In simple terms, cost of goods sold (also called cost of sales), or COGS, is the cost of a product to its seller.

Elaborating a bit more, cost of goods sold is the cost (borne by the seller) of procuring, producing, or manufacturing products that are sold by a company, manufacturer, distributor, or retailer. This amount includes all costs that are directly spent on purchasing or producing the product, including transportation costs, labor costs, storage charges, distribution costs, etc. This does not include indirect costs such as sales and marketing - basically, any cost that is not directly spent in producing or procuring the product.

in this article, we will cover everything you need to know about 'cost of goods:'

- Understanding cost of goods sold

- A real-world example of cost of goods

- Why correctly calculating cost of goods is crucial

- The importance of cost of goods

- What expenses are not included in cost of goods?

- Exclusions from cost of goods deductions

- The formula for calculating cost of goods

- A deeper dive into this calculation

- Accounting methods for calculating cost of goods

Understanding Cost of Goods Sold (COGS)

Lets look in details:

Cost of Goods With An Example

For example, assume Nike spends $100 on producing one shoe. This amount will include raw materials, man-hours, packaging, storage, etc., that Nike exhausts on this shoe. If Nike sells ten pairs of shoes, they have sold products that cost them a total of $100 x 10 shoes = $1000 to produce.

The cost of goods sold is an important expense in a seller's income statement, and, in most cases, will be the largest expense.

Why is it an expense?

The short answer is because the company expends this amount to own (by buying or producing) this product. This article will further explain what exactly cost of goods is, what can be added under cost of goods, why it is an expense, etc.

Why Correctly Calculating Cost of Goods Is Crucial

The difference between a company's net revenue and expenses is its gross profits, an amount that is taxable.

In our above example, if Nike sells 10 pairs of shoes at $150 each, they earn $150 x 10 shoes = $1,500.

$1,500, however, is not their profits because they spent $1000 is producing these 10 shoes. Their net profits, the amount that is taxable, is $1,500 - $1,000 = $500.

It is quite evident why every company must be diligent in listing their expenses. It reduces the taxable amount. Since cost of goods is a major expense, it must be accurately calculated so that a company does not end up showing more profits than they actually make, and end up paying more taxes than they actually should.

If Nike miscalculates and does not add, say, $5 per shoe to the cost of goods expense, they end up listing $50 as profits (that they haven't actually made) and then pay an additional tax on this amount.

The Importance of Cost Of Goods

Cost of Goods is an important factor in calculating a company's gross profits, and gross profits not only affects taxes but is also an indicator of the company's performance and profitability. Analyzing cost of goods and gross profits indicates how efficient the company is, how efficiently it is managing labor, resources, and supplies involved in the production process.

Cost of goods can also be seen as the cost of doing business. It is the cost the company has to bear in order to have products to sell. Analyzing cost of goods helps investors, analysts, and managers get a sense of the company's financials. A higher cost of goods results in lower taxes, yes, but it also results in lower profits for the shareholders. Striking the right value when it comes to cost of goods is key for a business to thrive.

What Expenses Are Not Included In Cost Of Goods?

Lastly, it is important to understand that a company cannot add the cost of all products produced to the cost of goods when creating its income statement. Cost of goods should only include the production cost of products that were actually sold for revenue.

For example, If Nike produces 100 shoes and spends $100 per shoe to do so, they incur a total expense of $100 x 100 shoes = $10,000. They cannot, however, add $10,000 to cost of goods in the income statement even though they have already exhausted that amount. If they sell 50 pairs of shoes throughout the year, the cost of goods line item will include $100 x 50 shoes = $5000. The remaining $5000 will be added to the balance sheet as a current asset (products that are ready to be sold for cash).

The production cost of the products that are not sold ($5000 in this example) carries over to the next financial year and is included in the calculation of cost of goods. This will be more clear when you understand how cost of goods is calculated.

Exclusions From Cost Of Goods Deductions

Service-based companies that do not sell any products do not have any inventory and do not show cost of goods in their income statement. Even they have business expenses like employee costs and equipment expenses, they do not list them in cost of goods, but rather list them as "cost of services," which does not count towards cost of goods deduction.

Formula For Calculating Cost Of Goods

The formula for COGS:

Cost of goods = (the cost of inventory at the beginning of the year + cost of purchases throughout the year) - the cost of the inventory at the end of the year

For example, let's assume Nike has an inventory of shoes worth $10,000 at the start of the fiscal year. They further procure and/or produce shoes worth $3,000 through the year. At the end of the fiscal year, they calculate their inventory worth to be $6,000.

The cost of goods for Nike for that year will be:

cost of goods = ($10,000 + $3,000) - $6,000 = $7,000.

