Subject to certain restrictions, Section 199A permits taxpayers other than corporations to deduct 20% of their eligible business income from a qualified trade or business. In February 2019, the government released the final rules governing this deduction.

The 199A deduction, however, is both a tax benefit and a compliance issue, as some who have begun to meet the requirements for eligibility may be realizing. In order to get a better idea of Section 199A deduction read the below article. Following are the topics covered:

- Sec. 199A

- Specified service business

- Sec. 1231 gain

- Determining the deductible amount

- Exception

- Problem areas and planning opportunities

- Limitations

- Key takeaways

Sec. 199A

The maximum deduction is 50 percent of W-2 wages related to the trade or company, or the sum of 25 percent of W-2 wages plus 2.5 percent of the unadjusted basis immediately upon the acquisition of all qualifying property, whichever is larger (generally, tangible property subject to depreciation under Sec. 167).

The deduction also cannot be greater than (1) the excess of (2) net capital gain plus (3) total eligible cooperative dividends over (2) taxable income for the year.

Qualified trades and businesses: All trades and businesses that perform services as an employee are not considered qualified trades or businesses, nor are those that provide services in the fields of law, accounting, finance, or any of the other enumerated professions, or where the reputation or skill of one or more owners or employees constitutes the primary asset of the company.

Qualified business income: The net amount of qualified items of income, gain, deduction, and loss with respect to a qualified trade or business that are inextricably linked to the operation of a business in the United States is known as qualified business income.

Certain investment-related income, fair compensation provided to the taxpayer for services rendered to the trade or business, and guaranteed payments are however excluded from the definition of eligible business income.

A taxpayer who is not a corporation is qualified to claim a deduction equal to 20% of their "qualified business income" from a "qualified trade or business" for tax years beginning after December 31, 2017, but before January 1, 2026. However, the deduction is only allowed for the greater of:

• The amount of 25% of the W-2 wages with regard to the qualified trade or business + 2.5% of the unadjusted basis immediately upon the acquisition of all qualified property; or

• The sum of 50% of the W-2 wages with respect to the qualified trade or business.

For each of the taxpayer's qualified trades or companies, the deductible portion of qualified business income is calculated separately and combined. The excess of:

• The taxable income for the year, over

• The sum of net capital gain (as defined in Section 1(h)) plus the total amount of the eligible cooperative dividends for the tax year is the second limitation that applies to the sum of these amounts.

This overall restriction was put in place to prevent the 20% deduction from being applied to income that is subject to preferential tax rates.

There is no way around the complexity of Section 199A. However, like with everything tax-related, it will be much easier to handle if you take your time and consult all of the available tax resources. If you have a tax expert at your side, it's especially manageable; after all, they make a living doing this.

The following are among the trades or enterprises that the law designates as SSTBs:

- Investment management

- Investing

- Athletics

- Trading Accounting

- Health

- Actuarial sciences

- Financial services

- Law

- Consulting

- Any other line of work or industry where the employees' abilities or reputations serve as the company's main asset.

How may your 199A deduction be maximized?

Put money into income instead of guaranteed payments.

Avoid guaranteed payments to partners as they have no impact on the QBI or the computation of the salary limits. Selecting priority allocation of earnings is a better strategy to take advantage of the 199A deduction benefits.

Change the owner's compensation.

Your income from compensation is not eligible for a 199A deduction. You can reduce your salary as long as the total is still reasonable compensation if you want to optimize QBI and achieve a bigger 199A deduction.

Purchase REITs.

The SSTB limitation and a W-2 limitation do not apply to income from qualifying REITs and Publicly Traded Partnerships (PTPs). A deduction of 20% is allowable for certain sources of income. The aggregate cap based on taxable income above net capital gains is the only factor to take into account.

Keep your salary below the cutoff.

The deduction is less limiting below the $315,000 barrier for joint filers and the $157,500 threshold for other taxpayers. It won't matter what kind of business you run either. Consider accelerating deductions, postponing income, or increasing contributions to your retirement plans, such as IRAs, 401(k)s, and defined-benefit plans, if your income exceeds the ceiling.

