- Reduced IT Burden: By outsourcing maintenance and support to the software provider, you can reduce the burden on your internal IT team and focus on running your business.

5. Integration with Other Tools

- Streamlined Operations: Cloud-based accounting systems often integrate with other business tools such as CRM systems, payment processors, and e-commerce platforms. This integration helps streamline operations by syncing data across different systems and reducing the need for manual data entry.

- Enhanced Functionality: By connecting with other applications, cloud accounting software can provide additional functionalities, such as advanced analytics, customer relationship management, and automated workflows.

6. Improved Financial Insights

- Real-Time Reporting: With cloud accounting software, you can generate real-time financial reports and dashboards, providing immediate insights into your business’s financial health. This timely information supports better decision-making and strategic planning.

- Customizable Reports: Many cloud solutions offer customizable reporting options, allowing you to tailor financial reports to your specific needs and preferences. This flexibility helps you track key performance indicators and monitor financial performance more effectively.

7. Enhanced Compliance and Accuracy

- Automated Compliance: Cloud accounting software often includes features that help ensure compliance with tax regulations and accounting standards. Automated tax calculations and compliance checks reduce the risk of errors and help you stay up-to-date with legal requirements.

- Accurate Data Handling: The automation of data entry and reconciliation processes minimizes the risk of human errors, leading to more accurate financial records and fewer discrepancies.

Cloud-based accounting software offers a range of benefits that can significantly enhance the efficiency and effectiveness of financial management for businesses of all sizes.

From improved accessibility and security to seamless integrations and real-time insights, these solutions provide the tools needed to streamline operations and support business growth.

Top 10 Accounting Software for Small Businesses

Here’s a detailed overview of 10 accounting software options tailored for small businesses:

1. Deskera

Overview: Deskera is a powerful cloud-based ERP accounting software that caters to small businesses. It integrates accounting, inventory, CRM, HR, and payroll features into one seamless platform. The software is designed to automate various business processes, making it ideal for businesses aiming to streamline operations.

Features: Deskera offers robust features including automated invoicing, expense management, financial reporting, inventory tracking, and multi-currency support. A standout feature is the AI-powered assistant, David, which helps in managing tasks like setting reminders and tracking payments. Additionally, Deskera provides mobile accessibility, enabling users to manage their accounts on the go.

Pros:

- Comprehensive all-in-one platform

- AI Assistant David for enhanced productivity

- Scalable to accommodate business growth

- Excellent customer support

- Mobile accessibility for on-the-go management

- Easy integration with other business tools

Cons:

- No document management capabilities

2. QuickBooks

Overview: QuickBooks is a leading accounting software for small businesses in India and globally. It offers both desktop and online versions, catering to businesses of all sizes.

Features: Includes invoicing, expense tracking, payroll, tax calculations, and extensive reporting capabilities. QuickBooks also integrates with numerous other tools, making it highly versatile.

Pros:

- User-friendly interface

- Wide range of features

- Strong support and community

Cons:

- Can be expensive with add-ons

- Limited customization in some areas

3. Sage Business Cloud Accounting

Overview: Sage Business Cloud Accounting is a simple accounting system for small businesses, offering cloud-based solutions that are accessible and affordable.

Features: Provides invoicing, expense tracking, bank reconciliation, and financial reporting. It’s known for its user-friendly interface and strong support for small businesses.

Pros:

- Affordable pricing

- Easy to use

- Strong customer support

Cons:

- Limited advanced features

- Basic reporting options

4. NetSuite

Overview: NetSuite is a comprehensive ERP accounting software ideal for small businesses with plans for rapid growth. It offers a wide range of features that go beyond just accounting.

Features: Includes financial management, CRM, e-commerce, and inventory management, making it a robust solution for growing businesses.

Pros:

- Highly customizable and scalable

- Integrated ERP features

- Strong global compliance support

Cons:

- Expensive for small businesses

- Requires significant setup and training

5. Sage X3

Overview: Sage X3 is a robust ERP solution designed for mid-sized to large businesses, offering advanced features and greater customization capabilities.

Features: Includes financial management, inventory control, production management, and supply chain management. It provides extensive customization options and integrates with other systems.

