Trade and accounting go hand in hand. Sellers/vendors adopt various ways to catalyze the sale of higher volumes at their end, while at the same time facilitating buyers with mechanisms that help them make bulk purchases in one go. This is one of the ways to build a good seller-buyer network with a long-term view, considering maintenance of trade volumes and creating a stable (more or less) stream of trade.

The 2/10 net 30 method is a way by which traders help sellers take advantage of trade credits in a very specific way. While this method is a huge convenience for the buyers, it translates into a matter of trust for the sellers.

In order to understand 2/10 Net 30, it is first necessary to understand what trade credits are and how they work. Trade credits form an integral part of the vendor universe; an understanding of how vendors deal with mounting credits in their journals and make adjustments helps to see 2/10 Net 30 in a clearer light. Let’s begin learning about 2/10 Net 30 by covering the following topics:

- Understanding Trading Credits for 2/10 Net 30

- What is 2/10 Net 30?

- How Journal Entries Work for 2/10 Net 30

- Risks and Benefits of 2/10 Net 30

Understanding Trade Credits

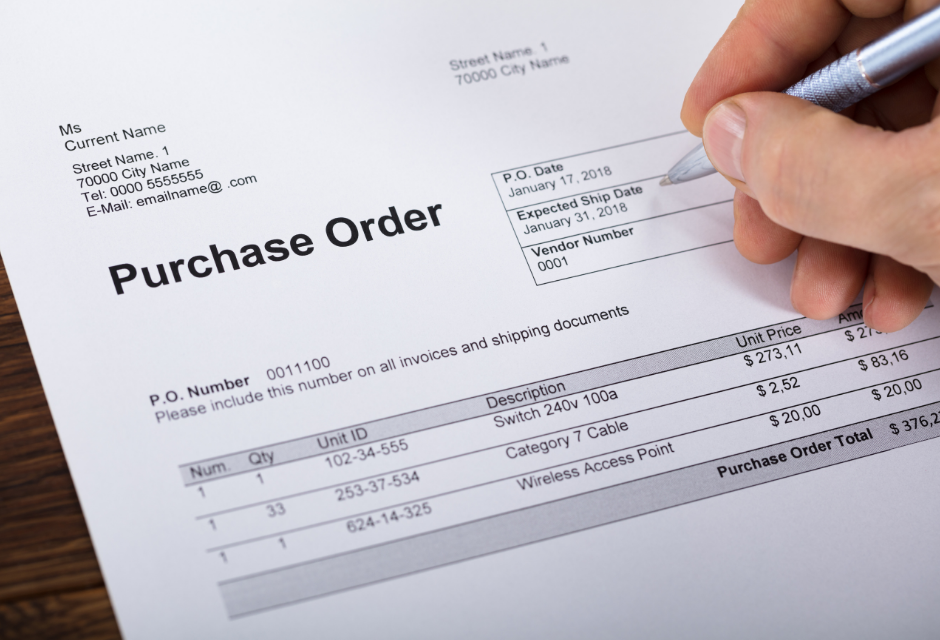

In the world of trade, “Credit” essentially means a good or service has been sold/extended to the buyer/receiver with deferred payment. In simpler words, trade credit is something a seller extends to the buyer wherein the buyer can pay later for the goods or services he has purchased from the seller.

There are always certain terms and conditions attached with trade credits. These terms are usually seller-established. They usually depend on the kind of cash flows that the seller wants to establish on his accounting books.

For example, say a trader agrees to sell a batch of ballpoint pens of 1,000 numbers to a buyer for $1,000. The buyer agrees to pay the cost at the end of the month where the accounting cycle of his firm resets. When the buyer and the seller both are in agreement with the trade credit terms set, the exchange happens. The buyer receives his pens for deferred payment and agrees to fulfill the invoice amount at the end of the month.

Regardless, while trade credits do work to bring in more volume of buyers and better quanta of goods sold, they also come associated with the risk of non-payment or defaulting. Let’s now understand what 2/10 net 30 is.

What is 2/10 Net 30?

The 2/10 Net 30 is a popular method of extending trade credits to buyers. It is popular among the sellers because of the mutually beneficial conditions embodied in it:

The “2” in the term signifies a discount of 2%, and the “10” signifies a period of 10 days.

This means that if the buyer is able to fulfill the invoice amount of the trade credit within 10 days of purchase, the seller will extend a 2% discount on the net price.

On the other hand, the “Net” in the term signifies the net price of the good, and “30” signifies a period of 30 days.

This means that if the buyer is unable to pay the full worth of the goods purchased within 10 days, there will not be any discount, and he must pay the net price within 30 days of purchase.

Hence, the term 2/10 Net 30.

