Running a business takes passion and hard work. But is that all? Coca Cola was started to give the world an amazingly tasting beverage. Microsoft was started to bring the common man closer to technology. There are infinite number of business that started with passion. But here comes the hard part. While you may understand your industry in and out, as a business owner and as an accountant in a business, you need to understand The Accounting Equation.

This equation is a fundamental concept in accounting, and you must understand it to make sound financial decisions for your company. The double-entry accounting system is built on to maintain the balance of your books. In this article, we will discuss what the accounting equation is and how you have to use it in your business.

We'll also provide some examples so that you can see how it works in practice. So, without further ado, let's get started!

What will you find in this article –

- What is an Accounting Equation?

- Elements of Accounting Equation Formula

- What is the Purpose of Accounting Equation in Business?

- What About Drawings, Income, and Expenses?

- How to Balance the Accounting Equation

- Why Does the Accounting Equation Matter?

- About the Double-Entry System

- Impact of Transactions on Accounting Equation

- Real-World Practical Example

- Limitations of the Accounting Equation

- Conclusion

- Key Takeaways

What is an Accounting Equation?

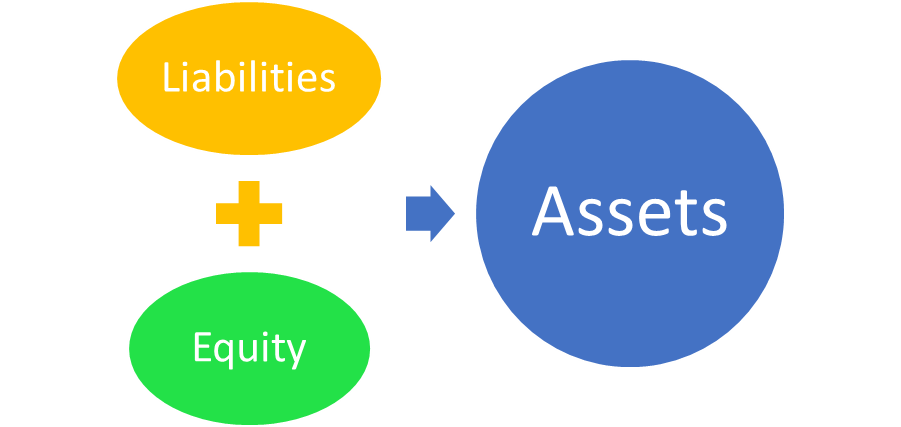

The Accounting Equation is the foundation of all double entry bookkeeping. It is an equation that must always balance. The equation states that

Assets = Liabilities + Equity

In other words, what a business owns (assets) is equal to what it owes to others (liabilities) plus the owners' investment in the business (equity). This equation forms the basis for creating a Balance Sheet, one of the three main financial statements businesses use. The other two are the Income Statement and the Cash Flow Statement.

The Balance Sheet can be considered a snapshot of a business at a particular point in time, showing what it owns and owes. The Income Statement shows how much money a business has made or lost over time, usually one year. On the other hand, the Cash Flow Statement shows the cash inflows and outflows for a business over a period, usually one year.

The Accounting Equation is essential because it provides a framework fo understanding businesses' operations. It can be used to assess whether a business is doing well and to decide where to allocate resources.

Therefore, If you're starting a business or already running one, it's crucial that you have a good understanding of the Accounting Equation and how it works. This will help you make sound financial decisions and ensure your business remains healthy and profitable.

Elements of Accounting Equation Formula

The accounting equation formula comprises three elements: assets, liabilities, and owner's equity.

Assets

Assets are anything of value that a company owns. This could include cash, inventory, buildings, equipment, or land.

Liability

Liabilities are anything that a company owes to others. This could include money owed to suppliers, outstanding loans, or taxes payable.

Owner's Equity

Owner's equity is the portion of the business that belongs to the owners. This includes investment capital from the owners and any profits the company has earned.

Owner's Equity = Assets – Liabilities

The accounting equation must always be in balance because it represents all the financial transactions that have occurred within a business.