Pros:

- Highly customizable

- Advanced ERP features

- Strong integration capabilities

Cons:

- Higher cost

- Complex implementation

6. Fishbowl

Overview: Fishbowl is an inventory management and manufacturing software that integrates with QuickBooks and Xero, offering advanced features for managing inventory and production processes.

Features: Includes inventory tracking, order management, manufacturing management, and integration with accounting software.

Pros:

- Advanced inventory management

- Integrates with popular accounting software

- Comprehensive manufacturing features

Cons:

- Requires integration with accounting software

- Higher learning curve

7. Katana

Overview: Katana is a manufacturing ERP solution designed for small to medium-sized businesses, focusing on real-time inventory management and production planning.

Features: Includes inventory management, production planning, order tracking, and integration with e-commerce platforms.

Pros:

- Real-time inventory tracking

- User-friendly interface

- Integration with e-commerce platforms

Cons:

- Limited features for large businesses

- May require additional integrations

8. JobBOSS 2

Overview: JobBOSS 2 is a job shop management software that provides comprehensive tools for managing manufacturing operations, from quoting to shipping.

Features: Includes job tracking, inventory management, scheduling, and reporting. It’s designed for job shops and custom manufacturers.

Pros:

- Tailored for job shops

- Comprehensive job tracking

- Strong manufacturing focus

Cons:

- May be complex for non-manufacturing businesses

- Higher cost

9. Acumatica

Overview: Acumatica is a cloud-based ERP solution that offers a range of features suitable for various industries, including financial management, CRM, and inventory management.

Features: Includes financial management, inventory control, CRM, and business intelligence. It provides robust reporting and customization options.

Pros:

- Comprehensive ERP features

- Flexible and customizable

- Strong reporting capabilities

Cons:

- Higher cost for advanced features

- Can be complex to implement

10. Odoo

Overview: Odoo is an open-source ERP accounting software that provides small businesses with customizable modules for various business functions, including accounting.

Features: Offers invoicing, bank reconciliation, expense tracking, and full ERP capabilities, making it a flexible solution for small businesses.

Pros:

- Open-source and highly customizable

- Integrated ERP features

- Affordable for small businesses

Cons:

- Requires technical knowledge for customization

- Can be complex to set up

How to Choose the Right Accounting Software for Your Small Business

Choosing the right accounting software for your small business involves evaluating your specific needs, budget, and the features offered by different software options.

Here’s a guide to help you make the right choice:

1. Assess Your Business Needs

- Size and Type of Business: Consider whether you’re a sole proprietor, small business, or growing enterprise. The software should fit your business size and type (e.g., service-based, retail, manufacturing).

- Key Features: Identify the essential features you need, such as invoicing, expense tracking, payroll, inventory management, or tax reporting.

2. Evaluate Software Features

- Core Accounting Functions: Ensure the software includes basic functions like invoicing, expense tracking, bank reconciliation, and financial reporting.

- Advanced Features: Determine if you need additional features like inventory management, CRM, project management, or multi-currency support.

- Integration: Check if the software integrates with other tools you use, such as payment processors, e-commerce platforms, or CRM systems.

3. Consider Usability

- User-Friendly Interface: The software should be easy to navigate and use, with minimal training required.

- Customer Support: Look for software that offers strong customer support and resources like tutorials, FAQs, and live chat.

4. Evaluate Costs

- Pricing Structure: Understand the pricing model (monthly subscription, one-time fee, or pay-per-feature). Consider your budget and any additional costs for features, support, or updates.

- Value for Money: Weigh the cost against the features offered to ensure you’re getting good value for your investment.

5. Scalability

- Future Growth: Choose software that can scale with your business as it grows. Look for options that offer additional features or higher-tier plans as your needs evolve.

6. Security and Compliance

- Data Security: Ensure the software has strong security measures to protect your financial data.

- Compliance: Verify that the software complies with relevant regulations and standards, such as tax laws and data protection regulations.

7. Trial and Reviews

- Free Trial: Take advantage of free trials to test the software’s features and usability before committing.

- User Reviews: Read reviews and testimonials from other small business owners to get insights into the software’s performance and reliability.

8. Customization and Integration

- Customization: Consider whether the software allows customization to fit your specific business processes.

