For many years, accounting has been a large sector of the global economy, supporting almost 2 million jobs. Additionally, you should be aware that 75% of contemporary accounting tasks can be automated.

Businesses are very busy at the end of the year. If you're a typical business owner, you're probably balancing busier traffic, increased sales, and payroll duties in addition to end-of-year accounting procedures.

You should use a year-end accounting checklist to plan how you close the year, rather than rushing to finish your operations.

Table of contents

- Checklist to Get Your Accounting Ready for End of Year

- What are financial ratios and how do they work?

- What is the balance sheet and its components?

- What are financial statements and their analysis?

- How to measure business spending using accrual accounting: Accrued expenses

- Checklist for Accounting: Daily, Weekly, and Monthly Tasks

- Understanding the Distinction Between Invoices and Receipts

- Why to employ a Tax Expert to Manage Your Taxes?

- Key Takeaways

Checklist to Get Your Accounting Ready for End of Year

You need to finish up a few accounting jobs before the clock strikes midnight on December 31. Your accounting records ought to be well-organized, current, and prepared for the start of a new year.

Before the calendar year ends, make sure to cross off these steps from your year-end accounting closure checklist.

Your small business depends on the information in your financial statements. They offer you a picture of the financial state of your company, year end checklist accounting. Additionally, statements provide you access to past and present financial data so you may forecast your company's financial outlook and make plans for the coming year.

Financial statements make it easier to comprehend your company's financial position and, hopefully, less stressful for your firm during tax season. Your accounting books contain your financial records, which you can access, year end checklist accounting. In order to build and analyse year-end statements, use your accounting records.

What are financial ratios and how do they work?

Financial ratios show how well your company is doing financially in many areas, such as its ability to pay off debt or its level of profit.

By entering your financial data into formulas, you can utilise these ratios. Depending on whose financial statement you're examining, you can utilise a variety of formulas, or different ratios.

Einstein-level calculations may be used by financial counsellors, investment gurus, CPAs, and writers of company annual reports to assist their customers in making financial decisions. But in this article, we'll focus on the most basic, crucial ratios that business owners use to assess the financial accounts of their organisations and make day-to-day operational decisions.

What is the balance sheet and its components?

Your balance sheet details the worth of your current assets as well as the amount of debt you have (liabilities). Cash, receivables from customers, machinery, supplies, and investments are examples of assets, year end checklist accounting. Accounts payable, accumulated expenses, and long-term debt like mortgages and other loans can all be considered liabilities.

Balance sheet components

All of your assets are the worth you currently own. Some of it is actual money, like the $20,000 in the business bank account line item in the example above. Some of it, such as inventory or equipment, is less liquid, year end checklist accounting. Accounts receivable, or money you are expected to receive, may not even be in your possession yet.

Liabilities are not good, they are expensive. You may get a general indication of how much worth your company actually has to deal with by deducting them from your assets. Accounts payable in the previous example, which are often payments made to vendors or contractors, could be viewed as a short-term debt because you'll probably pay them off each month, year end checklist accounting. Other obligations, like the debt from business loans, endure longer.

The capital that you, the owner, have invested in your company is known as owner’s equity. Capital is your first outlay, the cash you utilised to launch your business, year end checklist accounting. Retained earnings are the profits that your company has kept on hand. And drawing, often known as owner's draw, is the cash you receive from your company.

What are financial statements and their analysis?

Let us look into the steps of financial statement analysis:

Identify the economic characters of the industry

Establish the value chain analysis for the sector, or the sequence of processes that go into the development, production, and distribution of the firm's goods and/or services, year end checklist accounting. This step frequently involves the use of tools like Porter's Five Forces analysis or economic attribute analysis.

Know Your Company's Strategies

The nature of the company's goods or services, including their originality, level of profit margins, development of brand loyalty, and cost management, should then be considered, year end checklist accounting. It's also important to take into account variables like supply chain integration, geographic diversification, and sector diversification.

Evaluate the firm's financial statement's quality

Examine the important financial statements in light of the applicable accounting principles. The correct evaluation of balance sheet accounts depends on factors including recognition, valuation, and classification, year end checklist accounting. The main inquiry should be if this balance sheet accurately depicts the firm's financial situation.

