An Internal Revenue Service (IRS) review published in November 2020 reports that 94% of Americans believe it's every American's civic duty to pay their fair share of taxes. When the principles are set up, people and Online Businesses will, of course, give their all to use them for their potential benefit.

Furthermore understanding the tax deductions is an integral part of this Civic duty as well. Hence this article presents a list of tax Deductions for Online Sellers. This article includes:

- Home office expenses

- Co-working Space

- Advertising and promotion

- Rent

- Salaries and benefits

- Shipping and packaging

- Auto expenses

- Education

- Business insurance

- Working with independent contractors

- Business meals and entertainment

- Telephone and communications

- Travel

- Business interest and bank fees

- Professional services

- Improvements and Repairs

- Domain and Web Hosting

- Inventory Storage

- Services

- Seller charges

- Merchant processing fees

- Cost of merchandise sold

- Gifts

- Business permits and licenses

- Legal Fees

- Key takeaways

1.Home office expenses

On the off chance that you maintain your online business from home, you probably utilize the internet, you meet all requirements for an online business deduction. The size of this allowance will rely upon how much of your home is devoted to doing business. The rate depends on the amount of your home internet is for individual versus business use. These are the necessities you need to meet:

- You should routinely involve that part of your home for directing business

- Your workspace must be utilized for business exercises, and that implies personal utilization of your workspace isn't permitted

- You should involve your workspace as the principal business environment for your online business

Additionally, you ought to have no alternative work area. That implies no outer office or collaborating space from which you maintain your business. You have two choices for computing the workspace deduction: the simplified technique, and the regular method. Obviously, one is simpler than the other.

Utilizing the simplified method, you deduct $5 per square foot of your home utilized for business, up to 300 feet.

2.Co-working Space

Assuming you maintain your business from a co-working space, ensure with your CPA or tax advisor that the expenses related to the space are qualified to be deducted as office costs. Like claiming the costs related to traditional office space, you might be qualified to deduct the cost of the lease, utilities, supplies, and any equipment that you use in the co-working space.

3.Advertising and promotion

Assist your business with developing, and paying fewer taxes in the meantime. Regardless of whether you advertise your business on Instagram or in your local paper, the expense of advertising is tax-deductible.

All that you spend on advertising your internet based business is deductible, for example,

Marketing

Includes Facebook Ads, Google Adwords, advertisement placements in digital and print publications, promotion positions on sites, supported advertisement placements on seller platforms like Etsy, Amazon, eBay, email marketing software, charges for sponsored content by influencers, etc.

Website

Includes Domain names, hosting, subscription website services themes, stock photos, plugins, and different things you purchase for your website.

4.Office supplies and packaging

As an e-commerce entrepreneur, you want to have your workplaces supplied consistently. Your customers are continuously purchasing so supplies for packaging, shipping, and operating the internet-based business are tax-deductible. Since you're online doesn't mean you don't need to purchase office supplies. From software to file folders, office costs are characterized as the everyday costs that keep your business functional.

Consumable goods or items that get used, similar to office supplies fall into this one. In particular, this can incorporate paper, pens, ink, paper, boxes, tape, ink, markers, and the wide range of various supplies your office needs to run productively.

5.Rent

Regardless of whether your business is on the web, you might in any case have non-office rental costs, for example,

- Co-working space expenses once or repeating.

- Storage.

6.Salaries and benefits

Wages and benefits that you give to your representatives are deductible, including:

- Bonuses.

- Wages, compensations, and worker commissions.

- Representative advantages like medical coverage, 401(k) matches, HSA and flexible spending accounts, life and disability protection insurance plan.

7.Shipping and packaging

You have to get your products to your clients in some way or another. Also, that is the place where transportation and packaging costs come in. Except if you're maintaining a drop shipping business, you must get it done. Fortunately, the IRS considers the expense of doing as such "normal and essential." You can deduct things like:

- Delivery charges.

- Postage and membership postage services.

- Outsourcing charges.

