Hiring contract workers is cost-effective and flexible. 1099 contractors do not get employment benefits such as medicare contributions, payroll taxes, or employees' insurance. Furthermore, employers don't have to cover withholding taxes for contractors. Independent contractors must pay self-employment taxes.

However, the IRS still compels you to disclose contractor payments and maintain details of your working connection with them. So you'll have to fill out a few documents, but they'll be different.

This article provides a checklist of all the paperwork and documentation you'll need to recruit a 1099 contractor lawfully.

Let's Start!

Forms And Documents You Need to Hire a 1099 Contractor

If this is your first time hiring freelancers, keep in mind that the IRS is vigilant in investigating tax system abuses. So, if a corporation is unclear whether a person is a genuine contractor or an employee, the first step is determining this. The distinction is critical since the wrong classification may result in huge penalties.

Here are the forms and documents you are going to need when hiring a 1099 contractor:

1. Form W-9: It gathers tax information from independent contractors

The first tax document required to recruit a 1099 contractor is IRS Form W-9. Businesses use Form W-9 to engage freelancers to obtain details about the worker for tax filings. Upon hiring, a firm should send a fresh Form W-9 to the freelancer to complete and submit.

The W-9 form requests the following contractor information:

· Name or the name of their company

· Address

· Identification Number for Taxpayers

· Employer Identification Number

Collect form W-9 once the contractor begins working for your firm. If the information provided by the 1099 contractor changes, they must file a revised Form W-9. You will need the details on the form to submit other forms, such as the 1099-NEC.

2. Forms W-8BEN and W-8BEN-E are used to gather tax information from overseas freelancers

IRS uses Form W-8BEN to gather tax-related information from foreign contractors. Consider the W-8BEN to be a W-9 for international freelancers. The business confirms that the employee recruited is not a US citizen and works outside of the US by completing Form W-8BEN.

The IRS provides this form but does not require its submission. Instead, save it in your records for prospective audit purposes. If the foreign contractor is a company rather than a person, they must complete the IRS form W-8BEN-E and send it to the employer.

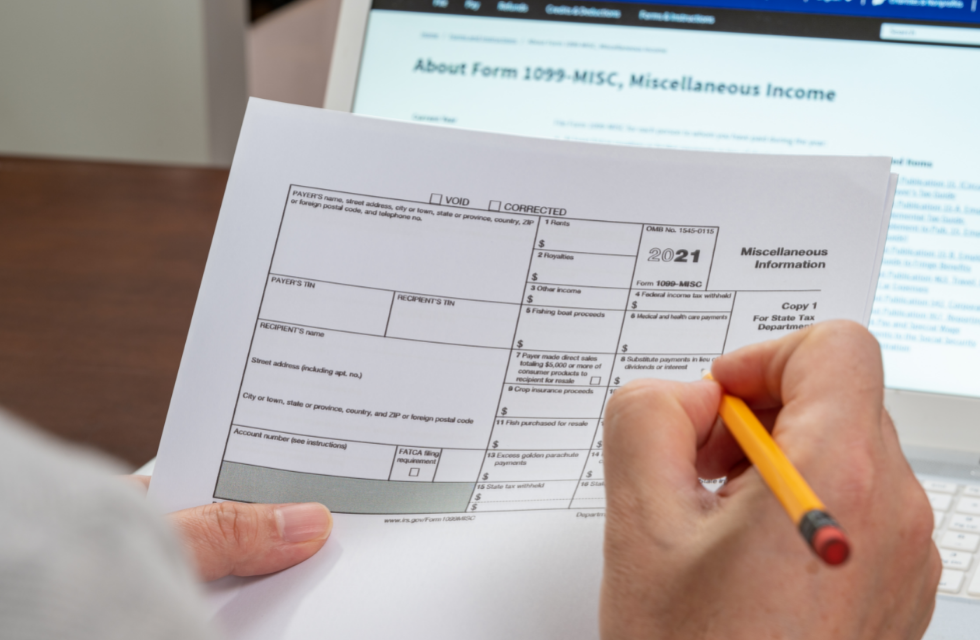

3. Form 1099-NEC: Contractor Income Report

The IRS uses Form 1099-NEC, which stands for non-employee compensation, to estimate taxable income earned by contractors and freelancers. Businesses use the form 1099-NEC to record payments made to each independent contractor throughout a tax year.

This document was previously part of 1099-MISC. However, beginning in 2020, Form 1099-NEC will be a different form. The corporation must submit that each 1099 contractor paid more than $600 one tax year. If a corporation pays a contractor more than $600, it must declare the payments.

