Accounts receivable is money that your customers owe you for buying goods and services on credit. Your accounts receivable consist of all the unpaid invoices or money owed by your customers. Accounts receivable are recorded as an asset on your company’s balance sheet.

Understanding the importance of accounts receivable is very crucial for maintaining the good financial health of your business. Having a healthy accounts receivable is always recommended. Even if you have a lot of customers, but if they are not paying you on time or not paying you at all can hurt your business very badly.

Late payments from customers can lead to cash flow problems for any business. If a company has accounts receivable balance, this means that portion of the revenue is still outstanding. If the customers take a longer time to pay, it can have a significant impact on your cash flow.

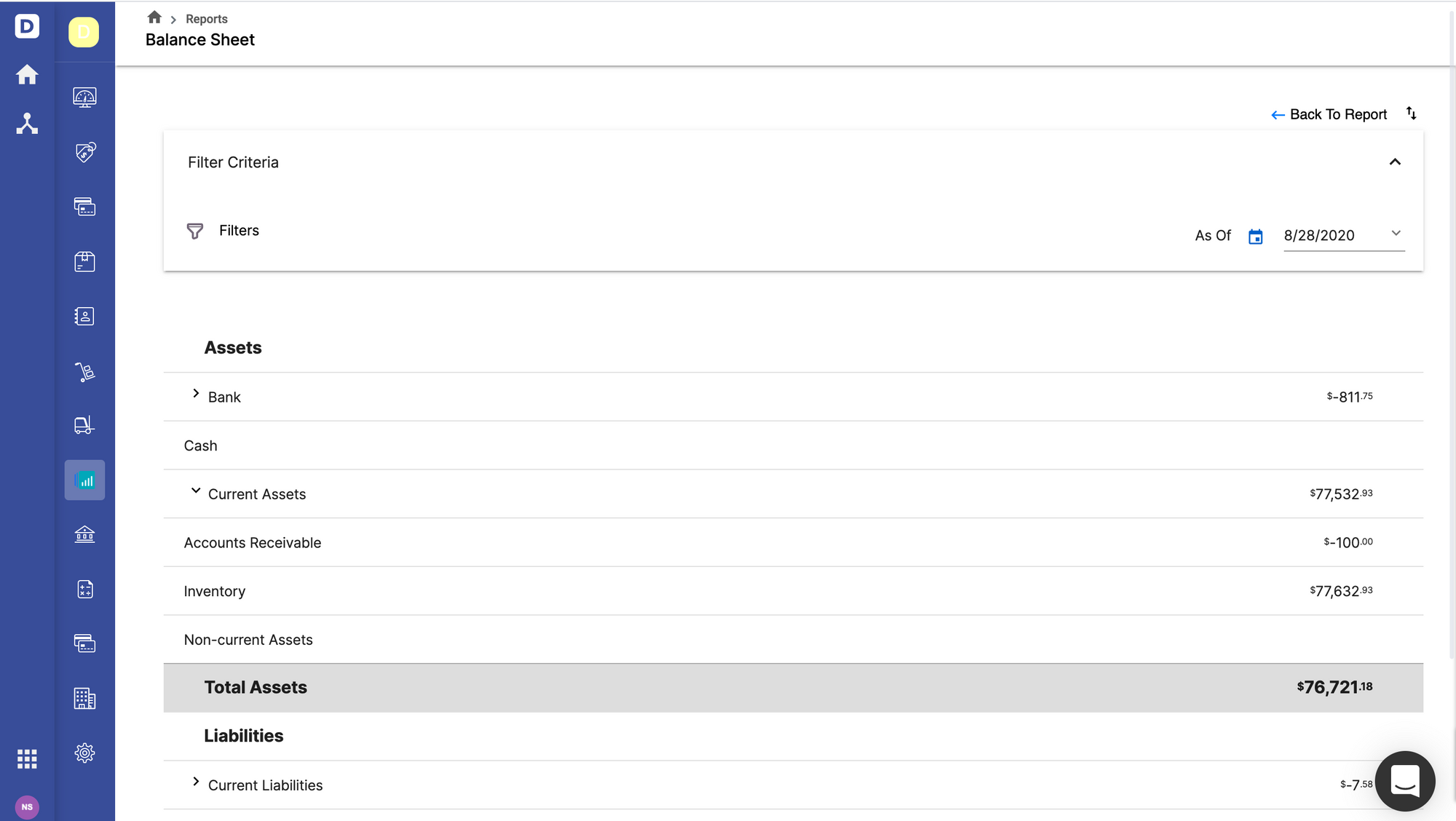

Accounts receivable are classified as an asset as they are outstanding payments and are recorded in the current asset section of the balance sheet.

We will be covering the following topics related to accounts receivables in this article:

What Is Accounts Receivable?

Why Do Companies Have Accounts Receivable?

Is Accounts Receivable an Asset or a Liability?