The fundamental goal of analysing the income statement is to accurately evaluate the earnings quality as a comprehensive picture of the firm's economic performance, year end checklist accounting. Understanding the influence of the firm's operations, investments, and financial activities on its liquidity position over the period basically, where the money came from, where it went, and how that affected the firm's overall liquidity requires an analysis of the statement of cash flows.

Analyze the profitability and risk of the present

This is the stage of evaluating the company and its financial statements where financial experts can actually bring value. Key financial statement ratios for liquidity, asset management, profitability, debt management/coverage, and risk/market value are among the most used analysis tools, year end checklist accounting.

There are two main considerations to consider when evaluating a company's profitability: how successful are the activities of the company in relation to its assets, regardless of how the company finances those assets, and how profitable is the company from the standpoint of equity shareholders, year end checklist accounting.

It's crucial to develop the ability to break down return metrics into their core impact variables. The final step in any financial statement ratio analysis is to compare the present ratios to those from previous periods, to those of other companies, or to industry averages, year end checklist accounting.

Get Financial Statements Projected

Financial professionals must, despite it being frequently difficult, make realistic predictions about the company's (and its industry's) future and analyse how these predictions will affect funding and cash flows, year end checklist accounting. Pro-forma financial statements, based on strategies like the percent of sales approach, are a common way to do this.

Respect the Firm

Although there are several valuation strategies, a sort of discounted cash flow methodology is the most used. These cash flows could take the shape of anticipated dividends or more intricate methods such as free cash flows to the equity holders or on an enterprise-wide basis, year end checklist accounting. Relative valuation or accounting-based metrics like economic value added are possible alternative strategies.

Income declaration

Your revenue and expenses are compiled in your income statement, often known as a profit and loss (P&L) statement. The total amount of money you made and lost over the course of the year is shown on your income statement, year end checklist accounting.

By examining the difference between money earned and lost on your statement, you can determine your company's bottom line, year end checklist accounting. To examine the variations in revenue and expenses over time, compare this year's income statement to last year's.

Flow of Funds Statement

Your company's inflow and outflow of cash are shown on your cash flow statement. Only your actual cash is listed in your cash flow statements; credit is not included. Positive cash flow means that your company's income exceeds its outgoing costs. When you spend more money than you bring in, your cash flow is negative, year end checklist accounting.

You can see from your cash flow statement when money enters or leaves your company. You may, for instance, examine which months your company's cash flow is stronger and which months it is weaker. You may forecast your future cash flow and develop one by monitoring your cash flow throughout the year and at year's end, year end checklist accounting.

Your company's financial status is tracked on your balance sheet, which displays your assets, liabilities, and equity. Your assets should always be equal to your obligations and equity. Make sure your accounts balance and everything is in order for the coming year by using your balance sheet at year's end, year end checklist accounting. In the event of a disparity, be sure to track out the accounting error and correct it.

Collect past due invoices

Try to collect the money that clients owe your company if you wish to close your books for the year. To do this, some extra effort must be made in order to collect past-due invoices before the new year. Some clients might only require a polite reminder of an invoice, year end checklist accounting.

Be professional when communicating with consumers about overdue debts. When interacting with consumers who are paying late, be kind, patient, and upbeat, year end checklist accounting.

Consider presenting customers with a payment plan if getting payment from them is challenging. It's possible that the customer won't be able to pay the entire amount at once. You may be able to obtain payment more quickly by negotiating an instalment plan. Additionally, it demonstrates to them your empathy and understanding of their problems, year end checklist accounting.

If you really aren't capable of collecting the money on your own, think about hiring assistance. For a fee, collection companies can assist you in recovering unpaid debts. The collection company typically retains a part of the entire amount owed.

Recognize the inventory

If your company has inventory, you need to do a precise inventory of the items and supplies you have on hand. If not, you can have empty shelves or inventory shrinkage (e.g., expired goods).

If your company keeps inventory, perform an inventory check before the end of the year. Compare the sums of your inventory to your balance sheet. Make modifications if you discover differences between your count and balance sheet.

You can determine how much you spent on inventory during the year and its value by accounting for it at year's end. Additionally, it can aid with inventory planning for the following year, particularly during busier seasons, year end checklist accounting.

Put business receipts in order

Are your business receipts still kept in a shoebox? If so, in order to get organised for the new year, you might want to reconsider how you arrange company receipts, year end checklist accounting.

Your small business may be at risk of having messy and inaccurate books due to disorganised receipts. Not to mention that disorganised documents might increase your risk of filing a tax return incorrectly and lead to more problems down the road.