This essentially means Nike spent $7,000 on producing the products that they sold that year.

The cost of inventory at the end of that fiscal year becomes the cost of inventory at the beginning of the next fiscal year.

A Deeper Dive Into This Calculation

While there are different ways to calculate cost of goods, the formula we have listed is the most used. Here's how each term can be interpreted:

- The cost of inventory at the beginning of the year - This amount is essentially the money already spent on producing or producing products. Since the company owns these products, they have already spent money on them and it is available for sale (and thus can be a potential cost of goods)

- Cost of purchases throughout the year - This amount is the money the company spends in procuring or producing new products throughout the year. Since this money is directly spent on the product, it is also a potential cost of goods

So far, both these expenditures, although already incurred, are only potentially cost of goods, and not actually cost of goods.

- The cost of the inventory at the end of the year - This amount indicates how much inventory is unsold, and how much should NOT be added to cost of goods

By deducting the cost of unsold products from the cost of all produced products, we get the cost of all sold products, the cost of goods.

Accounting Methods For Calculating Cost Of Goods

The inventory costing method used by a company to calculate the cost of inventory at the end of the year will decide the value of cost of goods sold. There are four types of inventory costing methods a company can use to record the cost of ending inventory:

- FIFO - First In, First Out

- LIFO - Last In, First Out

- Average Cost Method

- Special Identification Method

FIFO

FIFO method is calculated under the assumption that the goods purchased, manufactured, or produced earliest are sold first. Products that come into the inventory first, go out first. Since the cost of manufacturing tends to go up with time (because of inflation), a company that uses the FIFO costing method will sell the least expensive products (in terms of production costs incurred) first and have a higher cost of inventory at the end of the year resulting in a lower cost of goods as compared to if they used the LIFO method.

Because the cost of the inventory at the end of the year keeps increasing, the cost of goods keeps decreasing and net profits for the company continually increase in the FIFO method.

LIFO

The LIFO method of recording the cost of ending inventory is the opposite of the FIFO method. In LIFO, the latest products are assumed to be sold first. Because prices keep increasing with time, the products that cost the most to produce are sold first and the products that cost the least to produce are left in the inventory. This leads to a decreasing cost of the inventory at the end of the year, increasing cost of goods value, and decreasing net profits. LIFO is advantageous in recording a higher cost of goods and thus, lower profitability and a lower taxable income.

Average Cost Method

In this method of recording the cost of ending inventory, the order of products with varying prices of production due to inflation is ignored and an average price of all products in stock, regardless of purchase or production date, is used to calculate goods sold. The average cost method prevents the scenario where there is a huge fluctuation in cost of goods because of high expense events like acquisitions or purchases.

Special Identification Method

In this method of recording COGS, the specific cost of each product remaining in the inventory is used to calculate cost of goods at the end of the year. The company tracks exactly which product is sold, and what is its respective cost for manufacturing. This method is often used for high-value products like cars, jewelry, or real estate. It is also easier to track which products are sold in these cases.

What Type of Account is Cost of Goods Sold

There are five main types of accounts in accounting:

Cost of goods is recorded as an expense in accounting. Expenses is an account that records the cost of doing business, and cost of goods is a line item in this account. Expenses are recorded in a journal entry as a debit to the expense account and separately as a credit to either an asset or liability account.

Any company that sells a product can list cost of goods as an expense and deduct it from net revenue to reduce gross profits and thus, taxable income. In fact, cost of goods is a tax reporting requirement. Any company that procures, manufactures, or produces a product and sells it for revenue needs to calculate cost of goods sold in order to write off the expense, as per the IRS and government regulations.

Cost of goods is recorded on an income statement under the “sales” or “income” category.

How Deskera Books Help You With Cost of Goods(COGS)?