The expense of all that you use to get your product delivered on time and in one piece can be deducted from your tax form. This incorporates envelopes, boxes, paper, pressing material, tape, labels, markers, and printer ink.

8.Auto expenses

If you think you don't drive as an online business owner? Reconsider. While you may not drive to clients and places of work, you're presumably heading to the mail center, office supply store, conferences, and networking events.

Mileage deduction: The least demanding method for discounting your auto costs is by following your business mileage and taking the mileage deduction at tax time. Consistently the IRS sets a standard mileage rate. Toward the year's end, you simply duplicate your yearly business mileage by the rate, you have your mileage deduction.

9.Education

No one has a deep understanding of maintaining a business immediately and, on the tax side, the benefit is that you can write off the cost of learning new things. Nonetheless, this educational learning should associate with your business or the craft of maintaining a business. For instance, in the event that you sell clothes online, you can't take a culinary course and write it off since it doesn't have anything to do with your business. Here are the things you can write off:

Books and reference materials

Includes Printed books, digital books, magazine memberships, paper memberships, book recordings.

Studios and stages of preparation

Includes online course platforms, online summits, in-person workshops, conferences, meetings, course series.

10.Business insurance

Any premiums you pay for non-health-related insurance inclusion, similar to business insurance or renters insurance to cover your workspace, will meet all requirements for a tax deduction. This additionally incorporates workers’ compensation and liability insurance costs. Business, rental, liability, and workers’ compensation insurance are all tax-deductible.

11.Working with independent contractors

Assuming you recruited a self-employed entity to design your site, compose web copy, or take images of your products, the cost of their services is a tax deduction. Continuously make certain to gather 1099 forms from self-employed entities before they begin working for you, and record it appropriately you'll have to present a copy to the project worker, and one more copy to the IRS, before the cutoff time.

Form W-9 is utilized to gather the worker for the contractor’s name, address, and taxpayer identification number. You'll require this data to give a 1099-NEC to any self-employed entities you paid more than $600 to during the fiscal year.

12.Business meals and entertainment

Since the new 2018 tax law, the supper discount has been fervently bantered among charge experts. Half of all business dinners and diversion expenses can be guaranteed as an assessment derivation. Notwithstanding, business amusement costs are a vigorously investigated allowance. The new expense regulation has a few hazy situations with regards to discounting the expense of food, however, this is what we know:

- Meals while traveling as a proprietor or for a worker: half deductible

- Meals with workers for meetings: half deductible

- Meals for workers during work shifts for the accommodation of the business: half deductible

- Meals with business clients and partners: Perhaps half deductible. The new tax regulation is unclear regarding the deductibility of these meals. Continuously check with your tax preparer to get their take prior to claiming a deduction

13.Telephone and communications

Internet

An e-commerce business can't run without the internet, and that implies that your business' internet bill is tax-deductible. Assuming your business imparts the internet connection with the remainder of your household, you'll need to ascertain and deduct the level of the cost that is utilized to maintain your e-commerce business.

Mobile

Like the home internet deduction, you can likewise discount a percentage of your own mobile bill. That percentage depends on the amount you utilize your phone for business versus personal use.

Skype and VoIP expense

On the off chance that you utilize an internet phone, a VOIP phone system or spring for a 1-800 number for your business, you can deduct the whole cost of those taxes.

It's a brilliant move to report how you compute this deduction. Like that, in the improbable occasion you get examined, you'll have a proof for how you decided your rate and that it's been applied reliably year to year.

14.Travel

Need to go to a trade show or conference? Or then again to meet a potential distributor? You can write off the costs as long as your outing has a business reason and you are away from the area where you ordinarily work for the time being. You can write off:

- Airfare: The cost of your plane ride.

- Lodging: This is the expense of an inn, Airbnb, or another short-term rental.

- Ground transportation: Like Lyft, Uber, taxis, public transportation, and rental vehicles.

- Local transportation: You can in any case discount the write-off of going inside your local area for business purposes. Very much like ground transportation, you can write off taxis, public transportation, and Ubers.