What Is the Difference Between Accounts Payable and Accounts Receivable?

What Is the Journal Entry for Accounts Receivable?

Example of Accounts Receivable

How Does Accounts Receivable Work?

What Happens If Accounts Receivable Is Not Paid Ever?

What Is the Accounts Receivable Turnover Ratio?

What Is an Accounts Receivable Aging Schedule?

Tips for Collecting on Accounts Receivable

What Is the Function of the Accounts Receivable Department?

What Are the Responsibilities of Accounts Receivable Manager?

What Is Accounts Receivable Automation?

What Is Accounts Receivable?

Accounts receivable (AR) is money that your customers owe you for buying goods and services on credit. Your accounts receivable consist of all the unpaid invoices or money owed by your customers. Your customers should pay this amount before the invoice due date. AR are recorded as an asset on your company’s balance sheet.

Why Do Companies Have Accounts Receivable?

In today’s competitive world, businesses need to sell goods and services on credit to make the payment process more flexible and easier for their customers. Allowing customers to purchase goods and services on credit also encourages more sales as all customers tend to hold on to cash and are more inclined to purchase on credit.

For example- Your vendor wants to purchase goods from you to sell to their customers as they have received sales order but do not have enough cash to pay for the goods. They will buy goods from you on credit and send it to their customer warehouse. Once your vendor has received money from their customer, they will pay you and clear the invoice.

Another example is for the electricity company. An electricity company provides electricity on credit and collect money at the end of the month. All the unpaid invoices from all the customers are part of their accounts receivable.

Is Accounts Receivable an Asset or a Liability?

Accounts receivable are classified as an asset because they are outstanding payments due in the future and provide value to your company. Accounts receivable are recorded in the current asset section of the balance sheet. If the business has to wait more than one year to convert AR to cash, it is considered a long-term asset.

What Is the Difference Between Accounts Payable and Accounts Receivable?

Accounts payable is precisely the opposite of accounts receivable. Accounts receivable represents money that your customers owe for goods and services purchased on credit. Accounts receivable are an asset account. Accounts payable represents the money that you owe to your suppliers for goods and services purchased on credit. Accounts payable is a liability account. Read more about the difference in accounts payable and accounts receivable here.

What Is the Journal Entry for Accounts Receivable?