What is the Purpose of Accounting Equation in Business?

It is initially helpful to look more closely at double-entry accounting to comprehend the goal of the accounting equation. The cash balance, which balances total liabilities, assets, and shareholder equity, is also at the center of this. With that being said, the accounting equation ensures that almost all capital (asset) origins and uses are equivalents (debt and equity).

Every company transaction must be recorded in at least 2 distinct financial accounts to comply with double-entry accountancy. For instance, a company would initially record the cash purchase of raw materials in the inventory valuation. The raw resources would be valuable, which would result in more inventories.

Due to the expenditure of cash, the transactions must also be recorded as a loss in capital. Double-entry accounting dictates that this one transaction calls for two different accounting entries.

Likewise, when a firm borrows money, the assets grow due to the borrowed funds. Additionally, this raises the company's debt-related obligation. The examples above demonstrate how double-entry accounting maintains the books' balance. That's where the financial accounting concept comes into play. The sum of 2 sides of the equation should always be the same. Equity plus liabilities must be equivalent to the value of assets.

Making this a worldwide norm would make it simpler for multinational firms to manage their finances. Additionally, it helps on a more basic level by maintaining the equilibrium of all transactions & establishing a clear connection between each spending and its funding source.

What About Drawings, Income, and Expenses?

We now know that the accounting equation is: Assets = Liabilities + Equity. But what about when we have drawings, income, or expenses in our business? How do these affect the equation?

- Drawings are when a business owner takes money out of business for personal use. This reduces the equity of the business.

- Income is money that comes into the business from sales or other sources. This increases equity.

- Expenses are payments made by the business, such as rent, supplies, or salaries. This reduces equity.

The accounting equation stays in balance because when one element changes, another must change to compensate. So, if assets go up, either liabilities or equity must also go up.

This is why the accounting equation is so important in business. It shows us at a glance whether our business is in financial trouble or not. If the equation is out of balance, we know we need to take action to fix it.

How to Balance the Accounting Equation

Accounting teams may easily check transactions using the equation. You should take into account every one of the three components to figure out how to balance the accounting equation:

Step 1:

Find the company's total assets for the relevant accounting period.

Step 2:

Add all the obligations from that very same accounting period.

Step 3:

Find the shareholder equity and include it with the liabilities.

Step 4:

Verify that total assets are equivalent to the total equity plus total liabilities.

Whether the calculation doesn't work, it's time to examine the financial records to see if any transactions were entered improperly.

The equation can also be rearranged to determine any missing components. For instance, let's say you know that Company A has £10 million in total assets and £8 million in equity. The obligations must thus equal £2 million after deducting the equity from the assets. The accounting equation provides a straightforward guideline for maintaining the balance this way.

Why Does the Accounting Equation Matter?

Mentioned below are the reasons why accounting equation matters for your business:

1. To understand what your business owns

The first reason is to understand what your business owns. The equation will show you the total value of your assets. This is important because it will give you an idea of how much your business is worth and how much debt you can afford to take on.

2. To comprehend what your business owes

To understand what your business owes, you'll need to know how to calculate your liabilities. This includes both short-term and long-term debts. You can use the accounting equation to help you determine your business's liabilities.

3. To find out what your business is worth

To find out what your business is worth, you'll need to calculate your assets. This includes both physical assets (property, equipment, etc.) and intangible assets (patents, copyrights, etc.). The accounting equation can help you determine the value of your business's assets.

4. To determine your business's equity:

Equity is calculated by subtracting your liabilities from your assets. This will give you an accurate portrayal of what your business is worth and how much money you would have if you sold your assets and paid off all of your debts.

5. To find out if your business is profitable

The accounting equation can also be used to determine whether or not your business is making a profit. Profit is equal to total revenue minus total expenses. If your total revenue exceeds your total expenses, you are making a profit. If not, then you are operating at a loss.

