As businesses operate, they engage in multiple financial transactions that generate revenue, incur expenses, increase inventory, and so on.

All of these transactions are journalized and summarized into several statements known as accounting reports.

Accounting reports display the financial status of a business at a given point in time, or over a specific period of time, usually a fiscal year.

In this guide, we will be going through the principles behind these accounting reports, why they’re so important, the main accounting reports used in small businesses, and much more.

Read along to learn about:

- What Are Accounting Reports?

- Why Are Accounting Reports Important?

- Principles of Accounting Reports

- 3 Main Types of Accounting Reports

- Automate Accounting Reports with Online Accounting Software

What Are Accounting Reports?

Accounting reports are financial declarations that represent where a business stands financially at a specific date, or over a certain time period. They are also commonly referred to as the financial statements of a company.

The most common accounting reports you’ll need to issue for your small business accounting include:

- The income statement, or profit & loss statement, gives details regarding revenue and expenses during an accounting period, typically a fiscal year.

- The balance sheet, also referred to as the statement of the financial position, provides a financial picture of a business’s assets, liabilities, and equity at a specific date.

- The statement of cash flows represents the cash that has been used for operating, financing, and investing activities.

Why Are Accounting Reports Important?

Staying GAAP Compliant

Publicly traded companies are legally required to generate accounting reports every year. This rule is based on GAAP principles, which are the accounting standards and procedures adopted by the United States.

But even if you’re a small business owner, it doesn’t mean that your business can’t create financial statements. Providing financial statements is a great start towards expansion, especially if you want your small business to go public in the near future.

Accurate Bookkeeping

Issuing accounting reports provides you with a 360-degree view of the money that’s flowing in and out of your small business. Everything gets recorded chronologically, through a systematic order that tracks down every aspect of your financial transactions.

You get to keep track of any outstanding invoice receivables or payables as well as easily identify how much profit and loss was generated at the end of every fiscal year.

Prevent Accounting Errors

If the debit and credit balances in the balance sheet don’t equal in the end, it means you’ve made an accounting error somewhere along the way. Luckily, just by taking a look at the balance sheet you can easily spot and correct these errors.

And if you’re using online accounting software to keep track of your finances and to generate your accounting reports, the system will automatically notify you of any out-of-balance amounts.

Want more tips on how to prevent and handle common mistakes made in accounting? Head over to our guide on accounting errors.

Make Better Financial Decisions

Accounting reports can be really useful in guiding financial decisions and obtaining higher profits.

You can get insights on what goods and services are selling best, which departments are growing, and which ones might need additional re-investments for the upcoming year. At the same time, you can create and forecast budgets to keep expenses in line, by analyzing your revenue and sales.

Preferred by Shareholders

Investors and creditors take particular interest in the cash flows of your business, and what they expect to receive from you in the future.

For instance, creditors need to know your ability as a company to meet your invoice payments, loans, and other financial obligations.

Providing accounting reports is one of the primary ways they can assess these probabilities.

And ultimately, you’ll be seen as a more professional and transparent business, and be taken more seriously by every single stakeholder.

Principles of Accounting Reports

Before diving into the details of what each accounting report represents, let’s briefly go over some of the main principles of accounting that you need to know in order to understand how financial reporting works.

Your accounting reports are made up of individual financial transactions. These financial transactions each go through an accounting cycle.

The accounting cycle starts with an initial recording of transactions as journal entries. Journal entries are created based on the double-entry bookkeeping method, in which one transaction affects two accounts.

One account is debited, while the other is credited, hence the name “double-entry”.

Now, the accounts that experience the change are found on your business’ chart of accounts (COA). Every firm has its own COA, depending on the type of financial activities that they take part in.

With that being said, the most common types of accounts used in financial accounting can be grouped into five main types:

- Assets: The resources a business owns

- Liabilities: What the business owes

- Owner’s Equity: The assets of a business the owner has rights towards

- Revenue: Income generated from operating activities

- Expenses: The costs of doing business

Debits increase an asset or expense and decrease a liability or owner’s equity. Credits on the other hand increase liabilities or owner’s equity, and decrease an asset or expense.

These journal entries with the corresponding debit and credit entries first get posted into the general ledger and are later transferred into an unadjusted trial balance.

Then, at the end of the year or month (depending on the business’ preference), before creating the accounting reports, adjustments are made to ensure financial statements are up-to-date and contain relevant information.

Finally, the adjustments are added into a new adjusted trial balance that has all of the data your business needs to prepare the accounting reports.

3 Main Types of Accounting Reports

The Balance Sheet

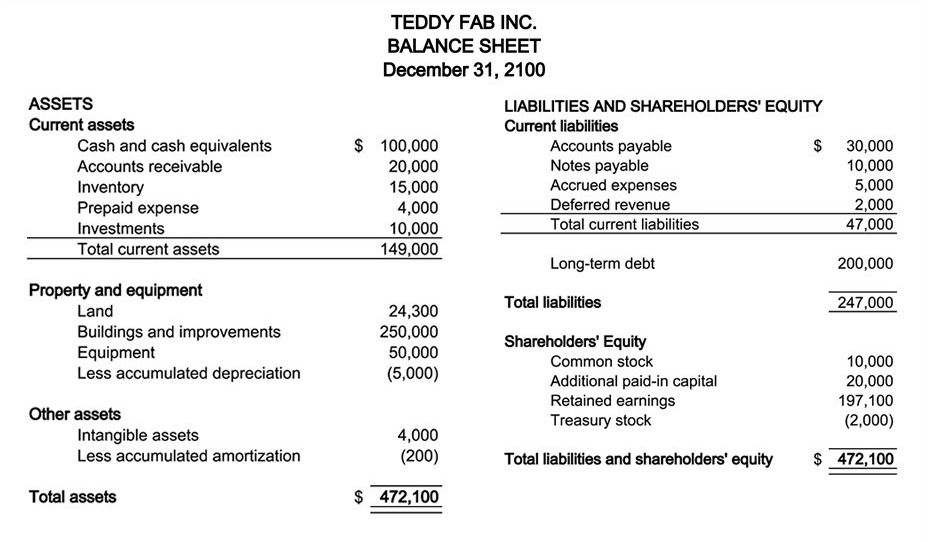

The balance sheet or the statement of financial position is the accounting report that describes what the financial position of a business is at a specific date. It’s often considered as a snapshot of the financial health of a business.

