The stock market has been news for its volatile nature and unpredictability. As more individuals are taking up risks to investing a fixed amount in the share market, even businessmen are considering the stock market as an option to attract talent. In fact, stocks are looked upon as a good option to generate incentives and retain star performers amongst the employees.

In the United States of America and the rest of the world, every company has its fair market value (FMV). This value is decided and set by the market for a public company. On the other hand, a private company’s market value is decided by independent appraisers.

This implies, a parent company will decide the basic market value of its dependent company. Now, if this company wants to grant an X number of shares to its employees, this is possible only through a 409A valuation.

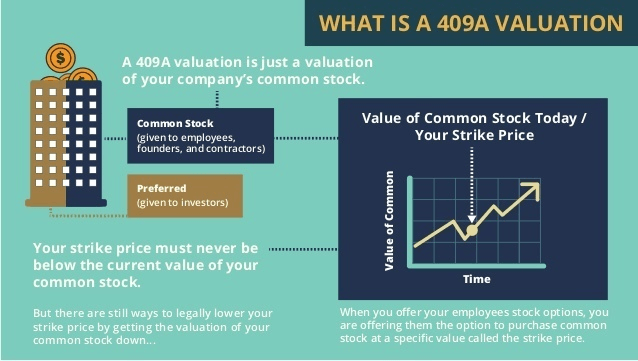

What is a 409A Valuation in the US?

In America, a 409A valuation is an approved method by which the market value of a company's stock is determined. It is an independent appraisal of a private firm’s stock. This stock is kept reserved for the employees and organization founders.

With the help of this valuation, one can understand the cost required to purchase a stock of the said company. In simple words, if a businessman wants to provide equity to his employees and grant a holding percentage to individuals, independently, he cannot give these equity shares to the workers without knowing their true value.

What is needed for doing 409A Valuation?

The IRS initiated a 409A valuation in response to the 2001 Enron scandal which was finalized in 2009. With the formulation of this rule, the equity loopholes were subsidized to a great extent in cases where stocks were attributed to the employees.

The 409A provides a framework for private companies. With this valuation, these organisations can understand when and how to value a private stock. The 409A valuation is done by an independent party for a company. When it is carried by an unaffiliated party, it is considered reasonable by the IRS barring a few exceptions.

An important point here to note is that the 409A valuation should not be considered lightly as there are strict penalties by the IRS if the organization fails to abide by the aforementioned rules and continues with wrong equity pricing. If the equity is mispriced, it can dent a hole in the pocket of employees and shareholders as they will end up paying a far more price or even face tax penalties.

When to do this Valuation?

The IRC 409A valuation can be done in the following circumstances -

- When the company decides to start issuance of its first common stock options

- It can start after completion of raising a venture financing round

- After every material event

- After every 12 months

- If the company decides to approach an IPO, merger or wants an acquisition

This valuation is valid for a time of a year or until some material event happens. A material event is an event that can affect stock prices. The most common material event for a start-up is qualified financing. While companies perform their own financial analysis in the early stages of the FMV cycle, these valuations can become difficult to comprehend with time and would require a third party for a business owner.

Methodologies used in this valuation

The annual 409A valuation can be completed by the standard methodologies which providers use to calculate fair market value. These are the income approach, market approach and asset approach.

Income approach

The enterprises which have a positive cash flow amount and a good revenue offer the 409A valuation by a straightforward income approach.

Here, FMV = Total assets - Corresponding liabilities

Market approach

If a firm raises financing round, the valuation is done by the OPM backsolve method by the providers. In this method, it can be safe to assume the newest investors have deposited FMV money for equity shares but have got preferred stock. Hence, adjustments should be made for the common stock FMV.

A few other market-based valuation approaches make use of financial information such as EBITDA, net income and even revenue. This data is then compared with available data from other public organisations and then the equity value of the said company is estimated equity value.

Asset approach

This approach is used by early-stage firms that have been incapable of raising enough funds and cannot generate maximum revenue. Through this method, the firm’s net asset value is calculated to understand its 409A valuation.

What data is needed?

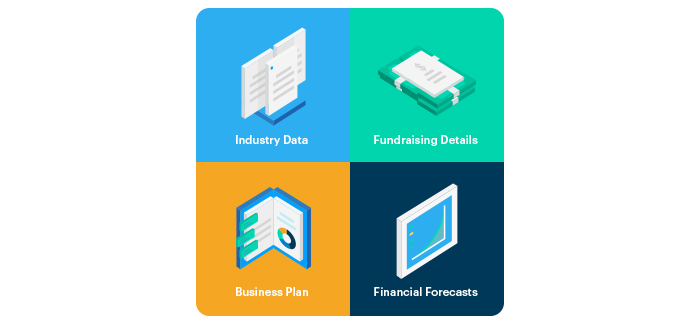

Once the company has selected the 409A appraiser, it needs to provide the following information about its business.

