Accounting: the one word a majority of the people seem to be scared of. Number crunching isn't everyone's cup of tea, right? However, once you understand the purpose of it, accounting starts to make more sense than anything else.

It makes total sense too. Every business setup needs to operate within the onus of tax laws, for which it is inevitably necessary to log all the financial activity that it encounters. Financial experts make it possible for businesses to comply with the statutory tax laws, make informed decisions regarding their money and, most important of all, account for every penny that enters or leaves the system.

One of the terms that frequently pops up in the world of accountancy is Accounting Ratios. They are also loosely termed as "Financial Ratios". This article is loaded full of information on these accounting terms to help you better understand how they can help your business grow by making informed financial decisions.

What are Accounting Ratios?

Accounting ratios are just what they sound like: ratios. It is a number that is derived from comparing two financial figures of a business - more specifically, a ratio of two financial data of a business.

This helps reduce the number of numbers the decision-making panel has to deal with and gives them a better picture of the financials of their business. Let's look in detail at the most important ratios that exist in accounting, and what they mean for a company.

Gross Profit Margin Ratio

One of the most important and crucial figures to track in your financial statements is the Gross Profit Margin ratio. Every business has revenue from sales; it also has a cost that is incurred from manufacturing the products it sells. The gross profit margin defines how the sales have performed with respect to production costs.

Gross Profit Margin = (Revenue from Sales - Cost of Goods Sold) / Revenue From Sales

Significance of this ratio:

- It tells you about how efficient your business operations are since the cost of production is being compared with revenues from sales.

- It helps you scale your business to compete with rivals.

Profit Margin Ratio

This number is a bit similar to the Gross Profit Margin ratio; however, there is one big difference. The Profit Margin ratio gives a more holistic picture of your entire enterprise, not just its operational efficiency. When all the operating and non-operating expenses are adjusted from the total revenue earned by your business, you get the Profit Margin Ratio.

Profit Margin = (Revenue - Expenses) / Revenue

Significance of this ratio:

- It helps you visualise the overall efficiency with regard to functions of your business, profit-wise.

- This ratio can help you make investment decisions.

Quick Ratio

It is well known that a business needs capital to operate. Not all businesses have capital ready that can be liquidated anytime - there are certain liabilities that it incurs during operation. Quick Ratio is a measure of the capability of a business to handle its financial liabilities.

Quick Ratio = (Current assets - inventory/prepaid expense) / Current Liabilities

Significance of this ratio:

- Helps you understand the financial health of your company.

- Gives you an idea of resource planning.

Current Ratio

Current ratio is the most common number which stays relevant for the current financial year of a business. It is a comparison between the assets and liabilities of a business for the ongoing FY.

Current Ratio = Current Assets / Current Liabilities

Significance of this ratio:

- It helps you understand whether or not your company would be able to pay its liabilities in the current FY

- A Current Ratio > 1 is a good number

Debt-to-Equity Ratio

As the name suggests, this ratio compares the debt with the equity position of a company. This number needs to be as low as possible. Here is why:

Debt-To-Equity Ratio = Total Debt (long and short-term) / Total Equity

Significance of this ratio:

- A higher number on this ratio means your company relies on debt to keep its operations running.

- Creditors often look at this ratio to determine whether or not your company is in a good place.

ROI Ratio

This ratio helps you understand the quality of the returns your business is generating for the investments that it has made. The formula is simple:

ROI Ratio = (Earning - Investments) / Investments

Significance of this ratio:

- This ratio makes sense for start-ups because it shows how well they are performing for all the investments they have done.

- The higher this number, the better it is.

