As a business, do you face challenges in recruiting workers either full-time or as consultants? For recruiters in developing associations, understanding the difference between W2 and 1099 workers is critical to filling talent gaps, accessing the right ability, and managing the Taxes.

Recording your taxes when you're independently employed means you're going to face a range of new tax guidelines that you've never managed for personal taxes. As an employee, your manager can assign the work you do in various ways. Most, managers make worker designations by utilizing different tax forms commonly, a W-2 form or a 1099 form.

In this article, we give a holistic overview of understanding W-2 and 1099. Given below are the topics covered in this article:

- W-2Worker

- 1099 Worker

- Determining the difference between W2 and 1099 workers

- Determining Independent Contractors

- How to find a W-2 or 1099 position?

W2 Worker

Consider a W2 worker as the default worker classification. They are the regular, salaried workers that you recruit to play out a particular job. A W-2 worker is an individual who gets a W-2 tax form from their manager toward the end of every year.

Unlike 1099 workers, W2 workers are employed for an endless timeframe to perform consistently required work. Obviously, workers can leave subsequent to giving the expected notification, and businesses can fire workers for poor performance or whatever other legitimate explanations that don't disregard violate anti-discrimination laws.

These individuals are viewed as internal workers and get a few advantages from their W-2 status. Managers can offer a time-based compensation or a yearly compensation to W-2 workers.

With every paycheck, the organization keeps specific state and government charges for the worker. Since these workers fill in as internal workers for their business, they're dependent upon specific work environment rules and expectations, like code of ethics and conduct.

Businesses are answerable for giving specific worker benefits, like overtime protection, the minimum pay permitted by law, health care coverage insurance, and paid time off. Many organizations decide to offer more benefits to prevail upon over in-demand talent, for example, retirement plan contributions, additional downtime, and benefits like child care.

With regards to paying taxes, organizations essentially keep government and state income tax, Medicare tax, and Social Security tax from workers' compensation. These sums are considered for the W2 form.

Pros and Cons of W 2

Pros:

- More prominent control: Employers have command over their worker's timetables, concluding when and how they work. On the off chance that you really want something done a specific way at a specific time, it's a good idea to recruit a worker to do the work.

- Single business: As a W-2 worker, you'll probably just have one employer. Obviously, individuals can work more than one W-2 position, especially on the off chance that both are part-time, however by and large, W-2 workers just need to oversee one tax document come tax time.

- Organization loyalty: Employees frequently recognize emphatically with their work, esteem the monetary security, and might need to remain with the organization longer than self-employed entities who bounce from one gig to another.

- Long-term potential: Most managers recruit their W-2 workers indefinitely rather than on a momentary agreement. W-2 work normally gives job stability and long-term learning experiences with the organization.

- Employer advantages: Employers are expected to give specific advantages to their W-2 workers in light of different organization attributes. Others offer advantages to tempt workers to join the association. You can expect benefits like medical coverage, etc.

- Progressing support: During busy periods, you can rely on your workers to contribute, work late, and assist with taking care of business. Workers can break different caps and assist with bringing down where they're generally required.

- Reliable compensation: Most W-2 workers get normal, trustworthy paychecks, either through compensation or a time-based compensation plan. This oversees pay and costs.

Cons:

- Higher cost: You're not just liable for workers' wages, you likewise need to pay your portion of their Social Security and Medicare taxes. You might have to give workers benefits like health care coverage, insurance, etc.

- Lack of independence: As a W-2 worker, your manager can decide the particular manner by which you play out your work, regardless of whether you like to deal with your work in different ways.

- Employer set timetable: Usually, you'll work explicit hours set by your manager with little opportunity to pick when you work.

- Resources: You really want to supply your workers with all that they need to take care of their responsibilities, in contrast to contractors. Workers are for the most part based on site also, so you want to guarantee there are adequate work areas for everybody.

- Guidelines and rules: You'll need to submit to specific organization rules and guidelines like code of ethics and conduct.

- Restricted negotiation: Almost all W-2 workers can and do negotiate salary hikes throughout their vocation, however, you might have fewer chances to do as such than you would as a contract worker who negotiates each occupation they work on.

- Managing workers: When you have people working for you, you want to train, manage, and motivate them. Ensure have the opportunity and time to focus on this.

- Set work environment: Most businesses relegate specific work areas for their workers, expecting them to work out of a particular office or another work area.