Taxpayers entitled to claim the deduction

Anyone who is a taxpayer "other than a company" is eligible for a Section 199A deduction. This includes:

• Sole proprietors, landlords, and owners of S corporations or partnerships;

• S corporations, partnerships, or trusts that have a stake in pass-through entities.

Future regulations will offer instructions on how to calculate the deduction in the case of tiered entities for the latter category. Regarding the calculation of the deduction in 2018 for a fiscal-year eligible business, the statute is ambiguous.

- It was made clear in a House of Representatives-passed version of the Act that taxpayers would only be eligible for a proportional benefit of the reduced rate with regard to fiscal-year businesses with a tax year that included December 31, 2017. That version of the Act would have generally imposed a top rate of 25 percent on qualified business income.

- Each business owner must calculate how much they can deduct when this information is provided. At this stage, they could be tempted to claim a deduction for only 20% of the eligible income. Even after all of this effort, wage and property concerns can still place additional restrictions on the deduction's size.

Several "greater of" calculations involving W-2 salaries and the unadjusted basis right away after acquisition (UBIA) of property used in the trade or business are included in these restrictions.

You can't just take a number from your payroll or depreciation reports to use in those computations. Instead, they include one of the three legal approaches for the W-2 wage limits plus a number of manual UBIA modifications.

The conference committee report to the Act, however, makes no distinction between the tax year of the taxpayer claiming the deduction and the tax year of the business producing the qualified business income, stating only that the final version of Sec. 199A is effective "for tax years beginning after Dec. 31, 2017."

It is reasonable to conclude that a calendar-year owner of a fiscal-year business is entitled to claim the full deduction on his or her 2018 tax return, despite the fact that some of the income earned by the fiscal-year business was earned prior to 2018.

This is because Sec. 199A is written from the perspective of the taxpayer claiming the deduction — and because the final Act does not contain the specific language governing fiscal-year businesses found in the House bill.

Qualified trade or business

To be eligible for the Section 199A deduction, a taxpayer must be operating a "qualified trade or business." Every trade or business is qualified under Section 199A, with the exception of the following:

• A specific service trade or business; and

• The trade or business of providing services as an employee.

The first rule forbids an employee from deducting 20% of their salary from their take-home pay.

Increased risk of a penalty for underpayment

A tax underpayment caused by a significant underestimate of taxes is subject to a 20 percent accuracy-related penalty under Section 6662. For taxpayers other than C companies, an underestimate is often considered significant if it exceeds one of the following amounts for the tax year:

• 10% of the tax that must be reported on the return for the tax year or

• $5,000

In accordance with a provision of the Act, any taxpayer who claims a Sec. 199A deduction is subject to a lower threshold before a substantial understatement penalty is assessed, which is equal to the greater of:

• 5% of the tax that must be declared on the return for the tax year; or

• $5,000

This lower standard is particularly harsh given the absence of advice regarding crucial Sec. 199A provisions and the challenges taxpayers and their counsel face when interpreting the statute.

It's significant to note that the modifications to Sec. 6662 do not mandate that the considerable understatement be attributable to the Sec. 199A deduction. Thus, even if the understatement on the return has nothing to do with Sec. 199A, any taxpayer who claims the deduction will be liable to the reduced threshold.

Specified service business

To avoid the conversion of personal service income into qualified business income, this second category of disqualified businesses serves the same function as the first. The owner of a "designated service trade or business" is barred from claiming a Sec. 199A deduction connected to the business under this latter category, which targets business owners rather than employees.

Sec. 1202(e)(3)(A) lists the following businesses as being among those not qualified for the benefits of that section and is cited in Sec. 199A(d)(2definition )'s of a specified service trade or business:

- any profession or business that involves providing services, including those in the fields of medicine, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, finance, brokerage services, or any profession or business where the reputation or expertise of one or more of its employees serves as the main asset.

Sec. 199A alters this term in two ways: first, by deleting engineering and architecture from the list of specifically forbidden service firms; second, by changing the final clause to refer to one or more of the company' "workers or owners" rather than just its "employees."

Then, under Section 199A(d)(2)(B), any business that engages in the performance of services that include investing and investment management, trading, or dealing in securities, partnership interests, or commodities is added to the list of specified service businesses.