Example of Accounting Ratios

Say for example, Company ABC has the following numbers on its cash flow and accounting statements:

- Revenue = $25,000

- COGS = $5,000

- Expenses = $15,000

- Current assets = $85,000

- Inventory = $40,000

- Current liabilities = $30,000

- Total debt = $135,000

- Total equity = $190,000

- Earnings = $70,000

- Investment = $30,000

With this financial data, ratios can be calculated as follows:

- Gross profit ratio = ($25,000 - $5,000) / $25,000 = 0.8

- Profit margin ratio = ($25,000 - $15,000) / $25,000 = 0.4

- Quick ratio = ($85,000 - $40,000) / $30,000 = 1.5

- Current ratio = $85,000 / $30,000 = 2.83

- Debt-to-equity ratio = $135,000 / $190,000 = 0.71

- ROI ratio = ($70,000 - $30,000) / $30,000 = 1.33

Classifying Accounting Ratios

There are many more accounting ratios that exist - only the most important ones have been discussed here. In order to make more sense out of these ratios, based on the information they give about a company, they are classified into the following categories:

Liquidity Ratios

Liquidity is the immediately available finance of a company, which helps to gauge how capable that business is in paying off its immediate liabilities. liquidity ratios help creditors to assess how well a company is doing. A value of 2 or higher is favorable. Following are the ratios classified under the liquidity category:

- Current ratio

- Quick ratio

- Cash ratio

Solvency/Leverage Ratios

While liquidity ratios tell about the short-term debt paying capabilities of a company, solvency ratios tell about long-term debt-paying capabilities. Lenders use this number to measure how creditworthy a company is. Listed below are some solvency ratios:

- Debt-to-equity ratio

- Interest coverage ratio

- Equity ratio

- Debt-to-assets ratio

Profitability Ratios

These ratios tell you about how well your business is earning from the expenses going into operations. Profits on all fronts are included in these ratios. Here is a list of profitability ratios:

- Gross profit margin ratio

- Operating margin ratio

- Profit margin ratio

- Earnings per share

Activity/Efficiency Ratios

This ratio points out how well your business is using its assets. It basically speaks of efficiencies of operations involved in your business. Following are some activity ratios:

- Receivable ratio

- Inventory turnover ratio

- Asset turnover ratio

Market Ratios

While not a direct indicator of company performance, market ratios tell you about the current share price of your stock. Here are some market ratios:

- Book value per share

- Dividend yield

- Earnings per share

- Market value per share

- Price/earnings ratio

Why is Accounting Ratio Analysis Important?

Accounting ratios provide a full picture of the financial health of a company. Instead of studying your cash flow statements and other financial statements, it makes more sense to look at ratios instead and get a clearer picture with a smaller data set.

Financial ratios help a business plan its future by telling the management how the company is doing across all its fronts - operational, market, liabilities and equity. It helps optimize resource allocation, business development and planning, M&A, etc.

A detailed analysis of accounting ratios lays a business bare in front of lenders and creditors, which is why it is important to keep a close eye on the numbers your company is creating. Additionally, these ratios make it possible for a business to form relevant strategies for the immediate and the far future so that it is able to prosper from what it is creating.

Why Accounting Ratios Make Total Sense for Small Businesses

The businesses that are just starting out or are operating at a smaller scale need to track their performance closely if they aim to enter the big game. It is for this reason that financial ratios need to be understood, analyzed and put to good use.

A specialist in accounting for start-ups can tell you that small businesses need more corpus and incentive to make it through the competition and stand on their own. In addition, their operational efficiencies and profits need to be able to keep them afloat. The best way to track these metrics is to track accounting ratios, and slowly bring them at par with the desirable values.

However, to ensure that you aren't underestimating or overestimating your business, it makes sense to compare the ratios of other companies in the same industry that are doing well. Aiming for those values in the initial stages and then scaling up bit by bit forms a stable, reliable and less-risky strategy that may help small businesses progress smoother.

How can Deskera Improve Cash Flow for Your Business?

Deskera is a cloud system that brings automation and therefore ease in the business functioning. It reduces the admin time while also increasing efficiency. Deskera Books can be especially useful in improving cash flow for your business.

As a business owner, you can invest in accounting softwares that can help you keep track of your depreciating assets, scrape value, residual value, salvage value, journal entries, balance sheet, inventory and production costs. A successful business needs an efficient financing process that meets its specific needs.