1099 Worker

A 1099 worker is frequently referred to as a freelancer or independent contractor. Organizations or clients recruit these workers to work on a particular venture or to fill a transient need most of the time. Rather than the W-2 tax document internal workers get, workers for hire total a 1099 tax document all things considered. Most employers pay their 1099 workers a pre-decided amount in light of the limitations of the work contract, which is quite often impermanent, rather than a yearly compensation or time-based compensation.

The contract worker's organization or client doesn't consequently keep specific state and government taxes for the worker for hire's sake as they do with internal workers. Nonetheless, 1099 workers regularly enjoy more opportunities in how and when they play out their obligations than internal workers.

Here is a concise list of the most widely recognized ones:

- Contractor: An independently employed person who looks for a decent job through an agency or vendor. Contingent upon the organization's structure, workers might report the employer and get normal payments through the office.

- Freelancer: These are independently employed people who can single out which projects they want to deal with, as well as their rates. Most freelancers are paid per project or per hour. Numerous freelancers work with more than one organization in turn.

- Consultants: These are independently employed workers who have broad abilities, skills, and experience in their individual fields. Because of the skills and abilities expected to be a Consultant, they frequently demand high payment for their services.

- Independent contractor: Like an independent contractor, freelancers can pick their work and how they are paid. In spite of this, it's more normal that they pick longer-term work courses of action with a couple of clients. For this situation, most independent contractors are paid by the hour. Now and then they settle on a retainer.

- Gig Expert: Gig workers are typically paid for each project, not by the hour. This is somebody who performs brief, flexible positions, frequently through an online application or platform.

Form 1099

1099 Form is certifiably not an exact method for addressing the forms on the grounds that 1099 isn't one form. 1099 is information returns series named as 1099 form by the IRS for an overall understanding.

In the event that you've paid out more than US$600 to a service provider or got more than US$600 for offering types of services, you'll give and get 1099-MISC for every business or individual. As somebody who's independently employed, you'll have to send 1099 to any individual who you've paid more than US$600.

Forms like 1099-MISC, 1099-NEC, 1099-DIV, and numerous different forms are collected under one series called 1099. Every one of these informational tax forms solely manages to report business transactions of organizations and self-employed people in a fiscal year.

1099 Pros and Cons

Pros:

- Skill: Contractors commonly are thoroughly prepared in their field and can get straight down to business with minimal preparation, they are autonomous, all things considered. They can focus on a specific task that you might not have mastery in.

- Hyper specialization: As a 1099 worker, or freelancer, you can hyper-specialize in a specific area and secure positions that take care of your skill.

- Plan flexibility: Employers don't continuously have that very everyday control over contractors as they do with W-2 workers, meaning you can frequently pick what hours and days you'll function as a feature of your agreement.

- Remote work choices: Just like the hours you work, you'll likewise have command over where you work. Numerous 1099 workers operate remotely rather than coming into an office or other business-determined work area.

- Costs: Contractors are not delegated, workers. So you don't need to keep finance taxes from their payments, and you don’t have to offer benefits like health care coverage. Payments to international workers for hire might be likely to separate withholding taxes. This can set aside money, albeit not dependably since workers for hire get compensated at a higher rate now and again.

- Pay potential: Often, 1099 workers have more command over their income since you can specify the amount you need to earn on every individual agreement you arrange.

- Adaptability and freedom: Independent workers for hire are employed for a particular undertaking or limited time frame, which gives organizations greater adaptability in recruiting and dismissing them.

- Momentary responsibilities: Most of the time, your agreements are present moment as a 1099 worker, meaning in the event that you don't associate well with the organization or client, you're not dependent on them for a consistent paycheck and can find other work somewhere else.

Cons:

- Less control: Businesses have less command over self-employed entities, who will generally partake in a more noteworthy measure of independence. In addition, they for the most part just work for a business for a short measure of time, which can be troublesome.

- Complicated tax assessment: As a 1099 worker, you'll be liable for dealing with the entirety of your state and government business tax collection. Your clients won't keep any income from your checks. Furthermore, you'll probably have many different 1099 forms to evaluate and submit at tax time, which can be intricate and take time.

- Lack of benefits: You will not be qualified for any business-supported benefits through your manager, similar to health care coverage, overtime pay, or paid-time-off.

- Legitimate considerations: Everything about your terms with your self-employed entities are constrained by your agreement. So draft your agreement cautiously and get a legal proficient to review it. While you can dismiss a worker voluntarily, you probably won't have the option to terminate the self-employed entity without being in a break of agreement.

- No guaranteed long-haul stability: 1099 work doesn't extend to much long-haul stability since essentially every employment opportunity is a momentary responsibility.

- Conflicting compensation: Your compensation will fluctuate from one month to another and year to year contingent upon the number of agreements you have and how much money you make on each agreement.