Make sure you are organised from the beginning if you want to maintain your receipts in good form all year. As soon as you receive a receipt, file or save it according to your filing system. You won't have to be concerned about losing the receipt or neglecting to account for it this way, year end checklist accounting. You might even be able to attach receipts and other documents to transactions in accounting software to better track them.

Reconcile your credit cards and bank accounts

Reconciling your bank accounts and credit cards should be a top priority on your accounting year-end operations checklist. By doing so, you can make sure that your bank accounts and accounting records are accurate, year end checklist accounting.

Compare your bank and credit card statements to your accounting records in order to reconcile your finances. Your books' balance and your statements should agree, year end checklist accounting. If they don't agree, look further to identify the discrepancy. To make the balances equal, you might need to make a change to one of your records.

Examine the payable and receivable accounts

Review your accounts payable and receivable before the end of the year to make sure you have paid off any debts and collections. Find any past due invoices in the accounts receivable section. Get in touch with a customer as soon as you can if they have any past-due or unpaid invoices, year end checklist accounting.

To find out if you have any past-due or unpaid debts before the end of the year, look at your accounts receivable ageing report. To begin the new year with a clean slate, follow up with suppliers and settle debts, year end checklist accounting.

Additional information

Add backing up information to your year-end closure checklist to make sure you safely save your accounting data for the coming year. Losing crucial accounting data from this year and earlier years is the last thing you want to happen. Have a dependable backup solution in place to safeguard the security of your data, year end checklist accounting.

You may print off documents (such financial statements) and keep them in a secure location, or you could back up accounting data on your computer or smartphone. You can feel secure knowing that your data is safe in the cloud if you use online accounting, year end checklist accounting.

Whatever you choose to do, be sure you have a plan in place to backup your company's valuable accounting documents.

Prepare the relevant paperwork for your accountant

Get your records ready for your accountant before year-end if you utilise an accountant for your company in any way, such as accounting software in conjunction with a tax professional.

How to measure business spending using accrual accounting: Accrued expenses

For businesses, accrual accounting offers a useful approach to assess and display the health of their finances. Instead than just depending on the money in your bank account, bookkeepers may account for both paid transactions and unpaid liabilities, providing more precise information.

However, this approach also poses an odd issue for businesses that manage spending in specific ways. If staff are overdue on expenditure reports and you don't have the most recent credit card and billing information, you won't know how much money you've committed to spending, year end checklist accounting.

What is an accrued expense?

A company's committed expenses are added to the books using the accumulated expense (or accrued liability) accounting method before they have been paid. Once the item has been incurred (the business has agreed to pay for it), it is recorded in the books to provide a more accurate picture of the business's financial situation, year end checklist accounting.

This is significant when paying via invoice in the accounts payable procedure. Companies choose a supplier and make a payment agreement for goods and services, but they often wait to make the payment until the product or service is delivered.

Accounting for accruals VS cash

Cash basis accounting is a popular substitute for accrual accounting. By using this approach, the cash flow statement of the business represents what has actually been taken out of the bank.

Consider conventional business credit cards. Your bank account won't accurately reflect the amount spent if the credit card payment isn't due until the end of the month. Even if you have $10,000 in credit card debt, your bank account won't show it until you make a payment. This $10,000 is essentially gone, but you still need to make the payment.

Generally speaking, the most accurate way to assess a company's financial situation is to look at the overall amount of committed spending. You still need to pay suppliers whether or not the money has officially left your accounts, but this is more of an operational issue.

Due to this, accrued expenditures rather than cash are the focus of best practices in spend management. However, the majority of businesses should have both a cash flow statement and accruals in their expense and purchase ledgers. Actually, it's not a choice between the two.

Expense accrual accounting

Accrued expenses are unfortunately nearly impossible to track in real time for many businesses. You won't know how much was spent if you have pooled credit cards, or even if individual employees have their own cards, until you receive the statement at the end of the month.

For expense reports, the same is true. You are unaware of the amount for which the firm is obligated to reimburse your teams until they submit their claims, which may take months after the expenses were incurred.

Because the finance team frequently handles the invoice itself directly, invoices are a little simpler. They can accrue the payment after receiving it even if they are delaying pushing the payment. Even so, it still depends on other teams submitting their invoices on schedule.