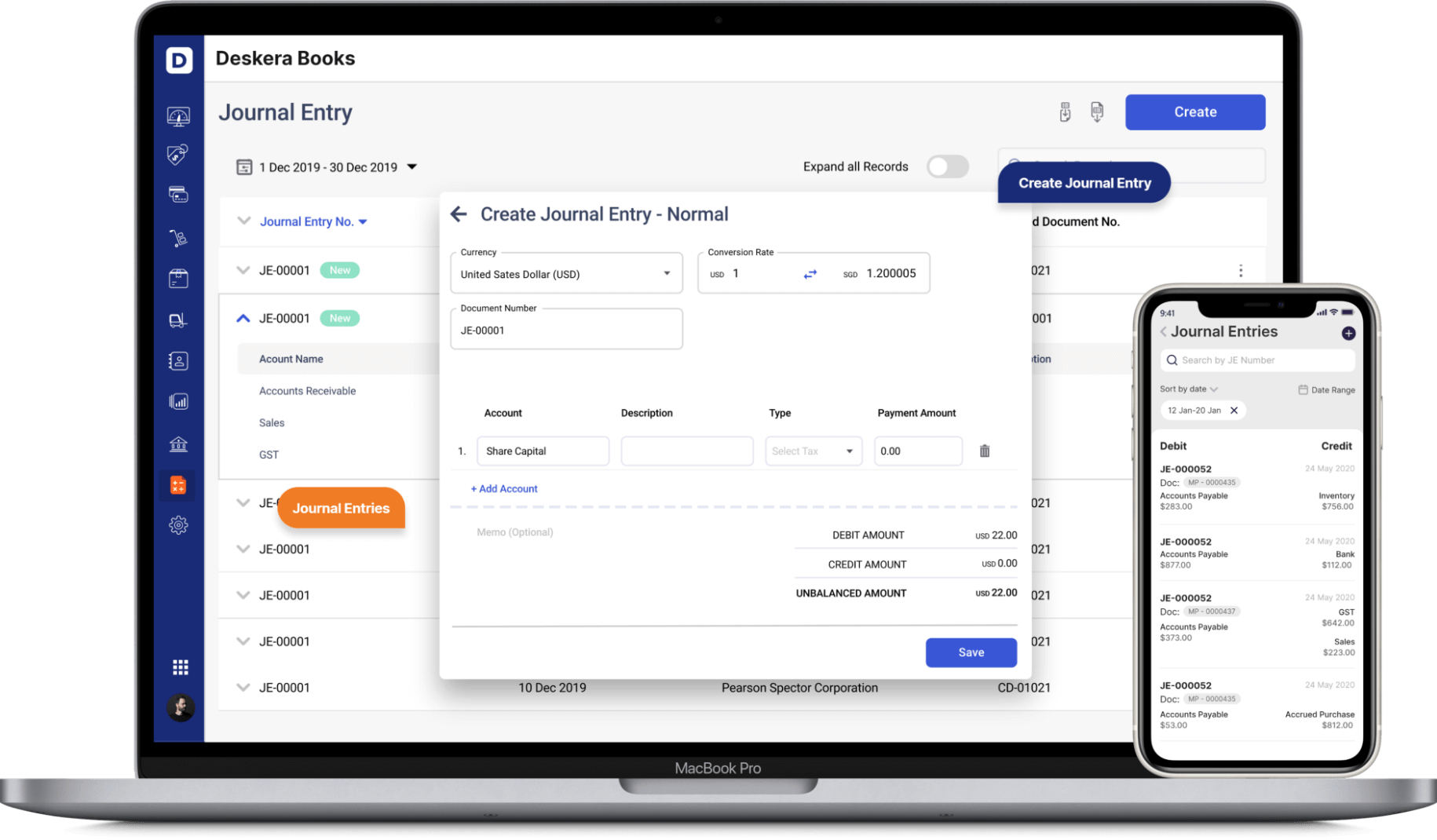

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

Through Deskera Books, reminders can be set with the invoices that are not being paid out, which are then sent out to the customers. Even in the case of recurring invoices, Deskera Books will become very handy especially with a payment link added to the invoice.

All in all, the follow-up system for all the invoices can be passed on to the system of Deskera Books and it will look into it for you. You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant. Such cloud systems substantially improve cash flow for your business directly as well as indirectly.

Key Takeaways

Accounting ratios aren't a very complicated thing - they are just numbers. In order to be able to tip the scales in your favor, understanding these ratios comes first. Before you can begin to apply your strategies, observing these ratios and gleaning the position of your business first will help you grow faster and better. The stability of your company is determined from these ratios - make them work for you.

Related Articles