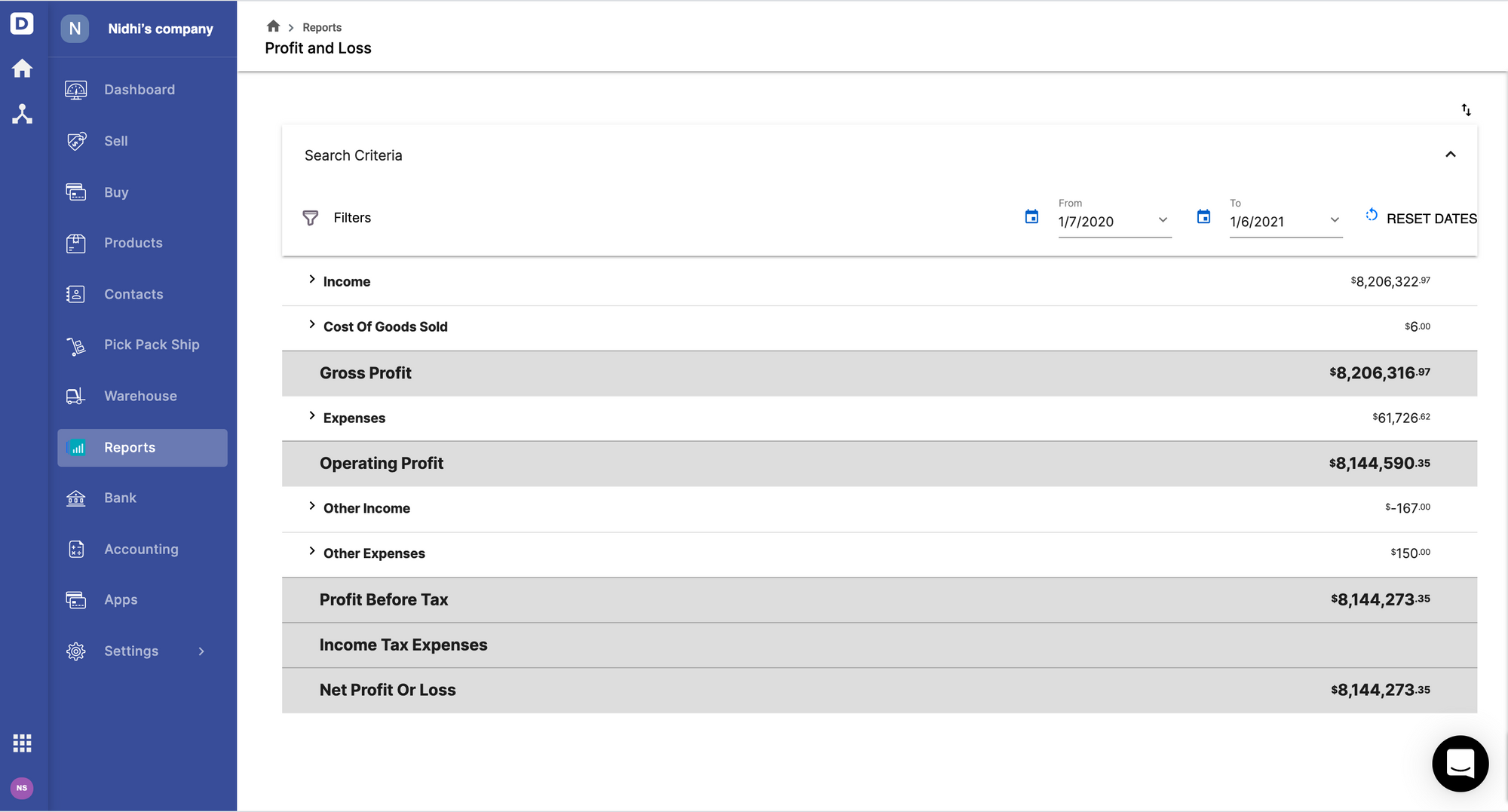

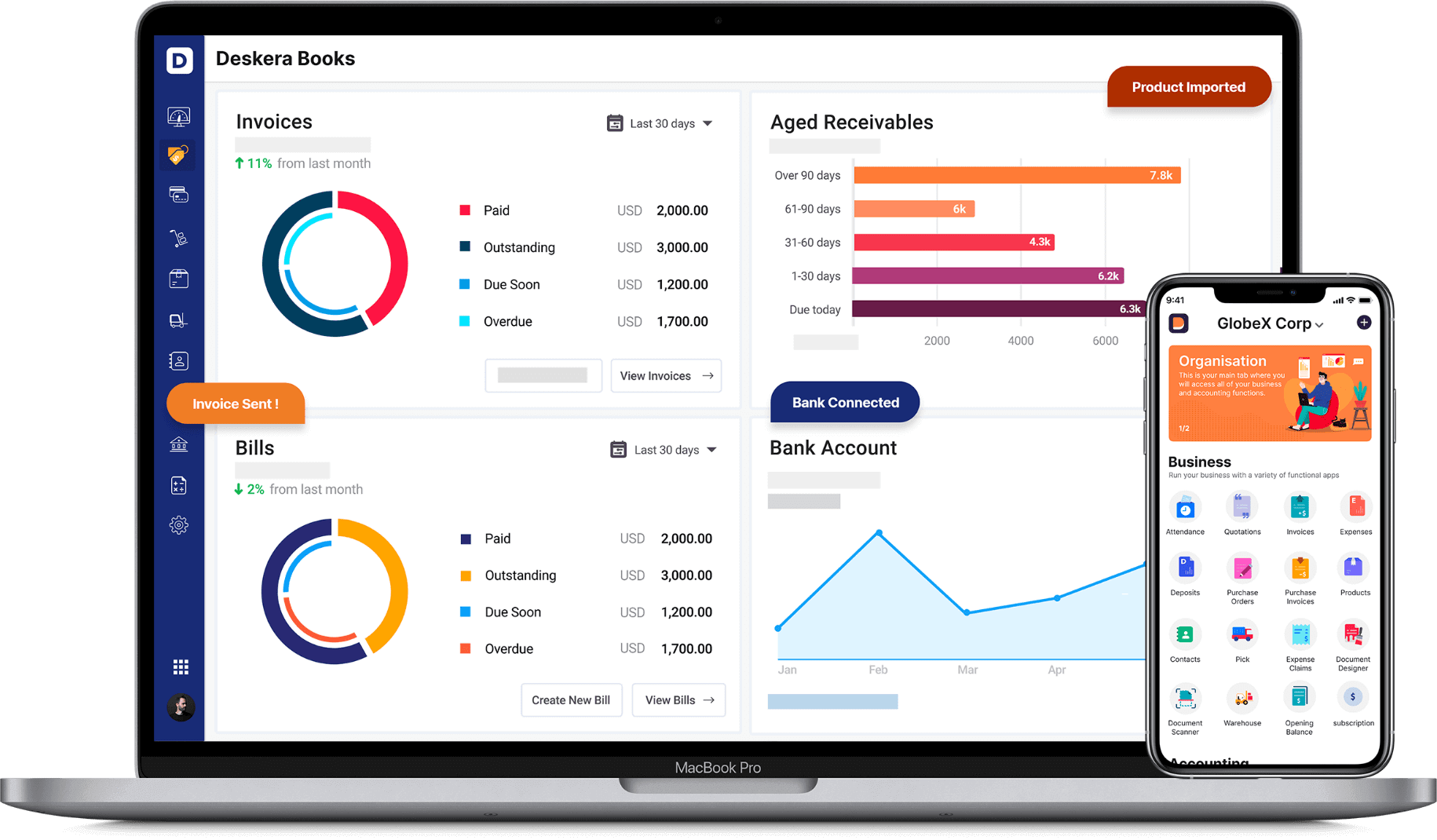

Deskera Books is all you need for automated bookkeeping and inventory management. Whenever goods fulfillment is done, the accounting cost of goods sold (COGS) journal entry is automatically posted in the system. Also, this will automatically update your financial statement and tax reports in Deskera Books. Deskera Books enables you to save more time without the need to create a manual entry for each transaction. The built-in compliance helps you to generate automated accounting and tax reports.

Deskera Books is an online accounting, invoicing, and inventory management software that is designed with the sole purpose of making your life easier. It is a one-stop solution that caters to all your business needs like creating invoices, tracking expenses, getting insights through financial KPIs, creating financial reports and financial statements, and so much more.

This platform works exceptionally well for all the small businesses that are being set up or need some help, especially in accounting. Whether it is recording your operating income, account payable, account receivable, or even returns on investments, or it is about updating your debit and credit notes, Deskera Books has made it all very easy as well as accessible.

In fact, the software comes updated with pre-configured accounting rules, invoice templates, tax codes, and a chart of accounts, to name a few, which makes it super easy for you to comply with sole proprietorship taxation. Deskera Books will also allow you to transfer your data from your previous accounting software by just updating the details on the spreadsheet available on Deskera Books.