Let’s understand this better with a couple of examples. Consider the following terms on an invoice:

|

Amount on invoice |

$2,000 |

|

Date of invoice |

1st December |

|

Due date of payment |

30th December |

|

Terms of payment |

2/10 net 30 |

|

Discount eligibility period |

10 days from the date of invoice |

Now, starting on the 1st of December through the 10th of December, the 2/10 condition will be applicable on the net price. Essentially, the buyer would only need to pay the discounted price if he pays on or before the 10th of December:

Amount payable = (100% – Discount%) x Net Price on invoice

Amount payable = (100% - 2%) x $2,000

Amount Payable = 98% x $2,000

Amount Payable = $1,960

Whereas beyond the 10th of December, the buyer would be required to pay the invoice in full, that is, $2,000. Additionally, let’s consider another imaginary example with slightly different trade credit terms for better clarity. Say that Vendor A agrees to sell goods to Buyer B at the following invoice details:

|

Amount on Invoice |

$10,000 |

|

Date of Invoice |

1st January |

|

Due Date of Payment |

30th January |

|

Payment Terms |

5/10 Net 30 |

|

Discount Eligibility Period |

10 days from the date of invoice |

Based on this data, it can be interpreted that within the 10-day discount eligibility period, the buyer can enjoy a 5% discount on the goods he purchased. On a bill of $10,000, this is a significant discount that buyers would not like to miss:

Amount payable = (100%-5%) x $10,000

Amount payable = $9,500

That is a saving of a massive $500 on the bill. However, this saving can only be achieved as long as the buyer pays the invoice amount by the 10th of January, as per the payment terms on the invoice.

Since there is deferred payment happening, it becomes important for the accountants to properly manage the books for accurate accounting. Let’s see how journal entries are treated in the case of trade credits like these.

Journal Entries for 2/10 Net 30

Trade credits represent the sum of money that the seller receives, is owed, or is set to receive with a guarantee in the near future. Therefore, they can be treated as assets in accounting. Now, accounting considers assets as debits and liabilities as credits. Beginning from here, let’s extend the first example discussed earlier into the Net and Gross methods of trade credit accounting.

Net Method

From the example considered earlier, the invoice amount was $2,000, and according to the 2/10 Net 30 payment terms, the buyer was eligible for a discounted price of $1,960 if paid within the first ten days of the invoice. Based on this data, the journal entries would look like this:

The trade-credit would reflect in the accounts receivable of the vendor’s journal, and also reflect a revenue accrued from the sales.

|

Date |

Account |

Debit |

Credit |

|

1st January |

Accounts receivable |

$1,960 |

|

|

|

Revenue from sales |

|

$1,960 |

When the customer makes the payment within the 10-day discount eligibility timeline, the amount in accounts receivable would then move into cash. The journal entry would then be adjusted thus:

|

Date |

Account |

Debit |

Credit |

|

9th January |

Cash |

$1,960 |

|

|

|

Accounts receivable |

|

$1,960 |

Since the customer made the payment on the 9th of January, he was eligible for the discount promised by the vendor on payment terms.

In case the customer fails to take the advantage of the discount, the journal entry would be adjusted as follows:

|

Date |

Account |

Debit |

Credit |

|

15th January |

Cash |

$2,000 |

|

|

|

Interest revenue |

|

$40 |

|

|

Accounts receivable |

|

$1,960 |

Since the payment made was 5 days past the discount eligibility, the payment was made in full. It is evident that the cash received from the customer is entered into the column representing cash inflow in the journal, whereas the same amount moves out as from the accounts receivable columns.

Gross Method

In the Gross method of journal entries, the values recorded in the books are face values of the items. Let's consider the same example. For 2/10 net 30 payment terms on an invoice amount of $2,000, the journal entries would look like this initially:

|

Date |

Account |

Debit |

Credit |

|

1st January |

Accounts receivable |

$2,000 |

|

|

|

Revenue |

|

$2,000 |

If the customer is able to successfully pay within the discount eligibility period, the journal entries would then be adjusted as follows:

|

Date |

Account |

Debit |

Credit |

|

9th January |

Cash |

$1,960 |

|

|

|

Discount on cash |

$40 |

|

|

|

Accounts receivable |

|

$2,000 |

If the customer fails to take the advantage of the discount available to him, the accountant would adjust this journal entry as follows:

|

Date |

Account |

Debit |

Credit |

|

15th January |

Cash |

$2,000 |

|

|

|

Accounts receivable |

|

$2,000 |

Risks and Benefits of 2/10 Net 30

Trade credits like 2/10 Net 30 are a great way to build a strong supplier or vendor network that understands and respects your accounting cycles. There are many advantages of using this method of trading:

- It facilitates bulk purchases since the payments can be deferred, allowing the buyer some time to arrange for the payment while avoiding the delay of deliverables at his end

- It helps foster relationships based on trust – that the vendor would allow for 2/10 Net 30 payment terms, and that the buyer would respect the invoice amounts and the terms of payment

However, there is one big downside to this method. The buyer can very well default on the payment, and it could translate into losses for the seller if the trade credit doesn’t get converted. It is, therefore, a discretionary action that must be based on trust and judgment.

Conclusion

Trade credits, or 2/10 Net 30, is an essential business tool that helps get work done on time, establishes trust and goodwill between a seller and a buyer, and promotes healthy business ethics.

Key Takeaways

- 2/10 Net 30 is a trade credit mechanism where the seller agrees to defer payment by 30 days while giving a 2% discount benefit to the buyer if he pays within the first 10 days of the invoice

- This method is recorded a little differently in the journal entries and adjusted according to the date when the payment comes in - based on whether or not the discount stipulated is applicable

- Trade credit entries can be done using Net Method or Gross Method in accounting journals. The Net method uses the net price at which a customer bought an item, while the Gross Method uses the face value of the item sold

Related Articles