Definition of specified service business

The definition of the "designated service firms" for which a taxpayer is ordinarily ineligible to claim the deduction is expected to be the most problematic component of Sec. 199A during the ensuing months and years.

As previously mentioned and referenced, Section 199A defines a designated service business, in part and before change, by reference to Section 1202(e)(3)(A), which lists the following firms as being disqualified:

- any profession or business that involves providing services, including those in the fields of medicine, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, finance, brokerage services, or any profession or business where the reputation or expertise of one or more of its employees serves as the main asset.

While it is obvious that professionals like doctors, accountants, and lawyers will fall prey to the defined sectors, many firms will not cleanly fit into one of the excluded groups. For instance, is a director in the performing arts area whereas an actor is? An artist for makeup? a creator?

- Even worse, despite the fact that Section 1202 has been a part of the Code since 1993, nothing is known about it, and only recently has it started to be widely used.

- Because of this, there is currently no information in the form of administrative decisions or judicial precedent to further clarify the kinds of actions that will disqualify a taxpayer.

- In need of more clarification, taxpayers and tax advisors may turn to other provisions of the Code. For instance, once typical gross receipts exceed a certain threshold, Sec. 448 exempts "personal service businesses" from the general requirement that a C corporation utilize the accrual method of accounting.

The performance of services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, or consulting, a list of businesses that is nearly identical to that found in Sec. 1202(e)(3), must account for more than 95% of the time spent by employees to qualify as a personal service corporation (A).

Avoiding personal service business designation through structure

Taxpayers operating a rejected specified service business will probably actively look for ways to make their operations eligible for a Sec. 199A deduction until more guidance is given.

One method that has been suggested is to introduce a qualified business into a disqualified business in the hopes that it will "muddie the waters" enough to turn the entire operation into a qualified business. For instance, a law firm might purchase commercial real estate that it rents to tenants, or a well-known actor might launch a clothing line.

There are two key obstacles to this method.

The IRS may compel a taxpayer to discriminate between different lines of business within the same organization since Sec. 199A mandates that the deduction is determined on a business-by-business basis, and it may disallow a deduction due to any disqualifying business line.

However, even if the firms could coexist, Sec. 1202(e)(3)(A) classifies any enterprise engaged in the provision of services in the sectors of health, law, etc. as a disqualified specified service enterprise.

Thus, the language in Sec. 1202(e)(3)(A) suggests that even a small amount of services provided in a disqualified field could taint an entire business, in contrast to Sec. 448, which requires that more than 95% of a corporation's employees' time be spent performing certain services for the corporation to qualify as a personal service corporation.

Qualified business income

The requirement to collect precise data from each trade or business in order to calculate the section 199A deduction makes this cumbersome for businesses.

For each pass-through, the qualified business revenue from each underlying trade or business must be determined. Qualified items of gain or loss with respect to each QTB are frequently included in the definition of income that is eligible; provided they are not prohibited or restricted by other laws and is actually connected to the operation of a domestic QTB.

Capital gain income, dividend income, net profits from currency exchange, some types of interest, and other items listed by law are not eligible.

A taxpayer must determine their "qualified business income" for each distinct "qualifying trade or business" they are doing after establishing that they are doing so.

The net amount of qualified items of income, gain, deduction, and loss with respect to a qualified trade or business that are inextricably linked to the operation of a business within the United States is referred to as qualified business income. However, certain investment-related income, such as:

- Any item of short-term capital gain, short-term capital loss, long-term capital gain, or long-term capital loss;

- dividend income, income equivalent to a dividend, or payment in lieu of a dividend described in Sec. 954(c)(1)(G);

- Any interest income other than interest income properly allocable to a trade or business; and net gain from foreign currency transactions is not included in qualified business income.

- Any amount received from an annuity that is not received in connection with the trade or business;

- Income from notional principal contracts, other than items attributable to notional principal contracts entered into as hedging transactions;

- Any deduction or loss properly allocable to any of these bulleted items described above; and

- Finally, the allocation of expenses. Another difficulty is that the current regulations don't specify how to do this and instead permit any "reasonable" approach. There is no going back once a method has been decided upon.