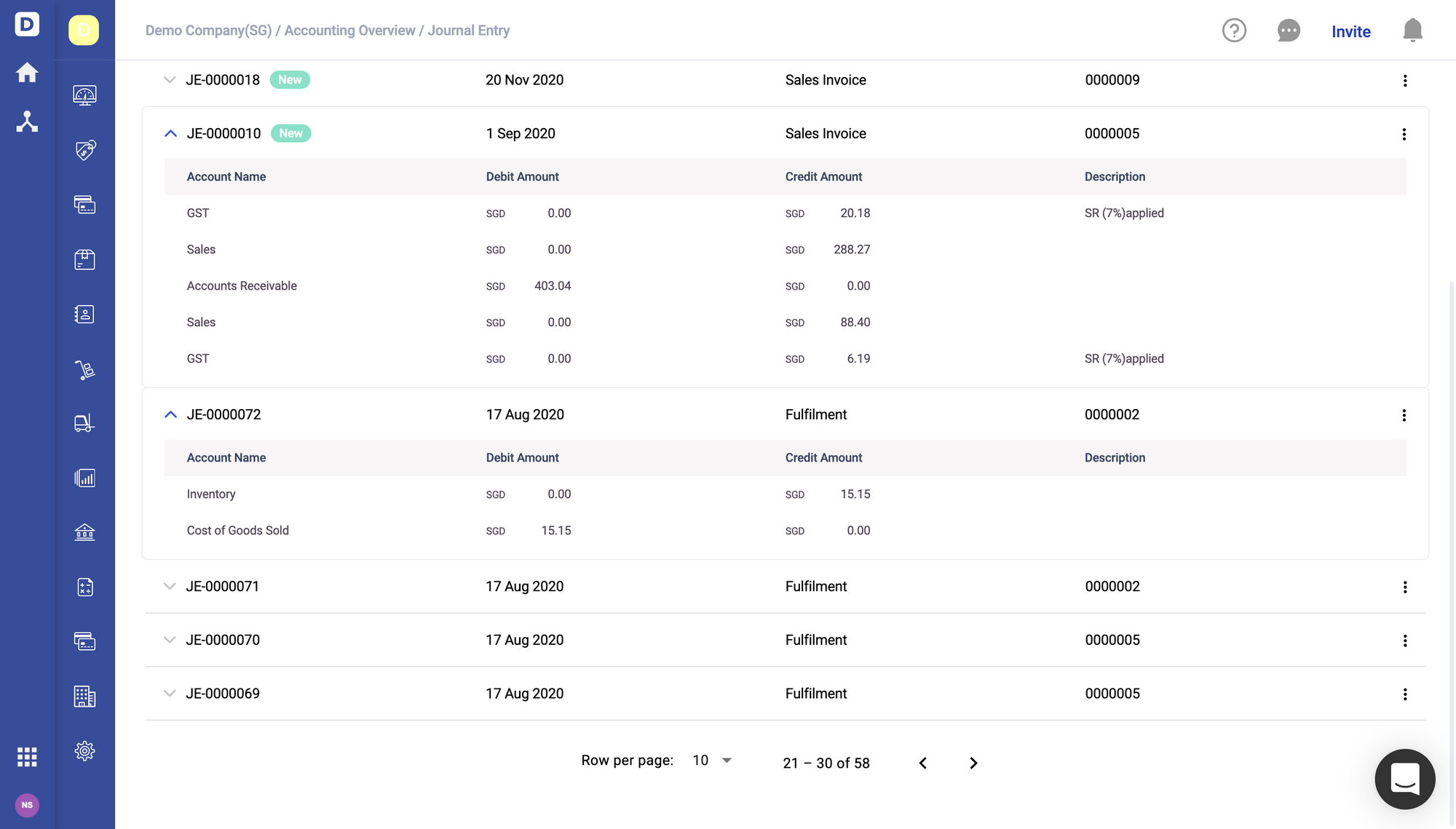

When a sale of goods or services is made to a customer, you use your accounting software to create an invoice that automatically creates a journal entry to credit the sales account and debit the accounts receivable account.

Journal entry to record the sales invoice-

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Accounts Receivable | XXX | |||

| Sales | XXX | |||

Once you receive the cash payment from the customer, the cash account would be debited, and the accounts receivable account would be credited.

Journal entry to record the cash payment-

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Cash | XXX | |||

| Accounts Receivable | XXX | |||

Some companies offer discounts to customers who pay before the due date.

Journal entry to record cash payment with discount-

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Cash | XXX | |||

| Discount | XXX | |||

| Accounts Receivable | XXX |

If any customer is unable to pay the invoice amount due to bankruptcy, you need to write off accounts receivable as a bad debt.

Journal Entry to write off accounts receivable as a bad debt-

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Bad Debt Expense | XXX | |||

| Accounts Receivable | XXX | |||

If your customer is returning the inventory items due to any reason, you need issue credit note to your customer.

Journal entry to record credit note issued to a customer-

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Revenue | XXX | |||

| Accounts Receivable | XXX | |||

Example of Accounts Receivable

Here we have explained accounts receivable with an example.

ABC company sold goods worth $50,000 on credit to CDE company. Here is the accounts receivable journal entry in ABC company books:

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Accounts Receivable | $50,000 | |||

| Sales | $50,000 | |||

The cost of these items for ABC company was $10,000. Once the inventory items are delivered to CDE company, here is the journal entry to update the cost of goods sold in ABC company books:

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Cost of Goods Sold | $10,000 | |||

| Inventory | $10,000 | |||

CDE company paid the full amount of $50,000 in cash to ABC company. Here is the payment journal entry in ABC company books:

| Account Name | Debit | Credit | ||

|---|---|---|---|---|

| Cash | $50,000 | |||

| Accounts Receivable | $50,000 | |||

How Does Accounts Receivable Work?

Here we have explained the steps of accounts receivable process:

Step 1 Selling Goods and Services on Credit

The accounts receivable process start with selling goods or services to customers on credit.