The fundamental issue is a lack of current spending information. You can't easily maintain your purchase diary (or P&L statement) up to date if you don't know what has been committed in real time.

Which explains why so many companies struggle to complete their monthly bookkeeping on time. There is always some new information coming in.

Checklist for Accounting: Daily, Weekly, and Monthly Tasks

Recurring accounting tasks

When they are focused on running their business and providing customer service, small business owners frequently put off accounting tasks, but during audit season, they will likely spend hours every day attempting to find and correct accounting or inventory irregularities.

The accuracy and efficiency of your company's records can be greatly increased by establishing a daily schedule for accounting operations, year end checklist accounting. Here are some suggestions for daily duties that you ought to carry out:

Update and reload your financial information

Your accounting software should ideally automatically sync your bank and credit card feeds, as well as the sales information from your POS system. You'll need to carry out this task manually if it doesn't, year end checklist accounting. This gives you a current view of your finances and demonstrates how much money is coming into and going out of your company.

Balance your cash and receipts

At the conclusion of each day, reconciling cash and receipts makes it easier to spot cash shortages or overages promptly, allowing you to track down where the money went and spot mistakes or theft. This is crucial for building controls and responsibility in your company, which falters when neglected daily, year end checklist accounting.

Waiting for your monthly bank statement is unnecessary if your accounting software is linked to your bank and synced every day, year end checklist accounting. Numerous accounting programmes make reconciliation easier by recommending matches; all you need to do is review and accept them.

It's simple to spend a short amount of time on this work each day, which eliminates a tiresome month-end chore, year end checklist accounting. It's also a good idea to check pending transactions for any mistakes or irregularities so you can start looking into potential problems right away.

Record and group your expenses

It's simple to handle them right away because many accounting software packages feature apps that you can use to submit expenses and upload receipts, year end checklist accounting. At the end of the month, take a picture of the receipt and make a note of the details rather than going through a stack of receipts.

Received record inventory

By entering inventory into your system the same day you get it, you keep your system up to date and can see your stock more accurately. By notifying clients you're out of stock when an item just hasn't been loaded into the system, your team may lose sales if you don't do this. Additionally, if your system isn't configured to enable negative inventory counts, reordering may be delayed if your staff sells out of an item, year end checklist accounting.

Daily inventory management also lowers the risk of product theft and loss. It serves as a crucial check and balance. Visit our review of the top inventory management software for additional details.

Daily accounting assignments

Here are some weekly accounting duties to maintain your company's books, cash flow, and operations in order:

- Keep track of your payments; deposit cash and cheques.

- To maintain a healthy cash flow and up-to-date records, deposit any paper checks and cash payments you get on a weekly basis.

Find out if your bank accepts mobile deposits and what the daily, weekly, and monthly limits are if the majority of your accounts receivable are electronic payments and you only have a few paper checks. Doing so can help you avoid having to visit the bank.

Send your clients a bill

Regular billing encourages timely payment from your customers. It is simpler to discuss any discrepancies with the bill right away rather than a month from now since the good or service you delivered is still fresh in their memories, year end checklist accounting. Your client will take longer to pay you if you wait longer to bill them.

According to John Rampton, the creator of online payments business Due, in a 2019 Forbes article, you are nearly 1.5 [times] more likely to get paid when you invoice the same day that the service is completed (as opposed to waiting two or more weeks for your billing cycle).

Even while daily invoicing to clients might not always be possible, it's still important to make sure it happens at least once every week.

Review timesheets for employees

Proactively reviewing timesheets, at least once each week, can help you identify any anomalies and actions that might be detrimental to your business, year end checklist accounting. Additionally, it will help you keep track of payroll costs so you may adjust your personnel mix and stick to your own spending limits.

Unauthorized overtime pay is another problem; if an employee works more than 40 hours per week, you may still be responsible for paying for it, even if you didn't allow it, year end checklist accounting. Weekly inspections can guarantee that such situations are minimised.

Accounting is important for businesses of all sizes, but small business owners in particular sometimes put it on the back burner as they juggle other duties like managing and maintaining daily operations. Accounting, however, should never be an afterthought, year end checklist accounting.

Keeping your finances in balance can help you financially plan months into the future and warn you of any potential financial shortfalls. If things get really bad, the appropriate accounting insight can even enable you to save your company, year end checklist accounting.