According to the final regulations, taxpayers must consistently use the selected reasonable method for each item in all ensuing years. This implies that as part of the preparation of their 2018 tax return, they must carefully consider—and plan around—the strategy they wish to utilize for allocating spending.

Each owner is informed of the results of these calculations for each QTB and SSTB as part of the filing of their tax returns.

Owner's compensation is included in qualified business income

It becomes worse because, in contrast to the previous example, a shareholder of an S company is worse off than a sole proprietor when their taxable income is lower than the limit set by the W-2 forms.

This is due to Sec. 199A's prohibition on include assured payments to partners in partnerships or reasonable remuneration provided to S corporation shareholders in qualifying business revenue.

Key points pertaining to Section 199A

Renters have a safe harbor under Section 199A.

When Section 199A first went into operation, it was unclear whether rental properties would be included in QBI. Its official:

Any form of rental revenue from real estate that results from a physical asset will be treated as business income. The same threshold amounts that were previously specified will still apply to these sums for both single and joint filers.

Service companies could be excluded.

You might have your deduction reduced or eliminated if your income comes from a white-collar occupation, such as being an athlete, performer, or investing professional.

The regulations can easily become confusing. You cannot claim the deduction at all if you have a taxable income of more than $207,500 for a single taxpayer or more than $415,000 for a married taxpayer.

Complexity exists in specific service trades or businesses.

According to the IRS, a specified service trade or business (SSTB) is "a trade or business that performs services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, investing and investment management, trading, or dealing in certain assets, or any trade or business where the principal asset is the reputation or skill of one or more of its employees or owners."

It protects passive income

The pass-through entities are covered by the Section 199A deduction. Pass-through entities are allowed to file a business tax return, but they are not subject to tax. Instead, the owners' or partners' personal tax returns are used to tax the business's gains and losses.

There are limits on taxable income.

Multiple limits are included in the deduction calculation. The most significant one states that the Section 199A deduction cannot be more than 20% of the taxable income subject to ordinary income tax.

Taxpayers with high incomes require W-2 earnings and depreciable assets.

The deduction for qualified business income (QBI) may be capped by the amount of W-2 wages paid by the qualified trade or business and the unadjusted basis immediately after acquisition (UBIA) of qualified property held by the trade or business for eligible taxpayers with total taxable income ($415,000 for married couples filing joint returns).

Loss from QBI is carried over

Regardless of how many businesses you own, your QBI represents your overall income. In other words, if you own several businesses and one performs terribly, it will be taken into account in comparison to your other firms. A negative QBI is thus feasible, in which case you would have to carry over the loss into the following year.

Sec. 1231 gain

Regarding how Sec. 1231 gains are handled for calculating eligible business income, the law is silent. Any depreciable asset or real estate that has been used in a trade or business for more than a year qualifies as a Sec. 1231 asset. The definition of a capital asset expressly excludes a Sec. 1231 asset.

The sale of a Sec. 1231 asset by a S corporation or partnership is not treated at the business level as a long-term capital gain or loss; rather, the asset merely maintains its status as a Sec. 1231 gain or loss when it flows through to the owners. The taxpayer is required to net all Sec. 1231 gains and losses at the individual owner level.

A net loss is written off as an ordinary loss, whereas a net gain is recognized as long-term capital gain.

- The House and Senate versions of the legislation that would become Section 199A both stated that qualified business income does not include any item that is "taken into account" in calculating net long-term capital gain or net long-term capital loss, without indicating whether this term applies to the business or owner level.

- If the former, one could reasonably conclude that the Sec. 1231 gain is not "taken into account" in determining the long-term capital gain of the business and should not be excluded from qualified business income because it is separately stated at the S corporation or partnership level, with its ultimate character determined only after netting at the shareholder or partner level.

- There is another, maybe more obvious, reason why Sec. 1231 gain should be included in qualifying company income. The aforementioned bulleted items are intended to formalize the legislative history of Sec. 199A's objective that certain "investment-related income" not be included in eligible company income.