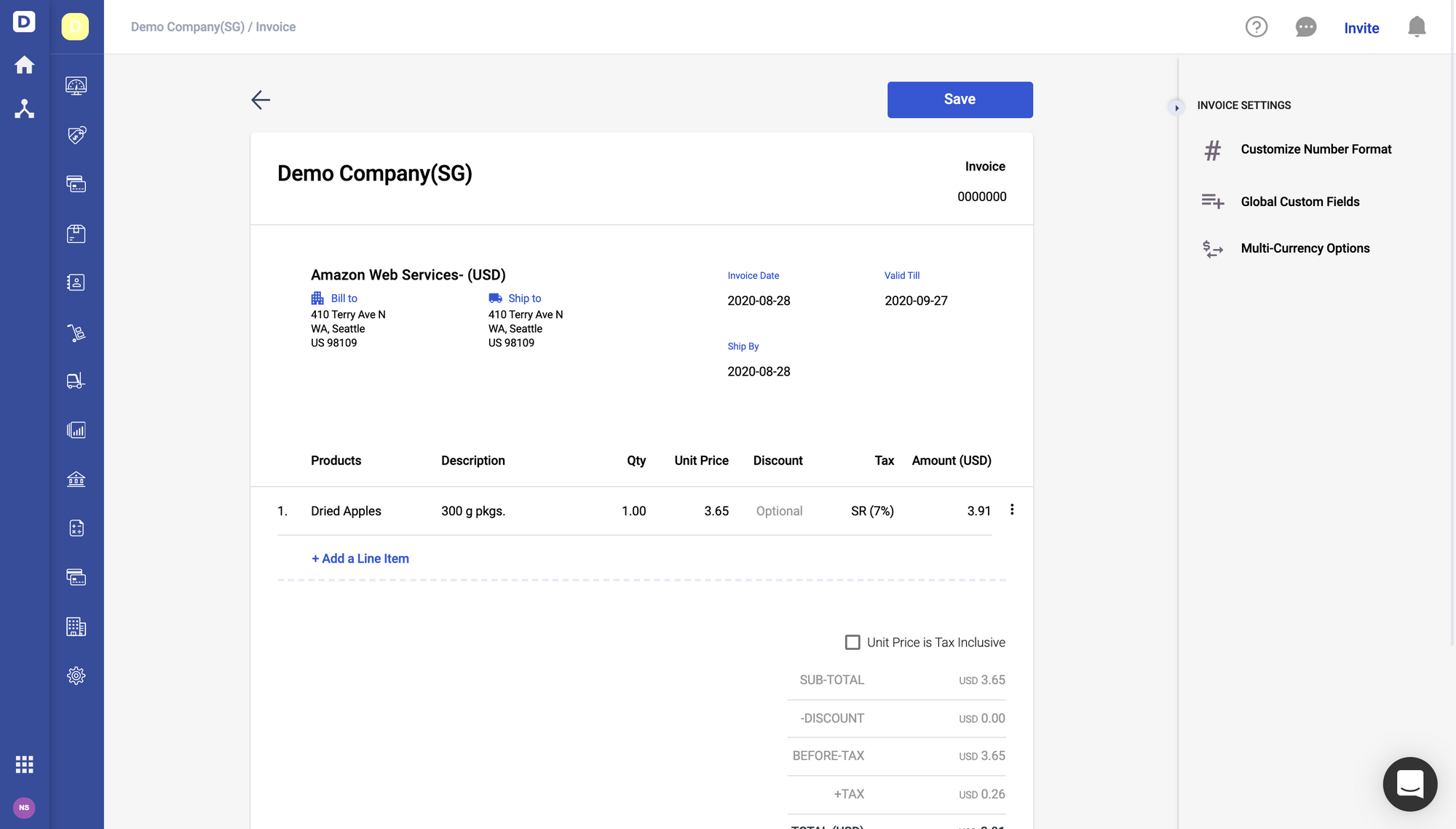

Step 2 Sending an Invoice

Once the sale is confirmed, you need to send an invoice to your customer. An invoice is a sales document that has a list of products and services provided with their quantity and prices. Sending an invoice to your customer is telling them about the money owed for the goods and services provided by your business. The invoice can be sent to customers before or after the goods or services delivery, depending upon the sales contract. While creating an invoice, ensure that invoice has all the important information such as:

- Invoice date

- Customer information such as name, billing, and shipping addresses, etc.

- Services and goods name, quantity with the price.

- Amount due

- Invoice Due date

- Relevant purchase order number and information if your customer shared it with you.

- Your contact information

- Payment terms

- Tax and discount details

Once an invoice is sent to your customers, you also need to record the invoice journal entry. While recording the invoice journal entry, you need to debit the accounts receivable account for the amount due from your customer and credit the sales account for the same amount. You also need to post the cost of goods sold journal entry to update your inventory. If you are using an accounting system such as Deskera Books, these journal entries will be automatically created upon generation of sales invoice and fulfillment.