Accounting is tiresome and frightening, which is one reason why small businesses frequently put it on the back burner. Financial management is regarded by 40% of small business owners as the most challenging aspect of running a company. Accounting errors can hinder the expansion of your small business and leave you vulnerable.

In this article, we've compiled the top accounting advice for avoiding mistakes that could hurt your company. You'll gain from functioning with clean books after you've achieved it, year end checklist accounting.

Keep an eye on the receivables

The most thrilling aspect of operating a business is getting paid. The management of your receivables isn't as enjoyable. When you send out an invoice, you log a receivable, or the fact that a client owes you money. You can quickly determine if a consumer owes money by looking at this listing.

When the client pays you, you should apply the funds to their invoice and mark it as paid. This is more difficult to do when you are trying to keep up with numerous orders. Since there are never enough hours in the day, customer deposits are all too frequently left to be reconciled at a later time. This means that you will have a lot of customer deposits in your revenue account at tax time and an inaccurate representation of your receivables.

Consequences include wasting hours maintaining your listing, paying too much in taxes, and accruing a lot of debt. You should therefore make a point of monitoring your transactions as they take place. Applying your customers' monthly payments can help you save a tonne of time and money over the long run when it comes to billing, year end checklist accounting.

Continually Monitor Your Cash Flow

Education is crucial when it comes to accounting advice for small businesses. Your chances of effectively managing the numbers in front of you increase as your understanding of them grows.

A cash flow statement is something you might consider creating while you conduct weekly and monthly financial reviews. You may have a deeper grasp of cash flow both inside and outside of your business thanks to these statements. In essence, a cash flow statement tracks the direction of income. It also has a temporal component, allowing you to see payment cycles and seasonal costs.

You can use cash flow statements to gain the knowledge you need to plan ahead for spending and allocate revenue more wisely. They are helpful for creating financial trajectories as well, year end checklist accounting.

However, in order to comprehend financial motion, you don't necessarily need to produce a cash flow statement. The correct technology alone can assist you in gaining a comprehensive understanding of how cash is used in your business model.

For instance, if you automate your bookkeeping procedures, you'll be able to quickly and readily visualise KPIs and information on cash flow.

Records of Expenses

Unfortunately, small business owners frequently make the error of failing to save copies of their expenditure reports. Numerous tax, accounting, and cash flow concerns may come from this.

If you've ever looked at your bank statement and noticed a charge for $100 but had no idea what it was, you are already aware of the issues that can arise from bad record keeping. Keeping a copy of every receipt your company receives from purchases is one approach to address this issue. Even while it could seem like a lot of work, there are several accounting tricks that can help.

The first is to pay for all business expenses using a single credit card. Establish a specific space for your receipts, such as a spot in your car or on your desk, and use it to keep track of them, year end checklist accounting. Or, even better, take a quick photo of your receipt with your phone! By using these tips, you can stay organised and submit your taxes on time.

When seeking accounting assistance, people frequently inquire as to where the business expense should be deducted. During tax season, expense records can make all the difference. To ensure that you have correct records for tax season, make sure that your staff is aware of the significance of saving receipts and itemising spending when they're out.

Register Cash Expenses

It is essential to keep track of all business-related expenses when you are an entrepreneur. When it comes time to file your taxes, these expenses can be deducted from the amount of your overall income.

You will have a more accurate idea of your annual profitability after doing this. It is simple to overlook expenses that were paid in cash. To ensure that the spending appears on the books, ask your vendor for a receipt or log it right away, year end checklist accounting.

Understanding the Distinction Between Invoices and Receipts

One all-too-common way small business owners muck up their finances is by combining invoices and receipts. Knowing the distinction between the two is a straightforward accounting tip to abide by.

A bill that is issued to clients after they have received your services is called an invoice. Consider invoices to be thorough statements of everything the client has purchased from you. A bill reminds clients they have money due to you. They're useful for accelerating cash flow, maintaining financial records, and making sure you get paid.

A receipt serves as documentation of a transaction. It's what you provide your clients once a sale has been made. Accounting may become a nightmare if invoices and receipts get mixed up. If you can't distinguish between completed and ongoing tasks, trying to balance your books will be quite difficult for you, year end checklist accounting.

Separate your personal and business accounts

For the first several months, many small business owners rely on personal cash to keep things afloat. Although there is nothing wrong with using personal funds for company purposes, it can be problematic, year end checklist accounting.