Aside from the information contained on the W-9, Form 1099-NEC includes information on:

· The sum transferred from the payer (business) to the payee (independent contractor) is taxable.

· Any tax withholding, including the amount and reason for withholding.

The deadline for mailing the form 1099-NEC to the independent freelancer for the last tax year is January 31.

4. Form SS-8: It helps in categorizing employees

The IRS Form SS-8 assists businesses in determining if they are at risk of misclassifying employees. However, it is not a required document.

Although the distinction between 1099 contractors and full-time employees is not often evident, the consequences of misclassifying individuals are significant.

Companies and employees can use SS-8 to assess if their workers should be employees or 1099 contractors.

Companies can also use government-provided standards to avoid worker misrepresentation, such as the common legal standard or the DOL's ABC test.

Employment status and qualification for professional perks depend on variables such as having significant influence over the worker's schedule, having company costs paid by the employer, or working full-time.

5. Independent contractor agreement

A formal agreement between a company and a 1099 contractor that outlines the project's scope, timeframes, payment conditions, and other pertinent elements of the partnership is known as an independent contractor agreement.

Even if the agreement is for a short period, a corporation should agree when engaging freelancers or small business units. A formal contract is always necessary to safeguard both parties.

The contractor agreement, in particular, safeguards both sides from labor misclassification by outlining the specifics of the contractor's position. The contract should state that the worker has the freedom to use their means and operate on their timetable.

They will not get any concessions such as health insurance or employer-funded compensation insurance in the exchange. In addition, the 1099 contractors will be liable for their own state and federal taxes, FICA, and unemployment insurance.

You should add the following information to the written contract:

· The scope of work: A detailed description of the contractor's job for the company.

· Ownership of stated work: The completed work's intellectual property owner.

· Deadlines: The time frame within which the contractor must do the task.

· Compensation: The total amount of money you will pay the 1099 contractor.

· Payment conditions: It includes the payment method and frequency.

· Any additional requirements and information based on local state laws and department of labor standards.

6. A confidentiality agreement

The non-disclosure agreement you and the contractor sign prohibits them from disclosing secret company information to outside parties.

The most typical restrictive agreement signed between workers and employers is an NDA. It might apply to individual projects or the whole professional relationship between the 1099 contractor and the firm.

7. Non-compete clause

Non-competition agreements specify that the 1099 contractor may not compete in the same field as the customer. Non-compete contracts often span the duration of the working association and a specific period after the agreement expires.

Non-compete agreements are not permitted in all states since they reduce earnings. Maryland and Virginia, for example, will prohibit a similar clause in 2021.

8. Non-solicitation contracts

Non-compete contracts are comparable to non-agreements, except they cover a different area of the firm. While a non-compete contract prohibits a worker from operating in the same area, a non-solicitation agreement prohibits a former colleague from taking any of the company's clients. Some businesses use this contract to substitute the legally forbidden non-compete clause.

Bottom Line

Considering the quantity of documentation and tax forms required, employing an independent contractor is no easy undertaking. Moreover, when it comes to filing taxes, the work becomes considerably more complicated.

Outsourcing the recruiting and payroll process allows company owners to develop their staff, focus on other essential elements of their organization, and have peace of mind regarding tax and documentation compliance.