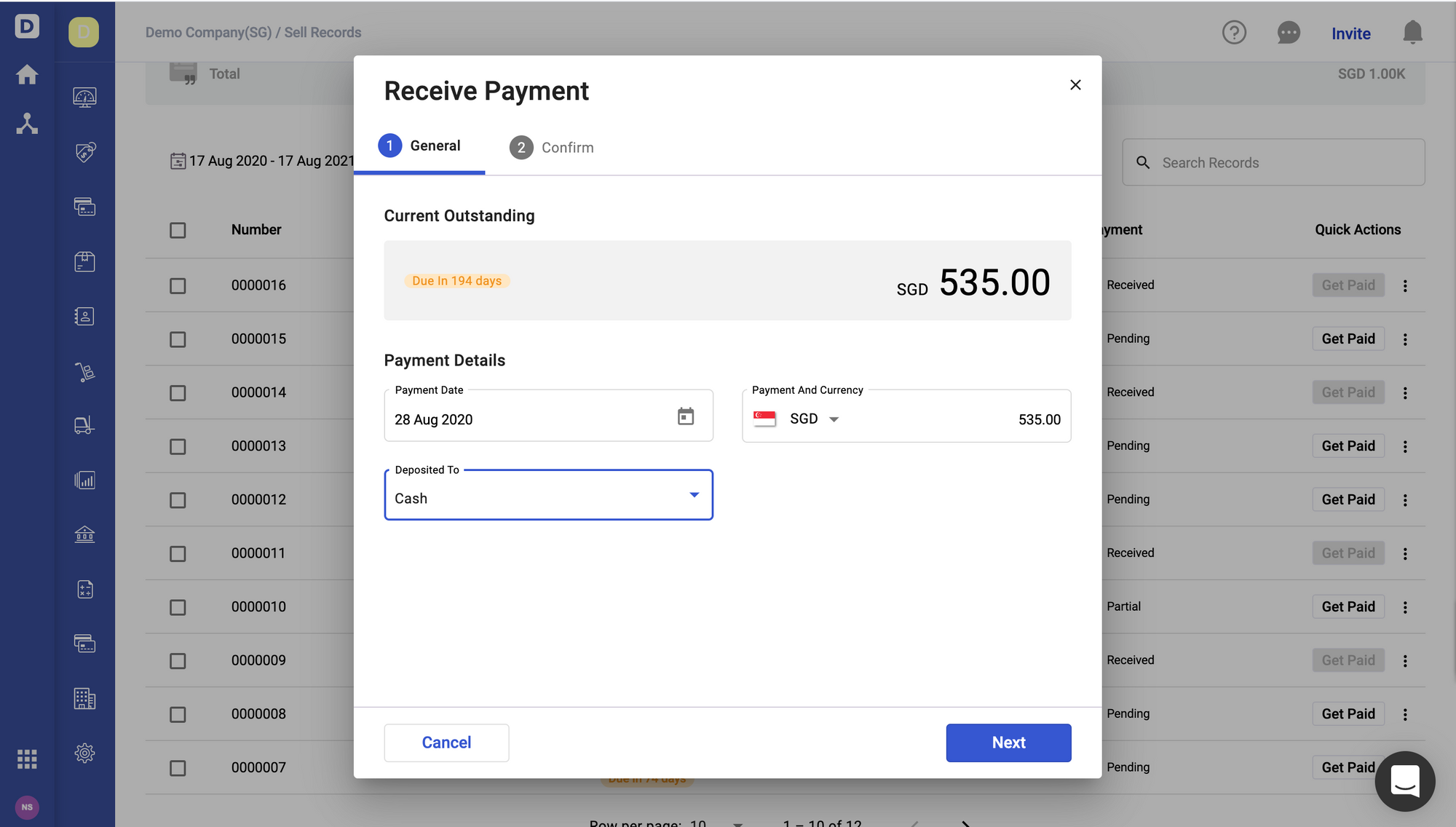

Step 3 Payment Collection

Once your customer has received the invoice, they need to make payment. All customers need to make payment before the invoice due date. Once you have received the payment, you need to give them a payment receipt and also record the payment entry in the system. While recording the payment journal entry, you need to debit the cash to show an increase due to the payment and credit accounts receivable to reduce the amount owed by your customer.

What Happens If Accounts Receivable Is Not Paid Ever?

When your customers are unable to pay an accounts receivable due to bankruptcy or any other reason, you need to write it off as a bad debt expense. Also, if your collection agency is charging higher fees than the total debt amount, you should write off the amount as a bad debt expense. Bad depth happens in cases when the customer is unable to pay due to the lack of available finances, or the customer is going bankrupt.

What Is the Accounts Receivable Turnover Ratio?

The accounts receivable turnover ratio helps you find out how fast your customers are paying their bills. The AR turnover ratio is used to identify a company’s efficiency in collecting its pending receivables owed by customers. The average accounts receivable ratio is calculated by dividing net sales by average accounts receivable.

Accounts Receivable Turnover Ratio Formulae-

AR Turnover Ratio= Net Credit Sales/ Average Accounts Receivable

Example of Accounts Receivables Turnover Ratio Calculation-

For example- Net credit sales for ABC company is $150,000 for this year. At the start of the financial year, $20,000 is AR balance, and $ 10,000 is accounts receivable balance at the end of this year. Here average accounts receivable will be ($20,000+$10,000)/2 which is $15,000. To calculate the accounts receivable turnover ratio, you need to divide $150,000 by $15,000, which is 10.

Net sales- $150,000

AR balance for the previous year- $20,000

AR balance for this year- $10,000

Average Accounts Receivable = ($20,000+$10,000)/2= $15,000

Accounts Receivable Turnover Ratio(ARTR)- $150,000/$15,000= 10

What Is an Accounts Receivable Aging Schedule?

If you have many customers, it will be very difficult to track and maintain accounts receivables for each customer. All accountants create a receivable aging report to keep track of all pending customer payments. This report can be manually created by an accountant or can be generated with the help of accounting software. AR aging schedule shows you the list of all customers with the payback period. Also, the aging schedule highlights late payments by customers.

