There has been a tremendous surge in the number of small businesses operating in the US. Yet, studies depict that not even 50% of the employers offer a retirement plan.

Despite the growing trends, a lot of small businesses struggle and walk a tightrope of budgets and insufficient resources. As a result, employers have to get innovative when it comes to compensating their employees. This includes offering benefits package that compete with the big companies.

Offering retirement plans to your employees shows that you care about them and are thinking about them.

Owners of small businesses should offer retirement plans to make their employees happier and retain them longer. There are various retirement plans that are commonly selected by small businesses. We shall be learning in detail about the 401(k) plan and how it can be beneficial to both, the employers and the employees.

- What Is a 401(k) Plan?

- What are the advantages of offering a 401(k) to employees?

- Small business retirement plans you can offer employees

- How Do I Set up a 401(k) for My Small Business?

- Conclusion

- How can Deskera Help You?

- Key Takeaways

What Is a 401(k) Plan?

The 401(k) plan is a retirement plan that American employers offer to their employees and provides tax advantages to the saver. The employee registering for the plan agrees to contribute a percentage of their paycheck into the investment account.

The employer can choose to match either a part or all of the contribution. The employees receive benefits and a lot of investment options to choose from.

What are the Advantages of offering a 401(k) to Employees?

We have split up the benefits into different sections. Let’s take a look at them here:

Tax Benefits of 401(k)

401(k) plans sponsored by employers offer two tax advantages:

- A business tax credit can also make retirement plans like 401(k)s more affordable. During the first three years of the plan, up to $5000 of this credit can be applied to plan startup costs

- Employers can deduct contributions on the company's federal income tax return to the extent that the contributions don't exceed certain limitations

- In terms of elective deferrals and investment gains, they are not taxed at present and enjoy tax deferral until distribution

Retention and employee satisfaction

Employers can increase engagement and reduce turnover by providing retirement plans. Employees may be less likely to look elsewhere and switch employers by investing in their future. Assess the impact of retirement plans and benefits in total compensation packages and the possibility of adding additional benefits to your current offerings that can enhance employee retention.

Staying competitive to attract top talent

Compensation and benefits are often the most important considerations when hiring great employees. 401(k) plans allow your business to stand out among industry competitors to attract top talent.

Complying with state mandates

States have developed their own retirement plans. State law requires employers of a given size to participate in a retirement plan offered by the state or to set up their own qualified plan. This is a chance for employers to meet their state's requirements.

401(k) benefits for employees

401(k) is a plan that is beneficial not only for employers but also for the employees. Among the benefits are:

Small Business Retirement Plans you can offer Employees

We have already been through the benefits that employers enjoy when they offer retirement plans. Adding to that, employers do not have to bear heavy expenses for offering these plans. As a matter of fact, there are some plans in which the employers may not even have to make any contributions, depending on the plan you select.

Traditional 401(k)

The 401(k) is the most popular retirement plan for businesses with employees, and the IRS heavily regulates it. This means you need to complete additional tax forms and go through additional tasks to ensure you're distributing benefits correctly. The advent of cloud financing makes a traditional 401(k) plan more affordable and viable.

Suitable for: The plan is for employers who require flexibility in the design of their retirement plans, while also maintaining compliance with regulations.

Limits on contributions

For Employees: The employee must pay $18,500 or 100 percent of their compensation, whichever is less. Over-50s are eligible to make a catch-up contribution of up to $6,000.

For Employers: The employers can contribute 25% of their compensation up to $55,000. Employees over 50 can contribute 61% of their compensation.

Solo 401(k)

An employer with a few employees may use a 401(k). Still, a sole-proprietorship or partnership may use a Solo retirement plan to get all the advantages a business retirement plan offers. Similar contribution limits and restrictions are similar to a traditional 401(k). However, the company does not have to sponsor it.

Suitable for: Independent contractors or partnerships or self-employed individuals.

Limits on contributions

For Employees: In the case of employees, either $18,500 or 100% of compensation, whichever is lower. Employees over the age of 50 may contribute up to a maximum of $6,000.

For Employers: 25 percent of the compensation up to $55,000. For employees over 50, the cap is raised to $61,000.