15.Business interest and bank fees

Assuming that you utilize a credit card to pay for business expenses overtime or take out a small business loan, any interest you pay is a qualified tax deduction. Furthermore, any bank fees you incur while dealing with your business account are likewise tax-deductible.

Fees related to your business bank and credit card accounts are deductible.

- Bank charges: You can deduct month-to-month service fees, ATM charges, overdraft expenses, store charges, and wire transfer charges.

- Credit card fees: This incorporates yearly expenses and late payment fees.

16.Professional services

It's smart to have a business legal counselor, a CPA, and an accountant in your group to assist with dealing with the monetary and lawful parts of your online business. Charges for these and other expert specialist co-ops can be deducted on your assessment form. Lawful and proficient meetings for your business are deductible, including:

-Lawful expenses for a lawyer or online legal assistance.

-The cost of buying templates for contracts, agreements, and security arrangements.

-Bookkeepers and clerks.

17. Improvements and Repairs

A fundamental fix to your workspace, for example, fixing a broken window-can be accounted for as a cost on your tax return.

An improvement to your homework space can likewise be accounted for, yet it should be depreciated over a period of up to 27.5 years. Work done on your workspace is delegated an improvement on the off chance that it includes betterment, adaptation, or restoration- for example, introducing a bigger window.

Prior to paying for an improvement or fix, converse with your CPA to ensure you're classifying it accurately.

18. Domain and Web Hosting

You can't maintain an online business without an online presence. Domain and web hosting are tax-deductible. Assuming you buy web design templates or stock pictures to use on your web page, you can likewise deduct their expense. The same applies assuming that you pay to upgrade your store's theme in Shopify.

19. Inventory Storage

Assuming that you store stock for your online business in your home, you can deduct costs for the business utilization of your home without meeting the severe selective use test expected for a workspace. To qualify, you need to meet the accompanying tests as a whole:

-You sell items at wholesale or retail as your business

-You keep the stock or item tests in your home

-Your house is the main fixed area of your business

-You utilize the storage space consistently

-The space you use is an independently recognizable space appropriate for storage

Assuming you space outside of your home to store stock, for example, a storage unit or stockroom space you can likewise deduct lease and different costs for that space

20. Seller charges

You can deduct the charges you pay to sell your things on famous web-based business platforms or to have an internet-based customer-facing storefront. These are not expenses to deal with credit cards yet rather charges to utilize the platform to sell your items. Seller expenses from Amazon, eBay, Etsy, and Shopify are generally substantial models.

21. Merchant processing fees

Assuming you maintain a web-based business, you probably acknowledge credit cards. Many fees related to handling credit cards are deductible, including expenses from Stripe, PayPal, and numerous other installment passages and processors.

22. Cost of merchandise sold

Cost of Goods Sold (COGS) is a unique kind of cost that relates to the cost you, the vendor, ingests to make or sell a product. This is anything straightforwardly or by implication connected with the cost of making your product.

23. Gifts

Gifts to clients or business partners can be deducted, however up to $25 per beneficiary each year. Indeed, that implies assuming you purchase your client a $70 gift, you can only deduct $25.

24. Business permits and licenses

Any expenses or costs related to a permit, license, or accreditation that you want to maintain your business are deductible.

25. Legal Fees

On the off chance that you employ or hold a lawyer to plan contracts, file trademarks, and copyrights, negotiate leases, shield your business in court, or perform different services for your business, you can write off their expenses.