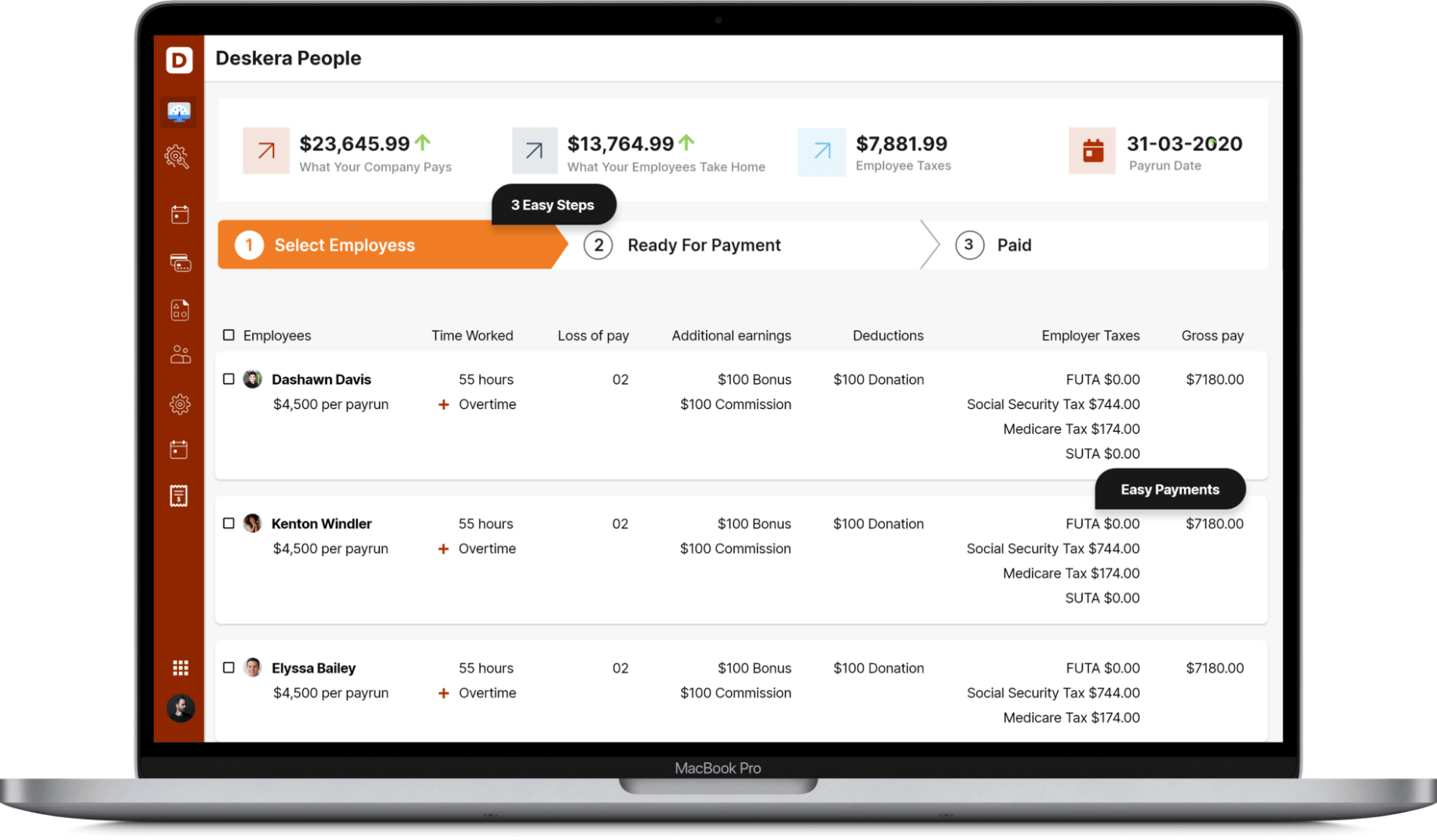

With Deskera People, handling leave, attendance, payroll, and other costs become easier. For example, paying your staff is now simple since the platform digitizes and automates HR activities.

The employee grid in Deskera People displays all of the employee's critical information at a glance. With filtering options available in every array column, it is easy to discover the data you want.

Frequently Asked Questions

Is it required for a freelancer to pay taxes on his income?

No taxes are withheld from the compensation because an independent contractor works as a non-employee. However, because the IRS requires the client to complete form 1099 MISC and provide one copy to the individual contractor, the contractor must pay all taxes for income generated during the calendar year.

What Is the Distinction Between a 1099 Contractor and a Self-Employed Person?

A 1099 contractor is the same as a self-employed employee. A dentist who has a practice, for example, is an example of a freelancer. However, a freelancer, for example, who makes hats and sometimes sells them at holiday markets, is not always a contractor, as they usually supply an item or service on a contract basis.

As a 1099 Contractor, How To Complete Form W-9?

If you are a contractor employed by a firm or individual to provide a service, they will almost certainly require you to fill out a W-9 form. You must validate information such as your name, residence, and tax id. The IRS website has all of the W-9 pages available and step-by-step instructions on filling them out.

How can Deskera Help You?

Deskera People is a cloud-based software that will help to create and assign custom pay components to an employee in light of your requirements.

Deskera People provides all the employee's essential information at a glance with the employee dashboard. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

Deskera People will distinguish those components assigned to the employee and naturally compute the wages taking in the specific conditions which can be designed in each component like pre and post-tax deductions.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

· Hiring contract workers is cost-effective and flexible.

· Contractors do not get employment benefits such as medicare contributions, payroll taxes, or employees' insurance.

· Forms and documents you need to hire a 1099 contractor:

· Form W-9: It gathers tax information from independent contractors

· Companies use forms W-8BEN and W-8BEN-E to collect tax information from overseas independent contractors

· Form 1099-NEC: Contractor Income Report

· Form SS-8: It helps in properly categorizing employees

· Independent contractor agreement

· A confidentiality agreement

· Non-compete clause

· Non-solicitation contracts

Related Articles