- Company Data

- CEO name

- Name of external audit firm (if applicable)

- Legal counsellor name

- Amended and restated articles of incorporation

- Industry information

- Industry type and name

- List of relevant comparable public companies

- Fundraising and options

- Probable time of liquidity fund

- Number of options expected to be issued in the next 12 months

- Details regarding company presentation, business plan and executive summary

- Company financials

- Financial statements

- Forecasted revenue for next 12 months

- Forecasted EBITDA for next 12 months

- Cash burn and run away

- Non-convertible debt amount

- Additional details

Any material but relevant events since the last 409A should be included in these details. If your company is doing this valuation for the first time, then include all relevant information.

409A Valuation Calculations

To sell your company’s stocks, the owner must know where his company stands in the market. If the entrepreneur wants to know his position, he needs to do a few calculations to understand his 409A valuation. These are -

- Calculate your enterprise value

- Determine the value of your company’s proposed common stock

- Apply a discount for the lack of marketability

Who pays for 409A valuation penalties?

When the 409A valuation isn’t performed by using any one of the above-mentioned methods, the company falls out of the 409A safe harbor. If the IRS discovers it, the enterprise, employees and even the shareholders can face substantial penalties which are -

- All the deferred compensation for ongoing and past years is termed as taxable to immediate effects

- There would be accrued interest on the revised taxable amount

- 20% additional tax shall be implemented on all the deferred compensation

It is observed that usually startups aren’t audited by the IRS. When your organization grows and approaches a merger, IPO or acquisition, then the firm will have to face IRS audits. The company can save its effort and time by working with a recognized 409A valuation provider since the start and save itself from the penalties.

How to select a firm that provides a 409A valuation?

If you are an investor and have a keen interest in the stock market, researching companies that offer 409A valuation becomes your core topic of interest. When you are ready to put in your hard-earned dollars and invest in the firm’s stocks, it is advised that you should check these points -

- Never invest in the valuation of a firm on the basis of its number of valuations completed until then. The reason behind this one cannot get a guarantee of its experience

- When you invest in a company’s stocks, know about who is leading its practices. In this way, you will understand the top audit professionals such as ASA or CFA and you can also know a bit about their experience or how long they have been associated with 409A valuation.

- Before you invest in a firm, know what stage the company is doing the valuations. At an early stage, the whole process has limited scope. It is only after multiple 409A valuations, complexity valuation needs related to audit scrutiny, IPO demonstrates more experience and is more valuable.

- You should check the number of clients who have exited the valuation by examining the history of the company’s stocks

- A thorough analysis of the firm and what type of other companies they have worked with can help the investor to understand the firm’s familiarity with the industry as well as its unique funding situation

- Auditors are the essential people when you talk about a 409A valuation. These professionals are valuation specialists and have an in-depth knowledge of the questions that can be asked by the IRS.

Conclusion

A 409 valuation is considered presumed to be reasonable if the company’s stock is valued within a year of the application option grant date. If there is no significant material change between the application date and grant date, then all the requirements are met and the company can proceed with selling the common stock.

How can Deskera Help You?

Deskera Books can help you automate and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Sign up now to avail more advantages from Deskera.

Learn about the exceptional and all-in-one software here:

Key Takeaways

- A company that decided to sell its common stocks has its own fair market value in the industry. To decide the price of the stock in the market, the firm must file a 409A valuation with the IRS in the US.

- With this valuation, the companies can understand how to value private stock. The methodologies used for this valuation are asset approach, income approach and market approach.

- To file this valuation with the IRS in the United States of America, the entrepreneur must give information such as company details, industry, fundraising options and financial details.

- To do an accurate valuation, the owner must understand his enterprise value. On the basis of this, he must propose a market value for its common stock.

- The IRS imposes heavy penalties if the company falls out of the 409A safe harbor. Additional taxes are levied on the deferred compensation.

- If you are an individual with a keen interest in the stock market and want to be an investor in the companies that offer 409A valuation, study the organization properly. You must understand which professional performs this valuation for the firm and his designation, educational background as well as experienced in the stock valuation. A thorough analysis of the valuation history is a good check for the investor to put his money into the company’s stocks.

Related Articles