Deskera Books also allows you to add your accountants to your Deskera Books accounts for free. You will just have to invite them. Once they are in, they would be able to check your financial reporting and statements like profit and loss statements, income statements, cash flow statements, balance sheets, and bank reconciliation statements. Your accountants will be able to help you navigate through all the taxation regimes in a faster and more efficient way through Deskera Books.

Learn More about Deskera Books Features:

- Inventory with Deskera Books

- Journal Entries with Deskera

- Making Purchases with Ease

- Warehouse Management with Deskera

- Opening Balances with Deskera

- Invoicing with Deskera Books

Key Takeaways

Here is a quick roundup of everything covered in this article:

- Cost of goods is considered an expense in accounting

- Cost of goods is the cost of doing business - the direct costs involved in procuring, producing, or manufacturing a product that can be sold for revenue.

- Indirect costs, like marketing and sales expenses, are not included in cost of goods

- Cost of goods is calculated by deducting the remaining inventory costs at the end of a year from the cost of producing or procuring products for that year

- Cost of goods is important in calculating a company's profitability and production efficiency

- Cost of goods is also mandatory as per the IRS. It is important in calculating the net taxable income.

- There are four types of inventory costing methods: FIFO, LIFO, Average Cost Method, and Special Identification Method

- The cost of goods and resulting profitability will depend on the type of inventory costing method the company uses

Related Articles