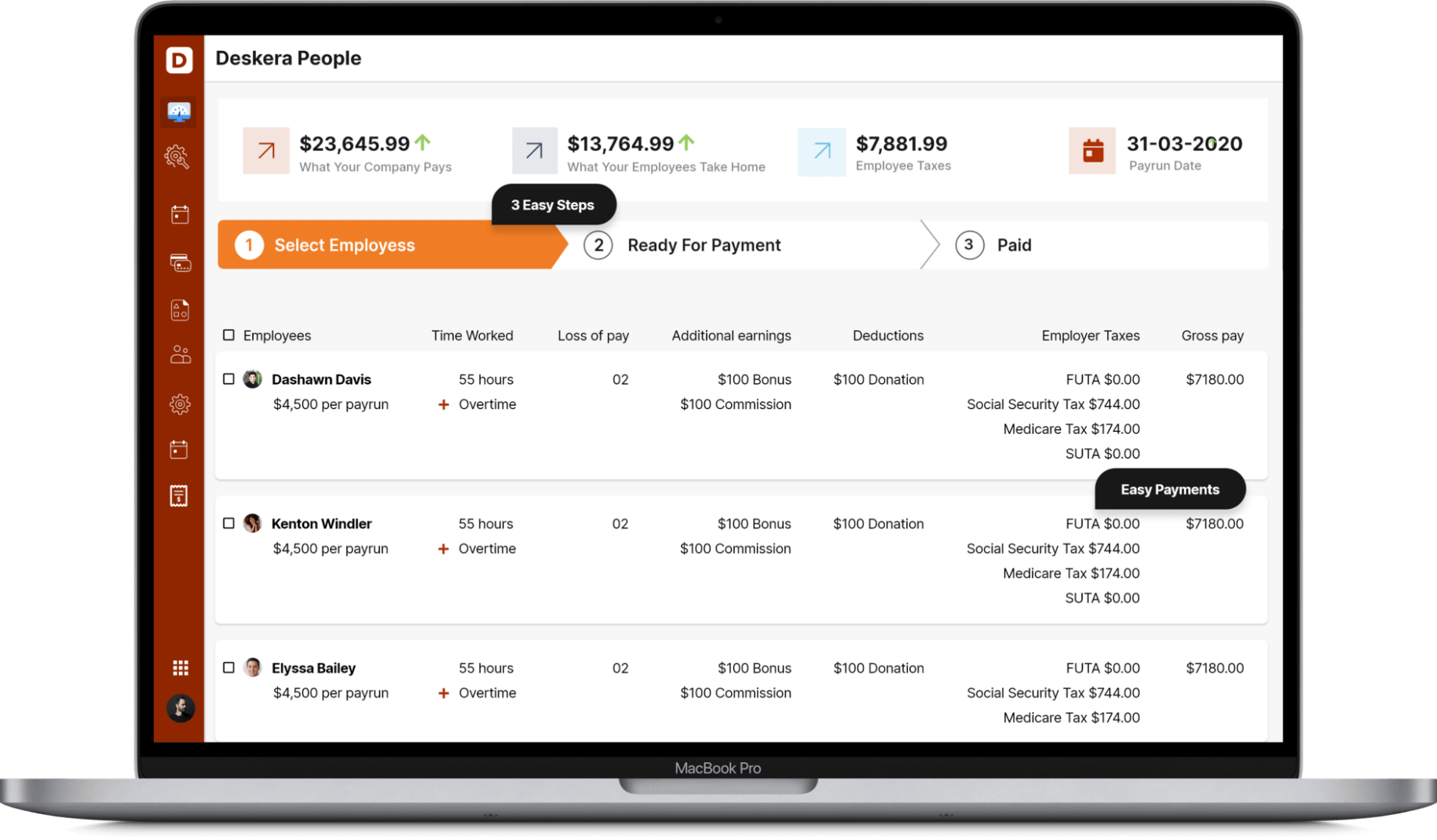

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key takeaways

- You might be enticed to get inventive with tax deductions. Be that as it may, the universe of costs of doing business is loaded with grey areas, and it tends to be not difficult to exceed the limits set by the IRS. As usual, converse with your CPA or tax counsel prior to claiming any expenses on your return.

- If all else fails, recollect this rule, and cling to the receipts attached to any business-related use. That way you would be able to double-check with your CPA to affirm what, and what isn't, tax-deductible before you document your return.

- Tax deductions straightforwardly impact how much money you owe in taxes every year. The more you comprehend them, the more you can write off and the less you'll need to pay.

Related articles