The balance sheet is often created at the end of the year, but some companies prepare it at the end of the month, week, or even on a daily basis.

But what exactly does the balance sheet contain?

The header of a balance sheet outlines three main elements:

- The name of the business

- The name of the financial statement

- The date

The body of the document contains a list of assets, liabilities, and owner’s equity of the business, with their corresponding balances, found in the adjusted trial balance.

Assets are listed first, on the left side of the balance sheet. They are divided into three main categories: current assets, fixed assets, and other intangible assets.

On the right side of the balance sheet, the liabilities are listed, and then the owner’s equity.

Liabilities are divided into current and non-current liabilities.

Current liabilities such as accounts payable, credit notes payable, salaries payable are listed on a separate line, followed by a figure of the total amount of current liabilities. The same goes for long-term liabilities such as long-term loans and capital leases.

The owner’s equity comes last and includes a listing of retained earnings, common stock, treasury stock, and a total of both liabilities and equity.

Here’s an example of what a balance sheet looks like with all of these elements put together:

A fundamental characteristic of the balance sheet is that this total of liabilities plus owner’s equity must always be equal to the total assets of the business.

This equality is expressed in the accounting equation:

Every business transaction, no matter how complex it may be, can always be expressed in terms of how it affects this accounting equation.

The Income Statement

The income statement or profit & loss statement is the accounting report that summarizes a business’ revenue and expenses over a certain period of time.

Ultimately a company will either succeed or fail based on the ability to earn a profit that exceeds its business expenses. That’s why investors and creditors are especially interested in analyzing your company’s income statement, as it represents the profitability of the business over time.

Revenue is listed first and it includes the total amount of profit the business has been able to generate from operating activities such as sales, services, interest revenue, and so on. The time period these profits are accounted for is usually one fiscal year.

And again, all the information is directly transferred from the adjusted trial balance.

After revenue, come all the expense accounts and their balances incurred. These are typically divided into operating expenses and non-operating ones.

The total amount of revenues is subtracted from total expenses to give us the net income or loss for the specified period of time.

This is how the finalized income statement would look like:

The Cash Flow Statement

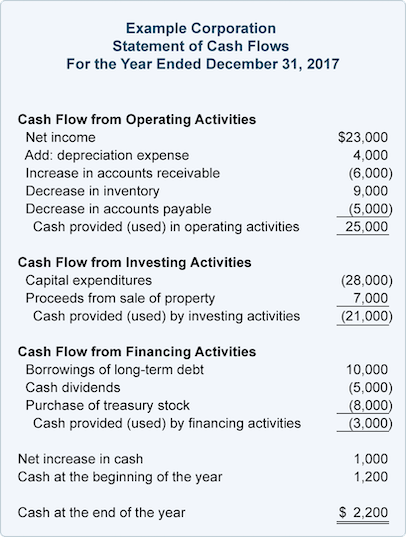

The cash flow statement classifies cash flow into three categories: operating, investing, and financing activities. The purpose of this accounting report is to explain how cash has increased or decreased for a specific period of time, due to operating, investing, and financing activities.

Cash flow for operating activities is related to revenue and expenses from operating activities, found on the income statement.

Investing activities are the cash effects of buying and selling assets.

Whereas financing activities include the owner’s investment in the business, along with any loaned money from other creditors and third parties.

Here’s an example of what a cash flow statement looks like:

By now, you should know what the main accounting reports are, and what goes into each report.

So you are probably wondering how to actually create these reports.

Well, you could write them up by hand, or using Excel spreadsheets. However, that is really tedious and time-consuming. And unless you are a certified accountant, you’ll likely run into some errors that will waste even more of your valuable time.

Surely, there must be a better alternative?

There is.

Online accounting software can help you automate most of your accounting process, including creating financial reports.

Automate Accounting Reports with Online Software

You can use comprehensive cloud accounting software like Deskera to manage, plan, and monitor all of your small business’ accounting reports.

Deskera offers a highly flexible, integrated, and automated financial reporting system that eases complex financial functionalities via simple automatic tables and graphs.

The software covers all of your reports, from the income statement, balance sheet, and statement of cash flow, all the way to the initial general ledger and trial balance reports.

You don’t have to worry about tax season, either!

Deskera has an in-built tax feature that generates all your tax reports in compliance with the tax regulations of the country your business is located in.

The best part?

These features can be accessed anytime, anywhere, through Deskera’s online dashboard on your desktop screen, and by downloading the Deskera mobile app on your mobile phone or tablet.

Give financial reporting with Deskera a try right now, by signing up for our free trial. No credit card details required.

Key Takeaways

And that’s a wrap! We hope this guide was helpful in understanding the basics of accounting reports, and what each statement contains.

Here’s a quick recap of the main points we’ve covered:

- Accounting reports are financial documents used to represent the financial state a business is in, at a specific date or time period.

- There are three main accounting reports small businesses need to generate: the income statement, balance sheet, and cash flow statement.

- Accounting reports guarantee accurate bookkeeping, prevent accounting errors, help businesses in making better financial decisions, and are preferred by shareholders.

Related Articles