Gain from the sale of a Sec. 1231 asset shouldn't be considered investment-related income because a Sec. 1231 asset is by definition not a capital asset but rather an item used in a trade or company. Therefore, it is appropriate to include Sec. 1231 gains and losses in qualifying business income until IRS guidance to the contrary is provided.

Guaranteed payments and fair compensation

Additionally, qualified business income excludes:

• Any guaranteed payments described in Section 707(c) paid to a partner for services rendered with regard to the trade or business;

• Reasonable compensation paid to the taxpayer by any qualified trade or business of the taxpayer for services rendered with regard to the trade or business; and

• Any payment indicated in Section 707(a) to a partner for services rendered in connection with the trade or business, to the extent permitted by rules.

The decision by Congress to exclude from qualifying company revenue wages provided to a shareholder or guaranteed payments to a partner may disfavor such taxpayers in comparison to sole proprietors at particular income levels.

Share attributable to a shareholder or partner

A shareholder of an S corporation and a partner in a partnership are only required to consider the portion of each eligible item of income, gain, deduction, or loss that is attributable to them.

According to Sec. 1377, a shareholder chooses how much of the S corporation's income is allocable to them on a per-share, per-day, pro rata basis. The amount of any exceptional allocations allowed by Section 704 is taken into account when calculating a partner's allocable share of partnership revenue.

Determining the deductible amount

Tentative deduction

Each eligible trade or enterprise is given a different deduction amount by the taxpayer. A preliminary deduction equivalent to 20% of eligible business revenue is first calculated by the taxpayer.

50% of W-2 wages limitation

The tentative deduction for each distinct qualified trade or business for taxpayers with taxable income above a certain threshold is capped at the greater of the following amounts:

• 50% of the W-2 wages with respect to the qualified trade or business; or

• The sum of 25% of the W-2 wages with respect to the qualified trade or business plus 2.5% of the unadjusted basis immediately after acquisition of all qualified property.

The total earnings (as defined in Section 3401(a)) subject to wage withholding, elective deferrals, and deferred compensation provided to employees by the eligible trade or company for the calendar year ending in the taxpayer's tax year are referred to as "W-2 wages."

For taxpayers with taxable income above a certain level, the tentative deduction attributable to each separate qualified trade or business is capped at the higher of the following amounts:

• 50% of the W-2 wages with respect to the qualified trade or business; or

• The sum of 25% of the W-2 wages with respect to the qualified trade or business plus 2.5% of the unadjusted basis immediately after acquisition of all qualified property.

The entire wages (as outlined in Section 3401(a)) paid by the eligible trade or business to its employees for the fiscal year that ended in the taxpayer's tax year, less any elective deferrals and deferred compensation, are referred to as "W-2 wages."

25% of W-2 wages plus 2.5% of unadjusted basis limitation

The "50% of W-2 salaries" restriction was the sole part of Sec. 199A that was first approved by the Senate. However, a different restriction was established during the subsequent conference committee meetings: 25% of W-2 salaries plus 2.5% of the unadjusted basis of "qualifying property."

- This late amendment to the law was added for the undeclared purpose of enabling owners of rental properties to be eligible for Section 199A's advantages. An organization that owns rental property frequently does not pay W-2 salaries; instead, it pays a management fee to a management business, which is typically a partnership.

Without this last-minute modification, many large landlords would not have been permitted to take the deduction since a management fee is not treated as W-2 wages for the purposes of Sec. 199A.

- Only 2.5% of a shareholder's or partner’s allocable share of the eligible property's unadjusted basis may be taken into account. A strict per-share, per-day basis is used to assign shares to shareholders. However, a partner must be given basis in the same way as they are given the partnership's depreciation expense.

- The limitation only applies to the unadjusted basis of eligible property. The basis of raw land and inventories, for instance, would not be considered because qualified property is tangible property subject to depreciation under Sec. 167. Unadjusted basis that was established "immediately after acquisition" is the basis of the property used to calculate the limitation.

Therefore, for any further depreciation, the basis is not adjusted. The classification of capitalized leasehold improvements, which are often handled as a modification to the underlying building's basis, as qualifying property is unclear.

Whether a partnership may include the step-up in its qualified property after electing to increase the basis in its underlying property in accordance with Section 754 is similarly questionable.