SIMPLE IRA

Savings Incentive Match Plan for Employees Individual Retirement Account is what SIMPLE stands for. It is up to the employer whether they match up to 3% of an employee's contribution or add up to 2% of the employee's earnings. Compared to traditional 401(k) plans, contributions and catch-up provisions are much lower.

Suitable for: Small companies with 100 or fewer employees.

Limits on contributions

For Employees: For employees, it is $12,500 or 100% of their compensation, whichever is less. The maximum catch-up contribution is $3,000.

For Employers: Contribute 2% of their compensation or match up to 3%.

SEP IRA

Employees of small businesses need to know about the Simplified Employee Pension Individual Retirement Account (SEP IRA). Only employers can make individual contributions.

Suitable for: The plan works for companies that have a little extra cash to be used for employee benefits.

Limits on contributions

For Employees: No contributions are allowed.

For Employers: The employer may contribute up to 25% of the salary but only up to $55,000. It is not mandatory to contribute, but the same percentage must go to each eligible employee if you do.

Profit-Sharing Plan

Under this plan, the retirement contributions are distributed as a percentage of company profits. This plan works by comparing the employee's salary to the total amount paid to all employees, this percentage applies to the total profit to be distributed to the plan. The plan is also known as a deferred profit-sharing plan.

Suitable for: This is apt when businesses distribute profits to employees as an alternative way to save for retirement.

Limits on contributions

For Employees: Contributions are not allowed.

For Employers: It allows only 25% of compensation up to $56,000 in contributions. If an employee is over 50, the contribution limit increases to $62,000. The maximum amount of money that can be considered or compensated is $280,000. It is not necessary to make a contribution.

Multiple Employer Plans

Multiple Employer Plans (MEPs) are a retirement alternative in which two or more employers pool their administrative resources to purchase a 401(k) plan. This is ideal for small businesses who want to offer a plan without bearing the entire expense and responsibilities. There are a variety of MEPs, including some that are available to unconnected companies and those that are only open to enterprises inside a trade group.

Suitable for: Small firms who want to offer a 401(k) plan but don't want to pay the full cost.

Limits on contributions: Restrictions are the same as 401(k) limits, except the plan is sponsored by a different company.

How Do I Set up a 401(k) for My Small Business?

Now that we have learned about the various kinds of plans available for small businesses, let us see how you can move ahead with setting up a 401(k). Here are the steps you must take to set it up:

Select the type of 401(k) you want to offer

There are a variety of 401(k) plans, which mostly vary by who can offer them, contribution limits, whether you’re required to match employee contributions and compliance requirements.

Determine if you want to match employee contributions

Matching contributions are an additional kind of compensation for employees that can help them maximize their retirement savings. Moreover, Employees and employers can both benefit from matching contributions. Small business owners might use vesting schedules to further personalize their plan design to match their objectives.

401(k) vesting schedule

The vesting schedule determines the employee's ownership of your contribution to their account. While some firms allow employees to own the entire amount as soon as it is deposited into their account, others require employees to reach a certain milestone or work for the company over a certain amount of time before receiving their contribution.

401(k) maintenance

When you are setting up your plan, ensure that you have estimated the costs you are willing to bear for the setup and its maintenance. The plans that require active management require you to input higher maintenance costs.

Calculate these costs before you move ahead:

- The overall amount you need to pay is based on the total number of employees you have

- Management costs are taken from the investments of the employees

Select a 401(k) provider for your business

Hiring the right provider could be an advantage. Once you have determined your plan, the vesting schedule, and maintenance costs, you can choose the provider who seems to be a good fit, given the size of your business.

If you have a small group, you can even ask the provider to take care of and send reminders about compliances. They could also help you with the administration and record-keeping.

A professional provider can be of tremendous help as they can guide you through the process and minimize or eliminate errors.

Select a 401(k) Trustee for your plan

The law prescribes that you appoint a trustee who controls and manages the contributions collected for the 401(k) plan. Setting up a trusted account guarantees that the funds are used fairly only for the benefits of the employees and their beneficiaries.

Documenting the 401(k) plan

Upon finalizing the details of your plan, you can now move ahead to the documentation part. The document must consist of the following factors:

- A list of all the eligible employees

- Details about the plan and its operation

- Time frame when the employees can withdraw the amounts

- Any fees or charges that the employees are subject to

- Where can the employees get assistance from, in case they are stuck at any juncture

Final Step: Onboard Employees

This step requires you to inform about the minutest details to the employees. Let them know how the plan works and how and where they can get support if needed.