All these factors are important to know to manage your finances properly. The accounting equation is a fundamental part of double entry bookkeeping, which is used by businesses all over the world to keep track of their money.

To get a better handle on your business's finances, you must learn how to use the accounting equation. This will allow you to see exactly where your money is going and where it's coming from. With this information, you can make informed decisions about how to best spend and invest your resources.

About the Double-Entry System

The double-entry system is the most common method of bookkeeping and is used by businesses all over the world. In this system, each transaction is recorded in two accounts: the debit and credit accounts. The total amount of debits must equal the total amount of credits for the books to be balanced.

The double-entry system has several advantages, including:

- It provides a clear record of all transactions that have taken place within a business.

- It helps to prevent errors from occurring, as all transactions must be recorded in two separate places.

- It makes it easy to identify where money has come from and where it has been spent.

The double-entry system may seem daunting if you are new to bookkeeping. However, once you understand how it works, you will see that it is actually quite simple.

Impact of Transactions on Accounting Equation

The accounting equation is the fundamental framework of double-entry bookkeeping. Transactions impact the accounting equation by affecting either one or both sides of the equation. For example, if a company borrows $100 from a bank, that would be considered a liability on its balance sheet because they now owe money to the bank. The $100 would also be considered an asset because it represents the company's cash available to spend.

If a company spends $50 to buy office supplies, that would be considered an expense on the income statement because it represents money that was spent during the period. The $50 would also be considered a reduction in assets because it represents the cash that was spent.

The double-entry system ensures that transactions are recorded in a way that impacts both sides of the accounting equation. This helps keep the equation in balance and provides a clear picture of a company's financial position.

Real-World Practical Example

Example 1:

Compute the missing figures using the formula of accounting equation in the following:

- Liabilities = $20,000, Owner’s equity = $30,000, Assets = ?

- Liabilities + Owner’s equity = $300,000, Assets = ?

- Assets = $100,000, Liabilities = $40,000, Owner’s equity = ?

- Assets = $120,000, Owner’s equity = $80,000, Liabilities = ?

Solution

- Liabilities + Owner’s equity = Asset

= $20,000 + $30,000

= $50,000

- Assets = Liabilities + Owner's Equity is the fundamental accounting equation. As a result, the total assets should also equal $300,000 if liabilities + owner equity equals that sum.

- Assets – Liabilities = Owner’s equity

= $100,000 – $40,000

= $60,000

- Assets – Owner’s equity = Liabilities

= $120,000 – $80,000

= $40,000

Example 2:

Mr. John established a company called "John T-shirts" to sell T-shirts. He carried out the following actions within first month of business:

-

Mr. John gave his company a $15,000 financial investment.

-

He bought a structure for $5,000 cash to use for commercial purposes.

-

A $1,500 cash purchase of furniture for commercial use.

-

Paid a producer $3,000 cash to buy T-shirts.

-

T-shirts that were sold for $1,000 in cash had a $700 cost.

-

T-shirts worth $2,000 were bought with credit.

-

T-shirts that were sold for $800 on credit and cost $550 each.

-

Paid his creditors $1,000 in cash.

-

Gathered $800 in cash from his accounts receivable.

-

Someone stole the $100 shirts from the store.

-

Mr. John paid his phone bill in cash of $150.

-

$5,000 was borrowed for business purposes from City Bank.

Required:

Describe how each of the aforementioned transactions affects John T-shirts' accounting equation.

Solution

Transaction 1:

The only asset of the company at this time is cash, and the owner is the only one who can claim it. As a result, the equation would seem as follows:

|

Asset= |

Liability+ |

Owner’s Capital |

|

Cash= |

|

Capital |

|

$15,000= |

|

$150,000 |

Transaction 1 has an impact on the following equation element(s): "Assets" and "Owner's equity."