It is simple for you, your accountant, or your bookkeeper to track how money is being spent when you have a separate bank account for company expenses. If you decide to do business using your personal account, you run the risk of missing crucial commercial transactions.

In the future, be sure to clearly distinguish between your personal and corporate finances. This might just entail opening separate checking and credit card accounts for each. Pay close attention to your spending and make sure that only expenses linked to your business are charged to your business accounts. The same is true of your individual account, year end checklist accounting.

We advise using credit cards only for all commercial transactions. This is due to the automatic and convenient method that credit card bills give you a tool to keep track of your spending.

Cash payments are simple to forget, and managing receipts is a challenge for many business owners. Poor forecasting and inaccurate cash flow management reports might result from missed cash payments, year end checklist accounting.

Why to employ a Tax Expert to Manage Your Taxes?

By handling their own taxes, many people attempt to save money. In fact, if you don't hire a tax expert, not having access to their accounting knowledge could end up costing your company a lot of money in the long run, year end checklist accounting.

You run the risk of overlooking a deduction for which you are eligible or underpaying your bill, both of which carry penalties. If you pay a professional, they are skilled at what they do and will employ accounting advice to place you in the best possible financial position.

They will be knowledgeable about the always evolving tax rules and able to prepare for potential tax increases that may be on the horizon for you.

Keep in constant contact with your accountant

You could find the lingo used by other experts, such as accountants or bookkeepers, to be complicated when you interact with them to manage your finances. You should let them know if you don't comprehend the language they're using. You are not a financial expert; you are a small business owner, year end checklist accounting.

You don't need to be familiar with the most recent technical jargon being used in the finance sector.

Your accountant and tax experts need to be considered members of your team, year end checklist accounting. They ought to be keeping an eye on you and providing you with reliable accounting advice.

Recognize double-entry accounting

Although most organisations now use accounting software rather than paper books, the double-entry accounting principles still hold true. The fundamental principle is to record both the expense and the gain associated with every purchase you make for your company, year end checklist accounting.

For instance, if you paid $10 for a pair of shoes, you would record a negative $10 on your balance sheet. The plus ten sign would also be used to indicate an increase in inventory under double-entry bookkeeping.

This kind of bookkeeping will be the most accurate at showing where your money is going, unless it has actually been lost. You can then decide what's best for your company.

Organize Your Accounts

You need numerous accounts to get the most complete view of your company. There should be a place for tracking transactions for each important component of your business, and the account balance should be modified as necessary.

Those who pay more attention to details may divide their accounts even further into sub-accounts in order to keep track of particular purchases or transactions.

Get financial statements ready

We have discussed the many types of financial statements a corporation can prepare in earlier accounting hints. The balance sheet, income statement, and cash flow statement are a few instances of this.

You should create each of these financial reports on a monthly or quarterly basis since they will enable you to assess the state of your company from many perspectives. The balance sheet displays a snapshot of the assets, liabilities, and equity of your company at a certain point in time. L

The income statement, on the other hand, displays your company's bottom line as well as the income and expenses that occurred over a specific time period. Additionally, the cash flow statement enables you to track the evolution of your cash balances over time.

If your business was publicly traded, you would have to give investors financial statements on a quarterly or annual basis. It is up to you to determine how frequently this kind of report should be generated for your organisation as you (probably) don't have this requirement.

Consider the future

Use the monthly financial report you create to forecast the financial course of your company. The simplest way to do this would be to list impending expenses like tax obligations or legal bills. It could include more complex strategies for business growth, such as budgeting for additional employees and increased rent.

This kind of forecasting can help you make the best use of your current resources. It can also assist you in making confident plans for future important junctures in the development of your company. Analyze your financial data on a monthly basis to forecast efficiently. Analyses supported by data can guarantee wise investment decisions.

Utilize technology

In reality, maintaining correct records is a difficult procedure. This approach becomes more demanding as your company expands. You may make several inputs into several of your various accounts as part of a single transaction. Trying to keep track of hundreds of these kinds of transactions can be stressful.

Where technology can help is in this situation. Accounting software is far simpler to use than the outdated practice of physically recording each transaction your company does in ledgers.

Make sure to maintain a copy of each receipt, either physically or digitally, even if you choose to utilise accounting software. This way, if you notice any errors when it comes time to balance your books, you can go back and double-check everything.