- Insurance: If contractors get harmed on the job, they could decide to sue the business. Workers, then again, are covered by worker's remuneration insurance and by and large can't sue their manager for business-related injuries.

- Tedious training: Your clients could expect you to prepare on projects or practices you're acquainted with, removing time from your genuine work obligations.

Determining the difference between W2 and 1099 workers

Understanding the difference among W2 and 1099 workers is the principal to staying away from misclassification. Indeed, even unintentional misclassification can prompt expensive results such as punishments and back taxes.

To assist managers with understanding, assuming an independent worker is genuinely self-employed, the IRS offers to direct questions that can assist explain the idea of the worker’s engagement with the paying organization. The IRS considers the accompanying the common law rules, which reduce the level of control the organization has and the degree of freedom of the worker.

- Type of Relationship: Have the two parties signed written contracts or are there worker-type benefits. For example insurance, pension plan, insurance, etc.

- Behavioral: Does the organization control or reserve the right to control how the worker does as well as how the worker finishes their relegated work?

- Financial: Does the paying organization determine the business parts of the course of action.

Organizations that recruit independent contractors or freelancers need to painstakingly think about these questions while deciding if they are to be sure a 1099 worker. While certain elements might demonstrate one classification, others might show another.

The IRS suggests employers regularly assess the whole relationship, consider the degree of the right to direct and control work, and furthermore document every one of the elements used to make the determination.

Determining Independent Contractors

The contrast between a worker and an independent contractor is the level of control you have over the worker or how much autonomy they have. An independent contractor is self-employed. You go into an agreement with an independent contractor entity to do a particular job or complete a particular task.

Contractors might decide their own working hours and utilize their own devices. They might even work for more than one business. Since they are independently employed, you don't keep taxes from their checks; they settle their own taxes and give their own benefits. The differentiation between a worker and an independent contractor is the degree of control you have over the worker or how much independence they have.

A 1099 form is a series of documents utilized by organizations to report payments made to a self-employed entity during the previous year.

An individual or business that pays a self-employed entity $600 or more in a scheduled year is answerable for sending the worker for hire a finished 1099-MISC (Copy B) by January 31 of the accompanying schedule year. There are exclusions that prohibit a few independent contractors from needing to be reported.

Independent contractor tax rate

Independent workers pay self-employment tax on the grounds that the organizations they work with don't keep Social Security or Medicare taxes for them. The independent work tax rate (comprised of Social Security and Medicare taxes) is 15.3 percent. It's somewhat more confounded than that. Pay up to $118,500 is dependent upon Social Security tax and all your pay is dependent upon Medicare tax.

How to find a W-2 or 1099 position?

Utilize these suggestions to assist you with finding the most ideal situation for your necessities, regardless of whether it's a 1099 or W-2 work:

- Have a number as a primary element for a time-based compensation, pay or agree to assist you with figuring out work postings and track down potential positions that meet your monetary necessities.

- Think about tax collection. Generally, finishing tax payments is more muddled for 1099 workers than W-2 workers. Make sure you're capable of taking care of your consultant tax necessities or component in the cost of recruiting a professional tax accountant to help you.

- Evaluate your range of skills. Know what your unique abilities and selling points are. Feature those on your resume and during your prospective employee meeting, regardless of whether the position is W-2 or 1099.

- Stay liberal. You could want a 1099 position however find an incredible W-2 place that addresses your issues during your pursuit of employment. Stay adaptable as you search for a job to ensure you think about every expected choice.

- Evaluate the numbers. At the point when you get a proposition for employment, either W-2 or 1099, Ensure the base compensation and advantages for W-2 workers presented by the business will meet your monetary necessities.

- Ask for what you really want. Haggle for the agreement you need. Think about the money you might actually make assuming the position was internal or independent and guarantee you're suitably paid.

How Can Deskera Help you?