Transaction 2:

The second transaction involves buying a building, which results in two modifications. First, the cash is reduced by $5,000, and second, the firm gains access to the building, which is worth $5,000. In other terms, $5,000 in cash is transformed into a structure. The following graph illustrates how this transaction affects the accounting equation:

|

Asset= |

Liability+ |

Owner’s Capital |

|

Cash+ Building= |

|

Capital |

|

$10,000+$5000= |

|

$15,000 |

Transaction 2 has an impact on the following equation element(s): "Assets"

Transaction 3:

This transaction's effects are comparable to those of Transaction 2. The business receives furniture while also disbursing cash. On the asset side, the purchase of furniture with a $1,500 value offsets the loss of $1,500 in cash.

|

Asset = |

Liability+ |

Owner’s Capital |

|

Cash+Building+Furniture |

|

Capital |

|

$8,500+$5,000+$1,500 |

|

$15,000 |

Transaction 3 has an impact on the following equation element(s): "Assets"

Transaction 4:

This transaction's effects are comparable to those of transactions 2 & 3. Cash leaves the company and is replaced with inventory, which is an asset. The cash will drop by $3,000, as well as inventory worth $3,000 would also be recorded on assets side at the same time.

|

Asset = |

Liability+ |

Owner’s Capital |

|

Cash+Building+Furniture+Inventory |

|

Capital |

|

$5,500+$5,000+$1,500+$3,000 |

|

$15,000 |

Transaction 4 has an impact on the following equation element(s): "Assets"

Transaction 5:

In this exchange, $700 worth of shirts are exchanged for $1,000 in cash. It decreases inventory by $700 while increasing cash by $1,000. The $300 difference represents the business's earnings, which would be transferred to the capital. So here is a diagram showing how this transaction's overall effect on the accounting equation:

|

Asset = |

Liability+ |

Owner’s Capital |

|

Cash+Building+Furniture+Inventory= |

|

Capital |

|

$6,500+$5,000+$1,500+$2,300= |

|

$15,300 |

Transaction 5 has an impact on the following equation element(s): "Assets" and "Owner's equity"

Transaction 6:

T-shirts worth $2,000 are bought on credit in this transaction. On the equity side of the equation, it adds inventory on the asset side and produces a $2,000 obligation called as accounts payable (abbreviated as A/C P.A.). Because it is a credit transaction, cash is unaffected.

|

Asset = |

Liability+ |

Owner’s Capital |

|

Cash+Building+Furniture+Inventory= |

A/C P.A+ |

Capital |

|

$6,500+$5,000+$1,500+$4,300= |

$2,000+ |

$15,300 |

Transaction 6 has an impact on the following equation element(s): "Assets" and "liabilities"

Transaction 7:

In this deal, the company offers to sell T-shirts that normally cost $550 for $800 off credit. Accounts receivable, often known as A/C R.A., is a new asset that is valued at $800 and lowers inventory by $550. The $250 discrepancy represents the business's profit and will be included to the capital portion of the head owner's capital.

|

Asset = |

Liability+ |

Owner’s Capital |

|

Cash+Building+Furniture+Inventory+ A/C R.A= |

A/C P.A + |

Capital |

|

$6,500+$5,000+$1,500+$3,750+$800= |

$2,000 |

$15,550 |

Transaction 7 has an impact on the following equation element(s): "Assets" and "Owner's equity"

Transaction 8:

In this deal, the business pays a past credit purchase with $1,000 in cash. Both the cash & payables liability will be reduced by $1,000.

|

Asset = |

Liability+ |

Owner’s Capital |

|

Cash+Building+Furniture+Inventory+ A/C R.A= |

A/C P.A + |

Capital |

|

$5,500+$5,000+$1,500+$3,750+$800= |

$1000+ |

$15,550 |

Transaction 8 has an impact on the following equation element(s): "Assets" and "Liabilities"

Transaction 9:

For a past credit sale, the company receives cash in the amount of $800 in just this transaction. Here on asset side, it decreases accounts receivable by $800 while increasing cash by $800.

|

Asset = |

Liability+ |

Owner’s Capital |

|

Cash+Building+Furniture+Inventory+ A/C R.A= |

A/C P.A + |

Capital |

|

$6,300+$5,000+$1,500+$3,750+$0= |

$1000+ |

$15,550 |

Transaction 9 has an impact on the following equation element(s): "Assets"