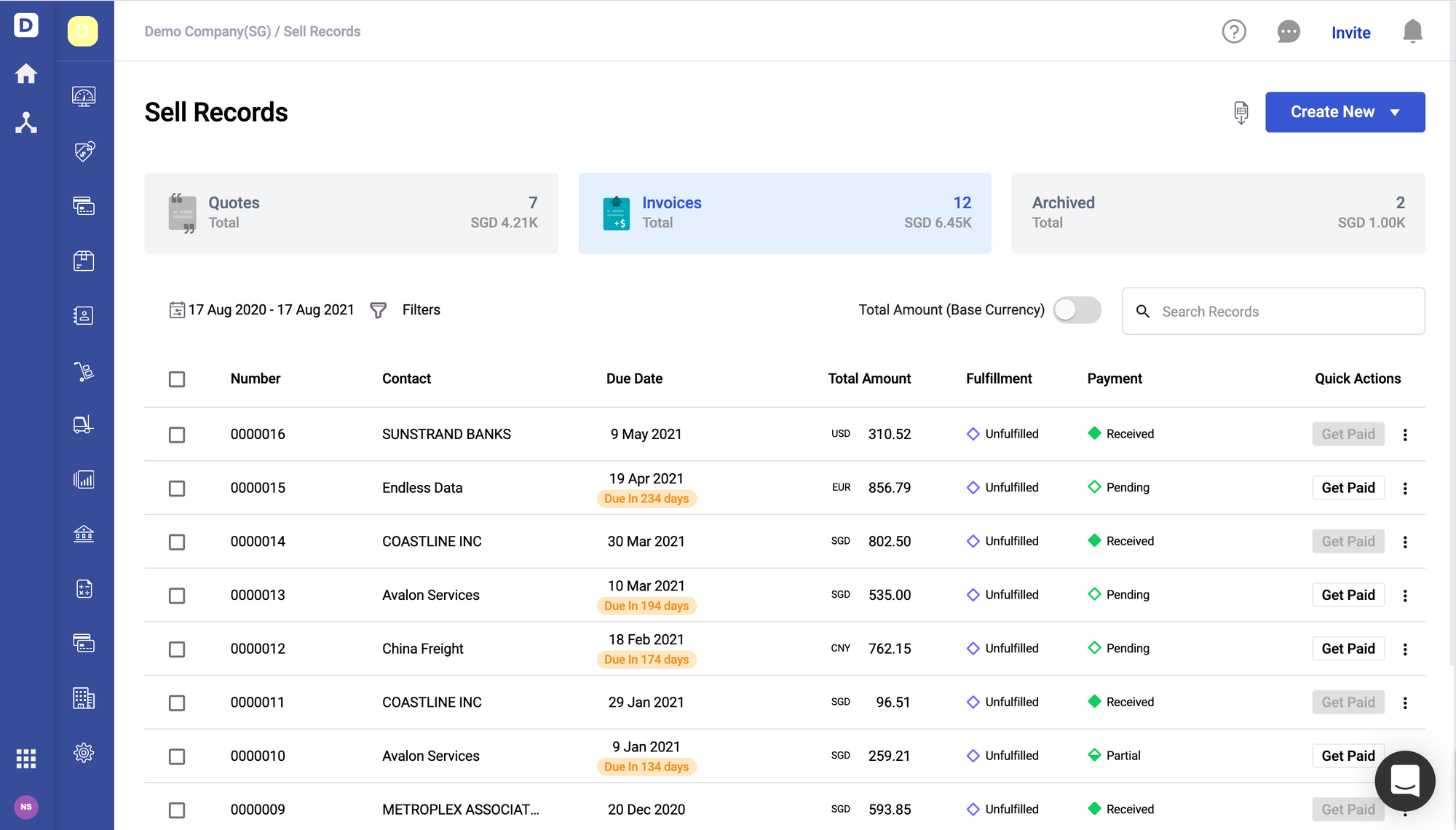

Here’s a sample AR aging report generated by Deskera Books accounting software:

Accounts Receivable Aging Report Sample-

Tips for Collecting on Accounts Receivable

Here we have listed some of the tips which companies can employ for accounts receivable collection:

- Ask customers to pay a late fee for overdue payments

- Reward customers who pay quickly by offering some discounts

- Send automated system alerts for overdue invoices

- Set up an efficient follow-up process for pending payments

- Hire a collections agency

- Keep track of all invoices with an accounting software

What Is the Function of the Accounts Receivable Department?

The main function of the accounts receivable department is to track all the receivables and follow up for pending payments from customers. AR department is responsible for generating the invoices, sending it to the customers, follow up for the pending payments, and recording payments. They are also responsible for maintaining goods terms with the customers by sending them friendly payment reminders.

What Are the Responsibilities of Accounts Receivable Manager?