To the extent that the step-up is allocated to depreciable assets, it would appear to produce qualifying property since the increase in basis is viewed for tax purposes as a new asset placed in service by the partnership.

- It is unlikely that a Sec. 754 step-up, which reflects an increase in the underlying value of partnership property instead of a new investment, should be included in qualified property, even if the policy reason for allowing the "2.5 percent of unadjusted basis" limitation was to reward business owners who invest in tangible assets. Like many other areas of Sec. 199A, advisers must wait for more clarification.

- At the end of the tax year, the qualified business must still own the qualified property and have it available for use. Eligible property must have been used at any point during the tax year to generate qualified business revenue.

Only for years where the "depreciable period" of the asset has not finished prior to the conclusion of the tax year may a taxpayer take into account the unadjusted basis of the asset.

The first day of the last complete year in the applicable recovery period that would apply to the property under Section 168 is the beginning of the depreciable period, which lasts for 10 years from the day the property is placed in service (ignoring the alternative depreciation system).

The asset was fully depreciated at the beginning of the year, however the partners may allocate their respective portions of the $50,000 unadjusted basis of the asset in 2018.

This is due to the fact that the depreciable period is longer of the following two events:

- 10 full years from April 12, 2010 (to April 12, 2020); or

- The last day of the last full year in the recovery period, which for a five-year MACRS asset placed in service during 2010 would have been 2014.

The partners will additionally consider the property's $50,000 unadjusted basis in 2019.

Alternately, suppose the equipment was activated on June 1st, 2008. Because the depreciable period concluded on June 1, 2018, before the conclusion of the 2018 tax year, the partners of Partnership AB decided not to consider the $50,000 unadjusted basis in 2018.

Rules for calculating the unadjusted basis of qualifying property obtained through like-kind swaps or forced conversions will be outlined in regulations.

Exception

Exception to W-2 and qualified property—based limitations based on taxable income

When the taxpayer claiming the deduction has taxable income for the year that is less than $315,000 (if married filing jointly; $157,500 for all other taxpayers), the W-2 and qualifying property-based limitations do not apply. Any Sec. 199A deduction is not taken into account for determining taxable income for these purposes.

Deductions for specific service businesses that generate taxable revenue are exempt from this rule.

Similarly, if the taxpayer claiming the deduction has taxable income of less than $315,000 (if married filing jointly; $157,500 for all other taxpayers), the restriction against claiming the Sec. 199A deduction based on income produced in a specified service business does not apply.

A taxpayer in a defined service business with taxable income below the thresholds can simply deduct 20% of any eligible business income since the two W-2-based limitations do not apply when taxable income is below those same thresholds (subject to the overall limitation).

Problem areas and planning opportunities

Satisfying the 'trade or business' standard

It might not be a good idea for Congress to utilize the word "qualified trade or business" for Sec. 199A purposes. The most well-known application of the term "trade or business" is in Section 162, which allows a deduction for any regular and necessary expenses paid or incurred in carrying on a trade or business, despite the fact that the term is not defined in the Code or regulations.

Case law has established that in order for an activity to meet the criteria for a Sec. 162 trade or business, a taxpayer must engage in it "with continuity and regularity" and not just sometimes, and that the activity's primary goal must be to generate revenue or profit.

Therefore, deciding whether a particular action falls under the definition of a Sec. 162 trade or business is typically a factual judgment.

- If Sec. 199A does in fact require a qualified business to meet Sec. 162 trade-or-business criteria, some taxpayers who own rental property may run into issues. The IRS declared that "the Treasury Department and the IRS do not feel that the rental of a single piece of property rises to the level of a trade or business in every case as a matter of law" in the preamble to the Sec. 1411 regulations governing the imposition of the net investment income tax.

- Years of legal precedent haven't really resolved the problem. The type of property (e.g., commercial real estate versus a residential condominium versus personal property), the number of properties rented, the owner's or its agent's involvement on a daily basis, and the type of rental are all factors that the courts have considered when deciding whether a rental qualifies as a trade or business (e.g., a net lease versus a traditional lease, or short-term versus long-term lease).