- Integration: Ensure it integrates with other systems you use, such as payroll services, CRM, or e-commerce platforms.

9. Mobile Accessibility

- Mobile App: If you need to manage your accounts on the go, check if the software offers a mobile app or mobile-friendly interface.

10. Vendor Reputation

- Company Stability: Choose a software provider with a strong reputation and track record of reliable service and updates.

By carefully evaluating these factors, you can select accounting software that meets your small business’s needs, supports your growth, and provides a good return on investment.

Why Deskera is the Right Accounting Software for Your Small Business

Deskera stands out as an ideal accounting software solution for small businesses due to its comprehensive features, scalability, and ease of use.

Here’s why Deskera could be the right choice for your business:

1. All-in-One Solution

Deskera integrates accounting, inventory management, CRM, HR, and payroll into a single platform. This all-in-one approach simplifies managing various business functions, reducing the need for multiple tools and ensuring seamless data flow across different departments.

2. Comprehensive Features

Deskera offers a robust set of features tailored to small business needs:

- Automated Invoicing: Create and send invoices effortlessly, reducing manual errors and saving time.

- Expense Management: Track and manage expenses with ease, helping to maintain accurate financial records.

- Financial Reporting: Generate detailed financial reports to gain insights into your business performance and make informed decisions.

- Inventory Tracking: Monitor inventory levels, manage stock, and handle orders efficiently.

3. AI-Powered Assistant

The AI Assistant, David, enhances productivity by assisting with routine tasks such as setting reminders, tracking payments, and managing schedules. This feature helps streamline operations and reduces manual workload.

4. Mobile Accessibility

Deskera provides mobile accessibility, allowing you to manage your accounts and business operations on the go. This flexibility is crucial for small business owners who need to stay connected and manage their business from anywhere.

5. Scalability

As your business grows, Deskera scales with you. Its flexible platform can accommodate increasing complexity and additional features, ensuring it remains a valuable tool as your business evolves.

6. Easy Integration

Deskera integrates smoothly with other business tools and systems, enhancing efficiency and ensuring that all your business data is connected and synchronized.

7. Excellent Customer Support

Deskera is known for its strong customer support, providing assistance and resources to help you get the most out of the software. This support is invaluable for small businesses that may need extra help during setup or when troubleshooting issues.

8. User-Friendly Interface

The intuitive design of Deskera’s interface makes it easy to navigate and use, minimizing the learning curve and allowing you to focus on running your business rather than struggling with software.

9. Cost-Effective

While Deskera offers a range of advanced features, it remains cost-effective for small businesses. Its pricing model provides value for money by consolidating multiple business functions into one platform.

10. Data Security and Compliance

Deskera ensures strong data security measures and compliance with relevant regulations, protecting your financial information and maintaining data integrity.

Key Takeaways

Accounting software for small businesses is a powerful tool that simplifies financial management, enhances accuracy, and provides valuable insights into a company’s financial health.

- Streamlines Financial Management: Accounting software automates core financial processes such as invoicing, expense tracking, and payroll, reducing manual effort and minimizing errors.

- Enhances Accuracy and Compliance: By automating calculations and financial reporting, accounting software helps ensure accuracy in financial records and compliance with tax regulations and accounting standards.

- Provides Real-Time Insights: The software offers real-time access to financial data, enabling small business owners to monitor cash flow, track expenses, and generate detailed financial reports for better decision-making.

- Simplified Record-Keeping: It centralizes financial information in one place, making it easier to manage records, retrieve historical data, and prepare for audits or tax filings.

- Facilitates Integration: Modern accounting software often integrates with other business tools such as CRM systems, inventory management, and e-commerce platforms, streamlining overall business operations.

- Improves Efficiency: Automated features like recurring invoicing and expense categorization save time and increase operational efficiency, allowing business owners to focus on growth and strategic tasks.

- Offers Scalability: Many accounting solutions are scalable, accommodating the evolving needs of growing businesses and adding new features or modules as required.

With options available to suit different needs and budgets, investing in the right accounting software can lead to more streamlined operations, reduced errors, and a stronger foundation for business growth.

Overall, Deskera’s combination of comprehensive features, scalability, ease of use, and strong support makes it a compelling choice for small businesses seeking an efficient and integrated accounting solution.

Related Articles