The main responsibility of the accounts receivable manager is to follow up on the pending payments and ensure that the company is receiving all the payments on time. They also need to create and send sales invoices to the customers and send them a payment receipt once the payment is received. The AR manager must have accounting knowledge, as well as they need to record sales invoices and payment transaction journal entries.

Here we have listed the primary responsibilities of an accounts receivable manager:

- Generating and sending sales invoices and account statements

- Posting all the invoices, payments journal entries

- Performing account reconciliations

- Maintaining accounts receivable files, and records.

- Investigating and resolving any irregularities or discrepancies

- Generating the relevant reports for the management

What Is Accounts Receivable Automation?

AR automation is automating the entire accounts receivable process with an accounts receivable automation software. Accounts Receivable Automation Software (AR Automation Software) helps you track all invoices with their payment statuses.

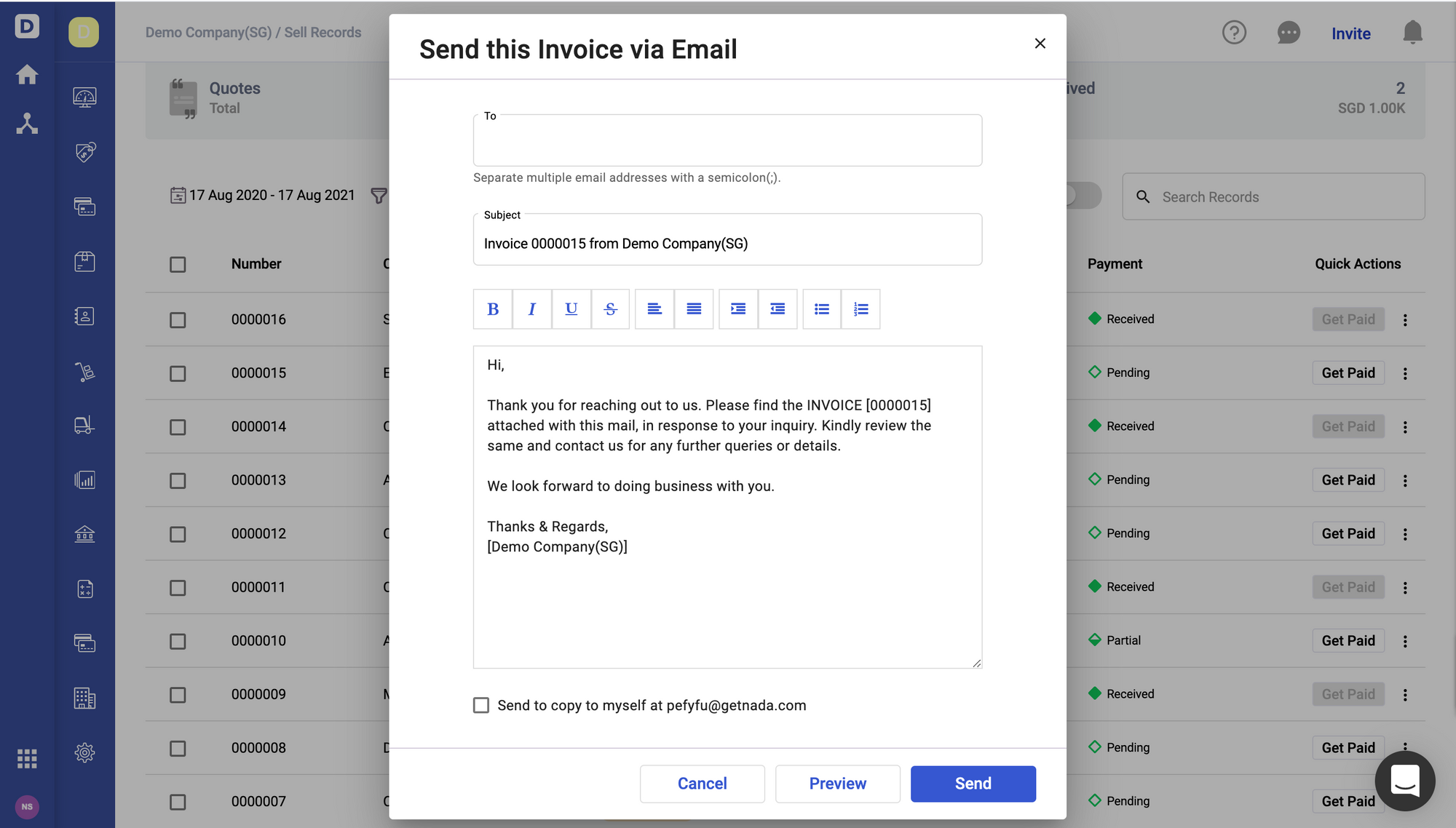

AR Automation Software allows you to automate your invoicing and payment collection process. With AR Automation Software, you can track your receivables and generate comprehensive reports. AR Automation Software also helps you to email invoices and statements to your customers.