- It's possible that future regulations under Sec. 199A will borrow a page from the Sec. 1411 final regulations and provide a safe harbor so that landlords can quantitatively prove that their rental rises to the level of a Sec. 162 business, or even state that all rental activities will be regarded as having met this standard.

The evidence in Section 199A, however, shows that Congress intended for all rental activities to be classified as qualifying trades or enterprises until that time. A non-corporate taxpayer is allowed to deduct 20% of any eligible dividends from a real estate investment trust under Section 199A(b)(1)(B) (REIT).

Since it is illegal for REITs to engage in rental activities that require a significant amount of personal labour, REITs typically produce the kind of passive income — such as rent from triple-net leases — that would prevent a non-REIT rental activity from qualifying as a Sec. 162 trade or business.

Therefore, it follows that if a 20% deduction is allowed for dividends received by a REIT, it should also be allowed for even the most passive of rental activities.

Netting of qualified business income and loss

Each qualifying trade or business must have a separate deduction amount computed in accordance with Section 199A. However, the Act is ambiguous about how to calculate the deduction for a taxpayer who runs many qualifying crafts or businesses, some of which produce qualified business income and some of which produce losses.

A thorough examination of the legislation text and a study of the conference committee's report provide some clarification but also pose a significant new query.

- The Senate's version of Section 199A, which permitted a deduction of 23 percent rather than the final law's 20 percent, is described in the conference committee report as follows:

- It is carried forward as a loss from a qualified trade or business in the next tax year if the net amount of qualified business income from all qualified trades or businesses during the taxable year is a loss.

The language goes on to say:

Any deduction permitted in a subsequent year is reduced by 23 percent of any carryover qualified business loss, just like it is for a qualified trade or business that has a qualified business loss for the current taxable year, although it cannot be reduced to zero.

The second quotation—which proves that Congress intended for a "negative deduction" attributable to a qualified company loss to lessen or cancel out a deduction attributable to a qualified business income—is crucial.

Limitations

W-2 wage limitation: Allocation among businesses

A few parts of the W-2-based constraints also require more clarification.

First, Section 199A mandates that the deduction be calculated in relation to each distinct eligible trade or company. Many popular business arrangements, especially those that don't own a lot of real estate, may find this to be problematic.

- Consider a collection of companies that are all under the same control as an example. All of the staff for the operational companies are housed in one management company, but the shareholders establish separate S corporations in each state where the business conducts business. Furthermore, none of the operating businesses own substantial eligible property.

- Sec. 199A does not now permit a distribution of the W-2 salaries provided to each of the operating firms by the management company. As a result, if the shareholders of the operating companies had taxable income that exceeds the threshold amounts, the W-2 limitations would prevent them from claiming a deduction.

Employees that are leased through a professional employer organization (PEO) or employee leasing company experience similar issues.

- An optional grouping scheme that enables owners to combine their eligible trades or companies for Sec. 199A purposes could solve this issue.

- For instance, the owners may be able to claim a deduction that would not otherwise be available by combining the W-2 salaries provided by a centralized management company with the eligible business revenue of the operational companies.

- However, Sec. 199A does not seem to be moving toward a grouping system as it is currently written. If Congress had anticipated such a course of action, it is likely that Sec. 199A would have been phrased in terms of "activities" rather than "eligible trades or companies," allowing future regulations to draw on the grouping framework already in place in the passive-activity requirements of Sec. 469.

- The late insertion of the alternate "2.5 percent of unadjusted basis" provision to Sec. 199A provides additional proof that a grouping regime is unlikely to be implemented.

- As was previously mentioned, this restriction was explicitly added to create a deduction for owners of rental properties who typically do not pay W-2 wages but instead pay a management fee to a management company, which in turn pays W-2 wages to employees.

The "2.5 percent of unadjusted basis" restriction would have been unnecessary in cases where the management company's owners were also the owners of the rental property if a grouping election had been made; the owners would have simply combined the businesses, combining W-2 wages and qualified business income for the purposes of the Sec. 199A deduction.

However, Sec. 199A(f)(4) permits the IRS to establish regulations "for mandating or regulating the allocation of commodities and salaries under this section as the Secretary judges appropriate," thus a fix could be on the horizon in upcoming regulations.