To manage your costs and expenses you can use many available online accounting software.

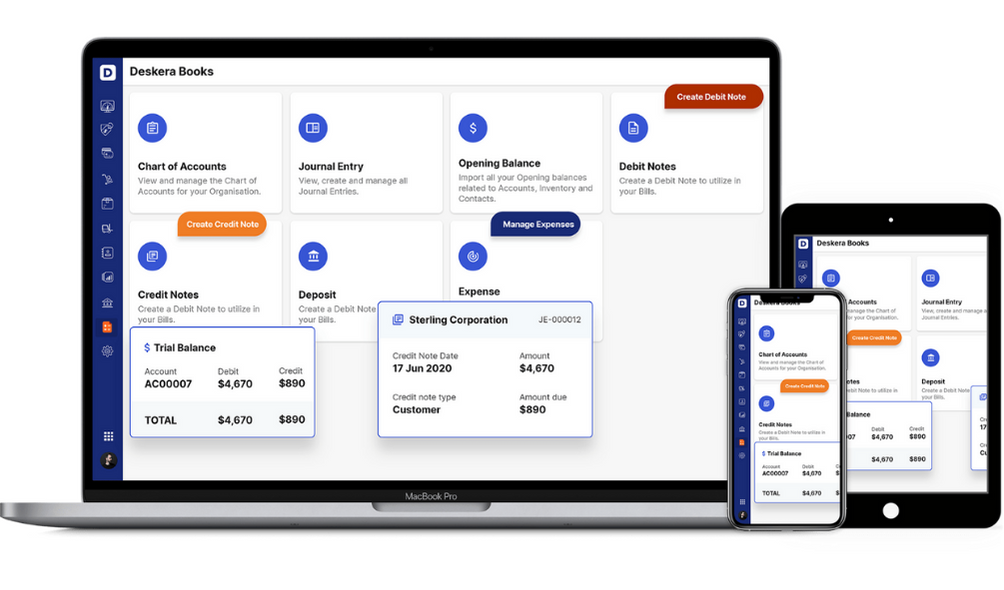

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

Your small business depends on the information in your financial statements. They offer you a picture of the financial state of your company. Additionally, statements provide you access to past and present financial data so you may forecast your company's financial outlook and make plans for the coming year.

Financial statements make it easier to comprehend your company's financial position and, hopefully, less stressful for your firm during tax season. Your accounting books contain your financial records, which you can access. In order to build and analyse year-end statements, use your accounting records.

All of your assets are the worth you currently own. Some of it is actual money, like the $20,000 in the business bank account line item in the example above. Some of it, such as inventory or equipment, is less liquid. Accounts receivable, or money you are expected to receive, may not even be in your possession yet.

Liabilities are not good, they are expensive. You may get a general indication of how much worth your company actually has to deal with by deducting them from your assets. Accounts payable in the previous example, which are often payments made to vendors or contractors, could be viewed as a short-term debt because you'll probably pay them off each month. Other obligations, like the debt from business loans, endure longer.

You can see from your cash flow statement when money enters or leaves your company. You may, for instance, examine which months your company's cash flow is stronger and which months it is weaker. You may forecast your future cash flow and develop one by monitoring your cash flow throughout the year and at year's end.

Your company's financial status is tracked on your balance sheet, which displays your assets, liabilities, and equity. Your assets should always be equal to your obligations and equity. Make sure your accounts balance and everything is in order for the coming year by using your balance sheet at year's end. In the event of a disparity, be sure to track out the accounting error and correct it.

Regular billing encourages timely payment from your customers. It is simpler to discuss any discrepancies with the bill right away rather than a month from now since the good or service you delivered is still fresh in their memories. Your client will take longer to pay you if you wait longer to bill them.

Proactively reviewing timesheets, at least once each week, can help you identify any anomalies and actions that might be detrimental to your business. Additionally, it will help you keep track of payroll costs so you may adjust your personnel mix and stick to your own spending limits.

Unauthorized overtime pay is another problem; if an employee works more than 40 hours per week, you may still be responsible for paying for it, even if you didn't allow it. Weekly inspections can guarantee that such situations are minimised.

In reality, maintaining correct records is a difficult procedure. This approach becomes more demanding as your company expands. You may make several inputs into several of your various accounts as part of a single transaction. Trying to keep track of hundreds of these kinds of transactions can be stressful.

Related Articles