Transaction 10:

The theft-related loss of shirts causes a $100 reduction in both inventories on the equity side & capital on the asset side. The capital or equity of the owner is reduced by all costs and losses.

|

Asset = |

Liability+ |

Owner’s Capital |

|

Cash+Building+Furniture+Inventory+ A/C R.A= |

A/C P.A + |

Capital |

|

$6,300+$5,000+$1,500+$3,650+$0= |

$1000+ |

$15,450 |

Transaction 10 has an impact on the following equation element(s): "Assets" and "Owner's equity"

Transaction 11:

Paying business expenditures such cellphone and electricity bills results in a $150 reduction both in cash on the asset side and capital on the equity side of the ledger.

|

Asset = |

Liability+ |

Owner’s Capital |

|

Cash+Building+Furniture+Inventory+ A/C R.A= |

A/C P.A + |

Capital |

|

$6,150+$5,000+$1,500+$3,650+$0= |

$1000+ |

$15,300 |

Transaction 11 has an impact on the following equation element(s): "Assets" and "Owner's equity"

Transaction 12:

Since the John T-shirts must pay back the loan to the City Bank, it is a liability. This transaction results in a $5,000 rise in cash on the asset side and a $5,000 increase in "bank loan" liabilities on the equity side.

|

Asset = |

Liability+ |

Owner’s Capital |

|

Cash+Building+Furniture+Inventory+ A/C R.A= |

A/C P.A + |

Capital |

|

$11,150+$5,000+$1,500+$3,650+$0= |

$1000+ |

$15,300 |

Transaction 12 has an impact on the following equation element(s): "Assets" and "Liabilities"

Note:

In the abovementioned example, we looked at how twelve separate transactions affected the accounting equation. It is important to note that while each transaction affects the dollar value of minimum one of the equation's fundamental components—namely, assets, liabilities, and owner's equity—the equation maintains its stability.

Limitations of the Accounting Equation

1. Only Applies to Double Entry System

The accounting equation is a powerful tool, but it has its limitations. For one thing, it only applies to businesses that use the double-entry system. This system records each transaction as both a debit and a credit. So, the equation won't be relevant to your business if you're using a different accounting system.

2. No Details About Time of Transaction

Another limitation is that the equation doesn't give you any information about the timing of transactions. In other words, it doesn't tell you when money was earned or spent. This can be important when trying to figure out things like cash flow or profitability.

3. Only Records Financial Transactions as Data

Finally, the equation only applies to financial transactions. It doesn't include things like inventory or equipment that have value but aren't directly related to money.

Conclusion

You may better comprehend the foundations of accounting by taking the time to study the accounting equation and also to recognize the dual side of every transaction. It can often be beneficial to consider just one account that could be impacted by a transaction, such as cash (asset), and use your understanding of the accounting equation to figure out the other ones if you are unclear about which accounts would be affected.

The accounting equation always will balance as a result of the transaction, no matter what happens.

How can Deskera Help You?

Deskera Books can help you automate and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Sign up now to avail more advantages from Deskera.

Learn about the exceptional and all-in-one software here:

Key Takeaways

-

The double-entry accounting system is thought to be built upon the accounting equation.

-

According to the accounting formula, a company`s assets are equivalent to the total of its liabilities and shareholders' equity on its balance sheet.

-

The company's significant resources are represented by its assets. Their responsibilities are represented by their liabilities.

-

Liabilities and shareholders' equity both show how a corporation finances its assets.

-

Debt funding is displayed as a liability, whereas equity financing is displayed as shareholders' equity.

-

Assets = (Liabilities + Owner’s Equity)

-

All of a company's debts are included in its liabilities. Loans, accounts payable, deferred income, mortgages, bond issuances, warranties, and accumulated costs are a few examples.

-

The overall market worth of the business, stated in dollars, is the shareholders' equity.

Related Articles