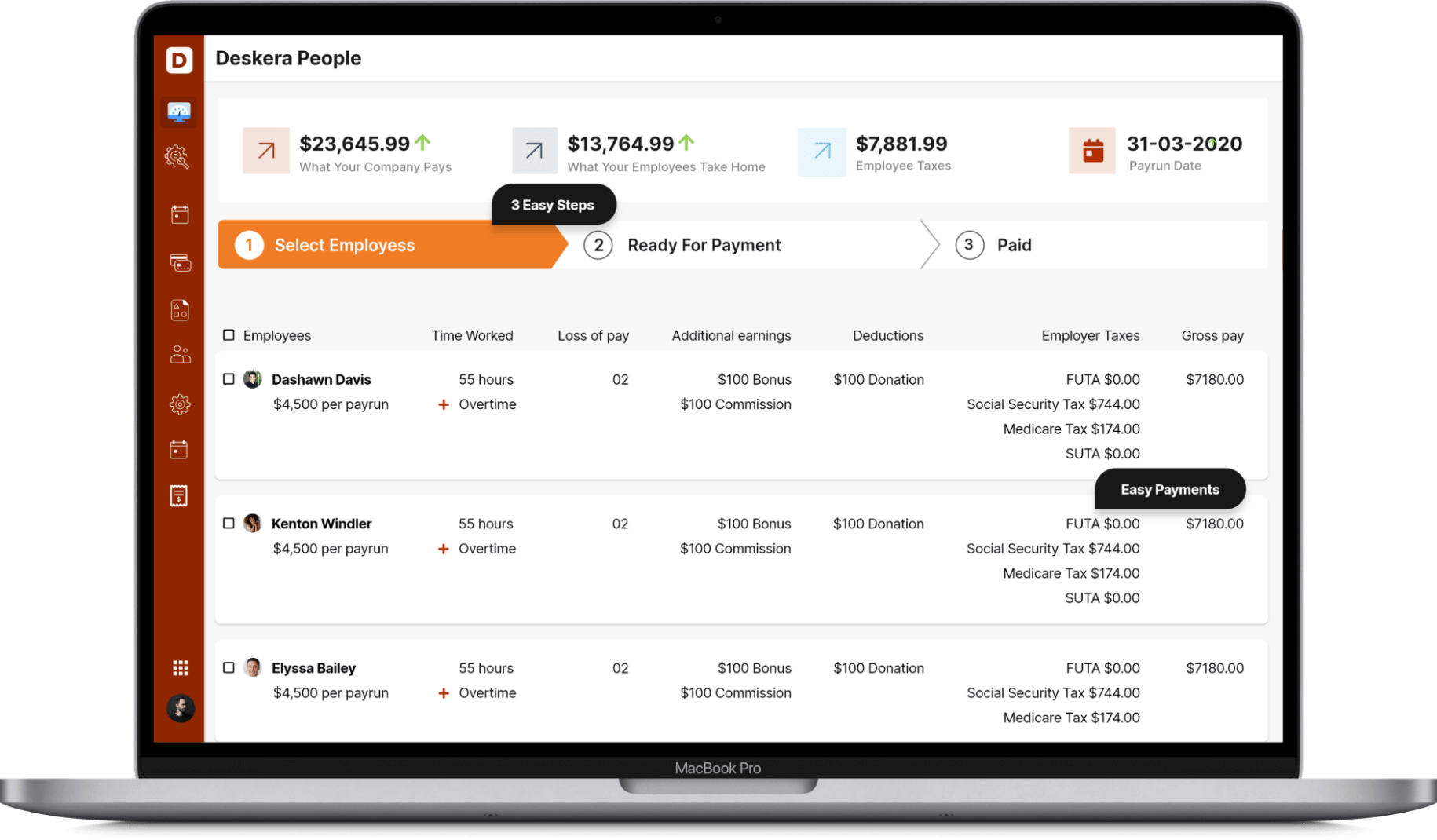

Deskera People is a cloud-based software that will help to create and assign custom pay components to an employee in light of your requirements.

Deskera People will distinguish those components assigned to the employee and naturally compute the wages taking in the specific conditions which can be designed in each component like pre and post-tax deductions.

Conclusion

The primary difference between W2 and 1099 workers is that a W2 is a payroll worker and 1099 is a non-payroll worker. The names W2 worker and 1099 worker come from their individual tax forms. The IRS takes note that, there is no special equation that makes somebody a contractor or employee.

Rather it needs you to check out the whole relationship and consider the degree to which you direct that individual in their work. It's vital to ensure that you are classifying your workers accurately since misclassification can bring about exorbitant monetary charges.

Key takeaways

- Self-employed entities have some simple-to-recognize benefits for the bottom line. Since you're not paying employment taxes and giving advantages to them, contractors can frequently cost not lesser than full-time workers.

- Whenever you've chosen whether to recruit workers or freelancers - or both - you really want to get to know the forms that the IRS expects you to submit for each kind of worker. The forms you find out about most are the W-2 and 1099.

- It's trickier to transform a worker into a contractor. Since workers are thought to be employees except if demonstrated in any case, changing somebody from a W-2 to 1099 may set off certain questions from the IRS. Ensure you talk with your legal counselor and accountant prior to rolling out these changes.

Related articles