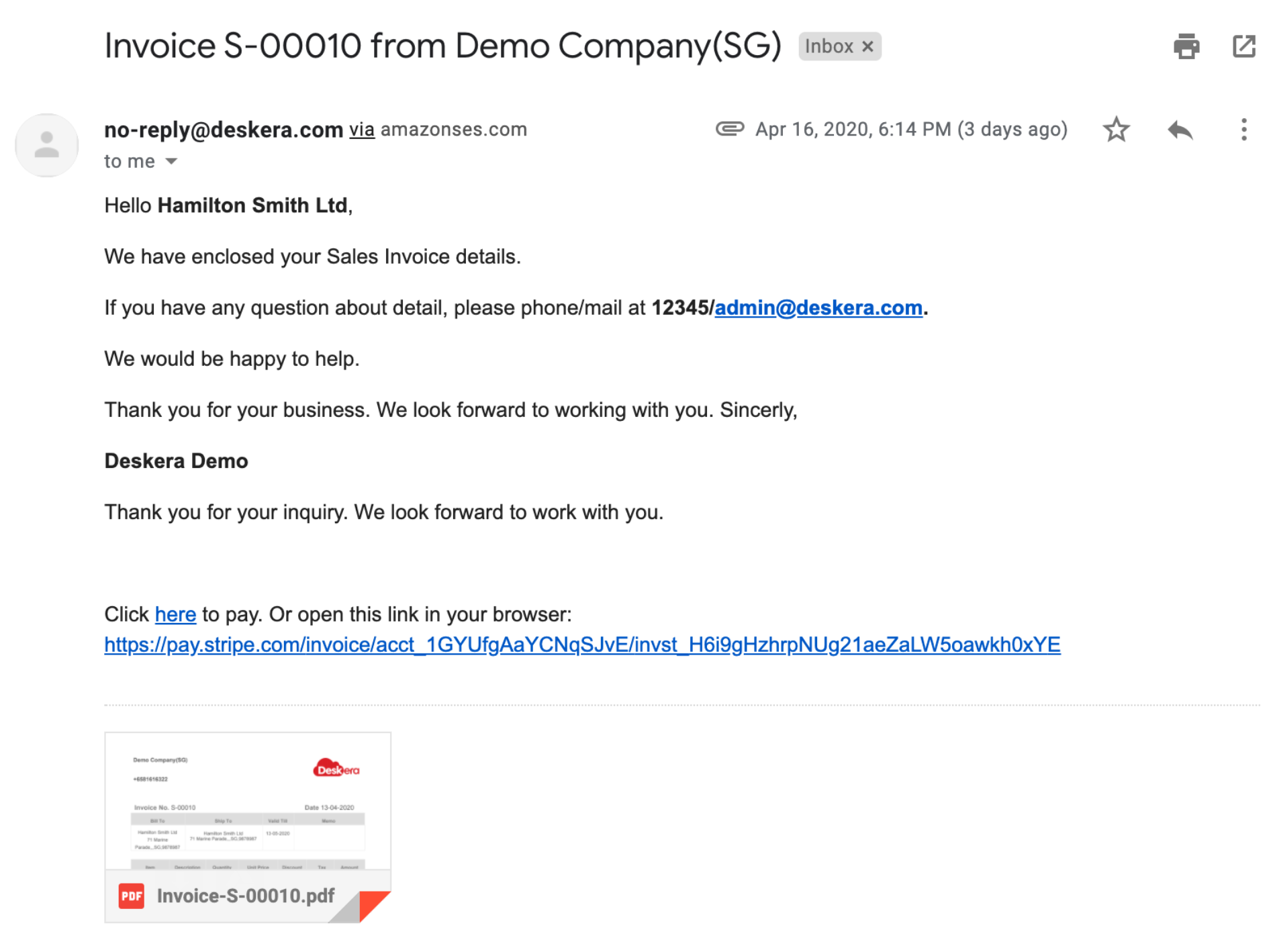

Once your customers receive the invoice, they can make an online payment, and payment entry will be automatically created in the system. Also, all financial reports will be generated, and all accounting journal entries will be automatically posted.

How Deskera Books Helps You with Accounts Receivable Process?

All businesses want to save time by automating the invoicing and payment collection process to get paid faster. With Deskera Books, you can digitise the entire AR process. You can eliminate the printing and mailing hardcopy of invoices to your customers. You can create invoices anytime, anywhere with web and mobile app. With Deskera Books, you can email invoices to your customers, and they can click on ‘pay now’ to make an online payment. Once the payment is received, all the financial reports are automatically updated. Deskera books allow you to get paid faster with the automated online payments.

Learn More about Deskera Books Features:

- Invoicing with Deskera Books

- Stay on Top of Your Billing

- Journal Entries with Deskera

- Better Accounting for Business

- Making Purchases with Ease

Sign up for a 30-day free trial of Deskera Books now!

Related Articles