Conclusion

This article serves as a guide to help you set up the 401(k) plan for your business. Knowing all the details about this plan can assist you in gliding through the setup and providing the appropriate benefits and comfort to your employees about the road ahead.

How can Deskera Help You?

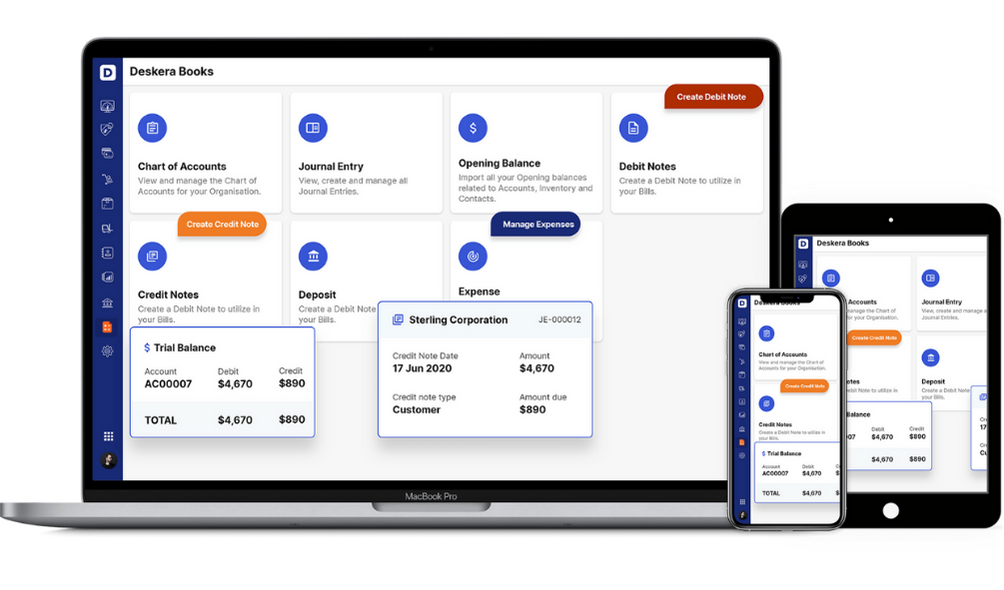

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs from creating invoices, tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

Here are the points that sum up the significance of the 401(k) plan and the factors associated with it:

- The 401(k) plan is a retirement plan which that American employers offer to their employees and which has provides tax advantages to the saver

- The employee registering for the plan agrees to contribute a percentage of their paycheck into the investment account

- The employer can choose to match either a part or all of the contribution

- The employees receive benefits and a lot of investment options to choose from

- 401(k) plan offers tax benefits along with letting the employers have employee retention and satisfaction

- The plan offers benefits to the employees in the form of retirement savings, matching employer contributions

- Traditional 401(k) is the most popular retirement plan, and it is heavily regulated by the IRS. This means you need to complete additional tax forms and go through additional tasks to ensure you're distributing benefits correctly

- Solo 401(k): A sole-proprietorship or partnership may use a Solo retirement plan to get all the advantages a business retirement plan has to offer. There are similar contribution limits and restrictions to a traditional 401(k)

- SIMPLE IRA: Savings Incentive Match Plan for Employees Individual Retirement Account is what SIMPLE stands for. It is up to the employer whether they match up to 3% of an employee's contribution or add up to 2% of the employee's earnings

- SEP IRA: Employees of small businesses need to know about the Simplified Employee Pension Individual Retirement Account (SEP IRA). Individual contributions are allowed like in a regular IRA, but they can only be made by employers

- Multiple Employer Plans (MEPs) are a retirement alternative in which two or more employers pool their administrative resources to purchase a 401(k) plan. This is ideal for small businesses who want to offer a plan without bearing the entire expense and responsibilities

- Setting up a 401(k) plan starts with selecting the type of 401(k) you want to offer

- Determining if you want to match employee contributions, the vesting schedule and evaluate the maintenance cost

- Select a trustee for the plan and document all the details pertaining to it

- Final step is to onboard all the eligible employees

Related Articles