Given that Sec. 199A's predecessor, Sec. 199, dealt with a similar issue, the IRS won't have to search very far for a framework to be employed in allocating W-2 salaries across commonly held corporations.

Domestic producers received a deduction under Sec. 199, which was eliminated on January 1, 2018, with effect. However, that deduction was only allowed for the first half of the taxpayer's W-2 salary for the year. Regulations under Section 199 allowed a taxpayer to consider any earnings received by another company and reported by that entity on Forms W-2 as long as the wages were given to the taxpayer's employees in connection with employment by the taxpayer.

As a result, earnings received by a related party, PEO, or employee leasing company were nonetheless allocated to a "common law employer" for the purposes of the W-2 limitation.

A comparable clause would offer many taxpayers who are attempting to claim a deduction under Section 199A much-needed relief.

W-2 wage limitations: Compensation for shareholders is included

The present W-2 restrictions have a second drawback. Sec. 199A does not distinguish between wages paid to shareholders in S corporations and wages paid to non-owner workers when defining W-2 wages that contribute toward the limitation. When taxable income exceeds the levels at which the W-2 limitations fully apply, this might have unfair effects on firms in comparable situations.

How Deskera Can help You?

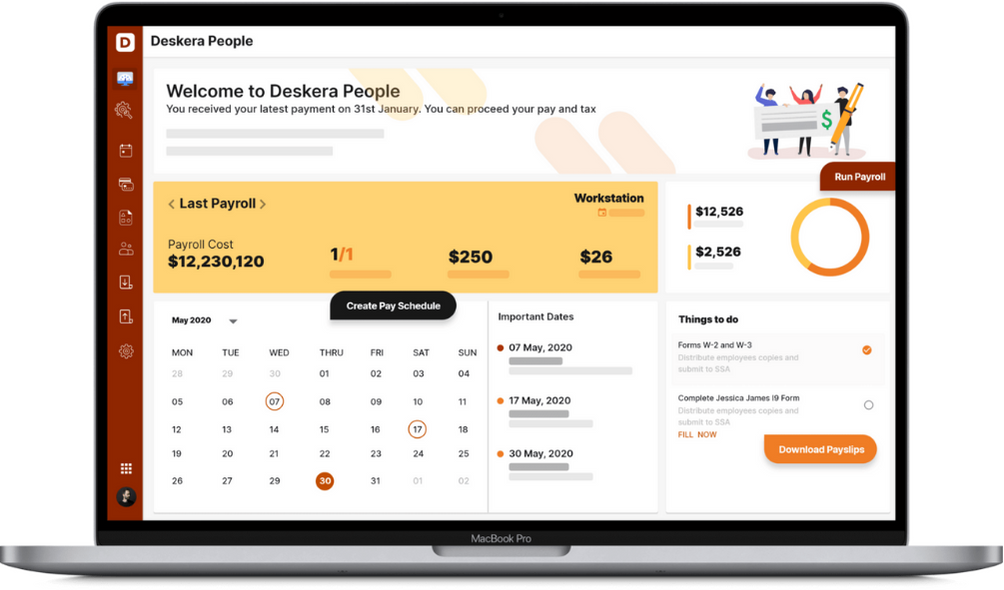

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

- The information required to determine the section 199A deduction is based on a trade or business level rather than the legal organization. Every business must first ascertain whether it has any trades or businesses before determining whether each one qualifies as a QTB or an SMB (specified service trade or business) (SSTB).

- This deduction was established in the 2017 Tax Act (P.L. 115-97) to level the playing field with businesses that benefited from the substantial corporate tax rate reduction. The deduction is available for tax years beginning before December 31, 2025 and is applicable for tax years beginning in 2018.

- The W-2 salary limitation is phased in for taxpayers with taxable income over certain levels and does not apply to those with taxable income of less than $157,500 for the year ($315,000 for married taxpayers filing jointly).

- Sec. 199A of the Internal Revenue Code, which allows owners of sole proprietorship, S corporations, or partnerships to deduct up to 20% of the revenue received by the firm, became law with the passage of the Tax Cuts and Jobs Act (the Act)1 on December 22, 2017.

Related Articles